The most recent Ericsson Mobility Report shows that worldwide there 8.2 billion mobile connections used by 6.1 billion unique subscribers. You can see the GSM Association GSMA’s cellular clock and data here.

The graphs above show Ericsson’s 2021 projections of world mobile services by technology. Ericsson usually has a pretty good handle on mobile world metrics and projections.

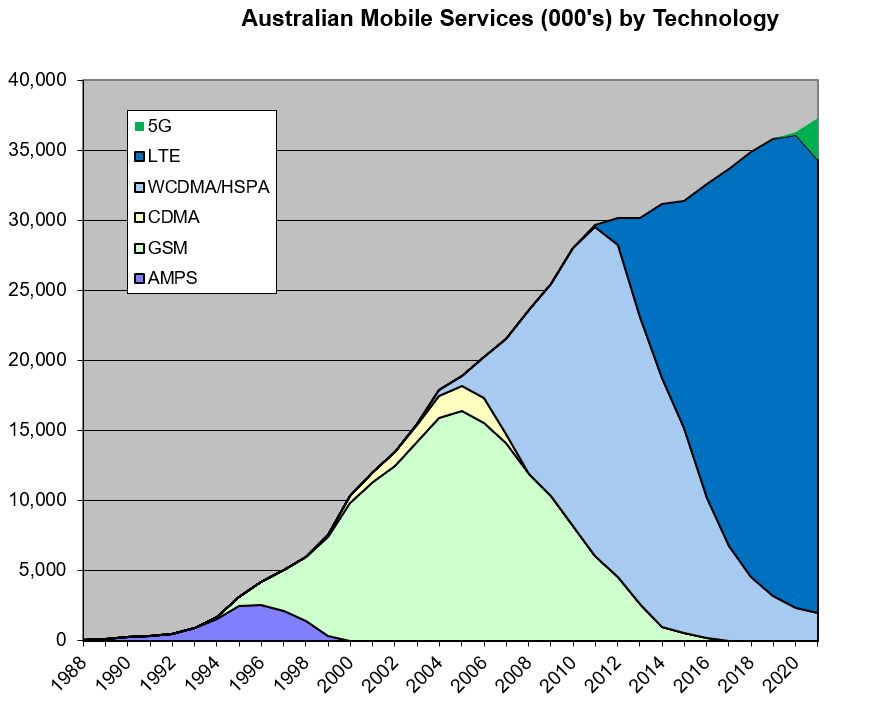

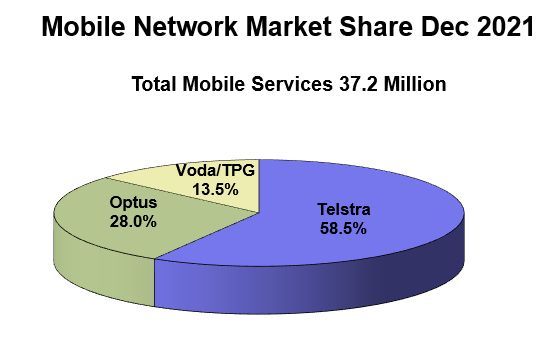

Foe Australian mobile connections totalled 37.2 million at the end of 2021 according to service numbers reported by the three operators. Connection numbers have been growing by around 800,000 per year over the past 10 years (2011 to 2021) reducing from 1.7 million per year growth on average for the 15 years prior (1996 to 2011). While subscriptions numbers have plateaued the data load on mobile networks, in common with those in other developed countries is rapidly increasing as smart phone penetration increases and consumption of app and video based data rockets. Mobile data downloads have increase at around 100% YoY over the past few years. The population of Australia is 25 million so the mobile penetration is just over 149%. The graph below shows the numbers of services in Australia for each technology since cellular mobile launched in 1987. It shows how each technology 1G AMPS, 2G GSM and CDMA and now 3G WCDMA/HSPA have each peaked. Each technology was replaced as newer, faster, more efficient and higher capacity networks and mobile devices became available.

1G AMPS

AMPS which had fabulous coverage was like the old outback ute no frills and tough as nails. It served very well from February 1987 until September 2000. It went as part of the Government’s push to introduce competition into telecommunications and into mobile in particular. The Government mandated its closure with the aim of having customers migrate onto one of three then newly licensed GSM networks. AMPS service peaked at 2.57 million in March 1996 by which time, three years after launch, GSM started to take off as phones and the three networks and coverage improved.

2G CDMA

The AMPS closure was painful for some as the replacement GSM technology initially performed poorly and the coverage was considerably worse than the old AMPS system it replaced. This coverage issue was a big deal especially for people out side of the cities and lead to Telstra being required, by a license condition, to provide a network which could in fact match the AMPS coverage before it was mandated to close in 2000. In turn this lead to Telstra building a CDMA network incorporating long range “Boomer Cells” which CDMA and Telstra’s supplier Nortel could do but GSM at the time could not. CDMA which was launched by Telstra in September 1999 peaked in services at 2.0 million in December 2005 and closed in April 2008.

2G GSM

GSM introduced a great variety of new capabilities into mobile communications like SIM card security, SMS, MMS, Voicemail, Prepaid, International Roaming, Data Transmission, Mobile Internet WAP etc. From the mid 90′s GSM boomed in Australia and worldwide. It became, and still is today, the most widely used mobile standard in the world. GSM created a demand for mobile data in quantity and speed which in the end it could not provide. The number of services and volume of calling on GSM networks has dropped to very low levels . As a result all carriers have refarmed all the 1800 MHz GSM spectrum and some of the 900MHz to. Telstra will close its GSM network down completely in December 2016 and Optus plans to do likewise in April 2017.

In Australia after a very slow start in April 1993 GSM services grew rapidly from 1996 until their peak of 15.9 million 10 years later in June 2006. Though GSM services are now less than 25% of their peak level none of the mobile operators has announced any plans to close GSM service.

3G WCDMA/HSPA

The demand for data speed and capacity lead to 3G WCDMA introduction in Australia starting slowly from April 2003. WCDMA had faster wider radio channels. It had other features like video telephony but it was the packet radio capability which drove its adoption. The 384 Kbps data channel on the initial WCDMA was replaced in short order by new high speed channels first HSDPA and the HSUPA and subsequently HSPA+. These HSPA technologies could make use of higher levels of modulation and bond two radio channels to provide more efficient data carriage and much faster data speeds. WCDMA/HSPA services reached their peak at 23.7 million in 2012 and are now in decline (around 15 million at the end of 2015) as new ever more efficient and faster LTE networks are used by the new smartphones in Australia.

4G LTE

LTE was first introduced by Telstra in September 2011 largely to relieve the pressure on its 3G network. The faster data speeds were a selling proposition but the main justification was to support the continued rapid growth in data usage and to reduce the cost of transmitting the data over the airwaves. The demand for mobile data growing at more than 100% YoY was created by the smart phone revolution, booming apps mobile internet usage and wireless broadband access for PC and tablets.

5G

5G NSA (Non Stand Alone) was first introduced in 10 major cities in Australia using equipment from Ericsson by Telstra in May 2019. The NSA version of the 5G standard used the 4G LTE network core and signalling with the data carried over new radio equipment and spectrum in the 3.6 GHz band.

5G NSA (Non Stand Alone) was first introduced in 10 major cities in Australia using equipment from Ericsson by Telstra in May 2019. The NSA version of the 5G standard used the 4G LTE network core and signalling with the data carried over new radio equipment and spectrum in the 3.6 GHz band.

The motivation for 5G NSA for the carriers in Australia and worldwide was to provide additional capacity using new spectrum and wider bandwidth channels (max 100 MHz rather than 20 MHz for LTE).

There are very many benefits of 5G over 4G in terms of reduced latency, higher data rates & capacity, support for far higher numbers of devices and energy and cost efficiency however except for data capacity and speed most of the benefits will be realised as new 5G core networks and SA (Stand Alone) radio access equipment is deployed. 5G SA was introduced first in Australia Telstra in May 2020. It was one of the first 5G SA deployments in the World.

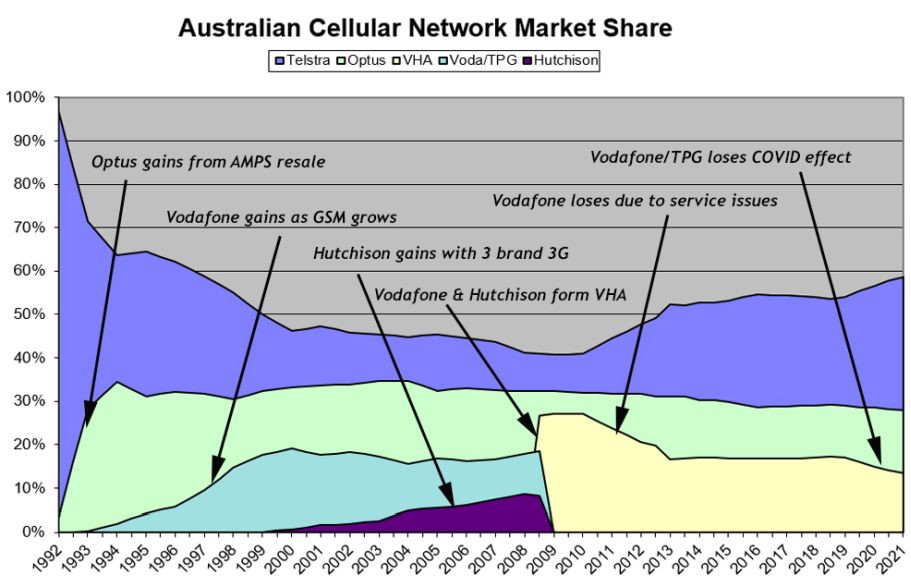

Mobile Market Share of Services

The graph below shows the share of Australian mobile services by technology since the launch of the first cellular service in 1987.

Telstra’s market share declined following the introduction of competition in mid 1992. It reduced initially due to Optus AMPS resale and then (mainly to Vodafone) as competitive GSM networks grew. Telstra lost more market share to Hutchison especially from 1993 when it conceded its network advantage by delaying 3G. Telstra gained from its investment in the superior NextG network and some more aggressive marketing. These move placed it in a good position to benefit from the customer churn stemming from the service problems which beset Vodafone from 2010.

Telstra’s market share declined following the introduction of competition in mid 1992. It reduced initially due to Optus AMPS resale and then (mainly to Vodafone) as competitive GSM networks grew. Telstra lost more market share to Hutchison especially from 1993 when it conceded its network advantage by delaying 3G. Telstra gained from its investment in the superior NextG network and some more aggressive marketing. These move placed it in a good position to benefit from the customer churn stemming from the service problems which beset Vodafone from 2010.

Optus’ market share has been stable after the initial “gold rush” period from June 1992 when it was able to take advantage of mandated resale of Telstra AMPS network to increase its market share. Optus built a market share in two years which has remained much the same for the last 20 years.

Vodafone did not avail of AMPS resale opportunity and stuck to marketing GSM – a difficult sell in its early days. As a result their market share only built slowly as GSM started to work as it should and began to dominate the market. Vodafone continued to gain but never reached Optus’ market share. Vodafone lost substantial share between 2011 and 2013 due to network performance and service issues. It had largely addressed these issues by 2014 and after a period of stable share lost again in 2020 and 2021 due to COVID closed borders and Vodafone/TPG’s higher reliance on temporary residence customers.

Hutchison only ever reached 2.5% market share with its Orange CDMA network but gained from 2003 when it launched Australia’s first 3G network more than two years ahead of the other carriers. By the time it merged with Vodafone to form VHA in 2009 Hutchison 3 had 9% of the Australian Market. The combined Vodafone Hutchison moved quickly to close the “3″ brand from August 2013 and merge its half of the Hutchison/Telstra shared 3G network into Vodafone’s. It was then marketed as Vodafone.

The Vodafone brand and the VHA business suffered major loss in services and revenue from a series of network and service issues from 2010 through to 2013. The problems mainly stemmed from poor capacity planning in a time when the company’s technical resources were focussed on merging the networks and not on planning for the then booming demand for mobile data. With major company focus and capital on the network the “Vodafail” situation was turned around and from 2014 the network was stabilised and market share loss stemmed.

The graph below shows the market share in the Australian Mobile Market from the introduction of competition in the market.