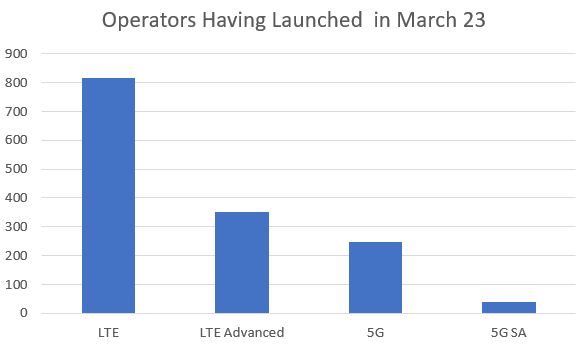

Global Suppliers Association GSA reported in in March 2023 Public Mobile Networks – March Snapshot that 816 operators had launched LTE based service. Of these 352 have launched evolved LTE or LTE Advanced service.

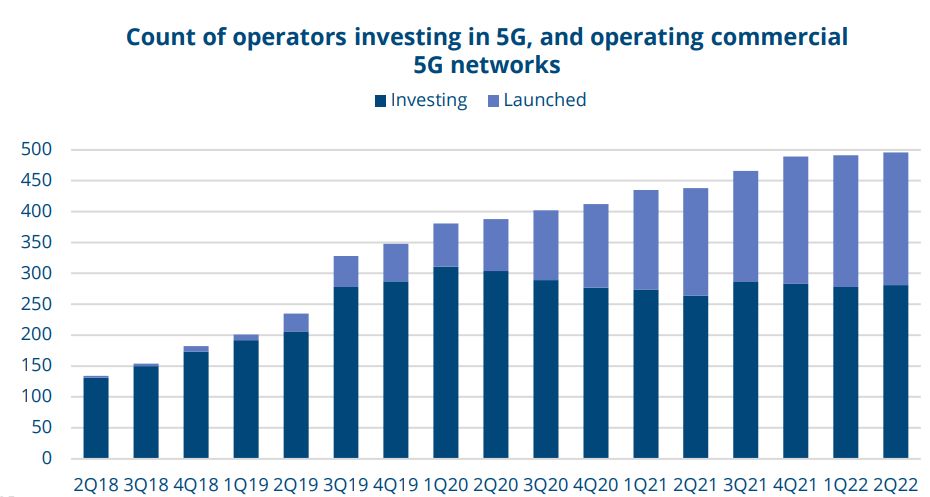

523 operators have invested in networks, tests, pilot or license acquisition for 5G services. Of these 249 have launched commercial 5G services and 40 of these have launched 5G Stand Alone.

At the Awards Night (GLOMO) at 2023 GSMA’s Mobile World Congress WMC23 in Barcelona 94 year old American Marty Cooper became the first recipient of a GSMA’s GLOMO Lifetime Achievement Award.

At the Awards Night (GLOMO) at 2023 GSMA’s Mobile World Congress WMC23 in Barcelona 94 year old American Marty Cooper became the first recipient of a GSMA’s GLOMO Lifetime Achievement Award.

Marty lead the team at Motorola which developed the first commercial mobile hand held phone the DynaTAC 8000X in 1983. This followed 10 years of development and improvement in technology from when the first prototypes were demonstrated and after a prototype was used for the first hand held mobile call.

The same AMPS (USA Standard Advanced Mobile Phone System) technology as the DynaTAC used came to Australia in 1987 and similar half brick sized expensive ($4,250) hand helds from Mitsubishi were marketed. Our History Page has more of these early developments.

The world has moved on dramatically in technology and scale with immense impact on society to the point where now there are 8.4 billion SIM connections owned by 5.4 billion unique mobile subscribers according to GSMA Intelligence.

Telstra claims another 5G speed record. Using 800 MHz of 26GHz mmWave spectrum and 100 MHz of mid-band 3.5GHz spectrum in a test device fitted with Qualcomm’s latest X70 modem they achieved 7.3Gbps download speed.

Telstra claims another 5G speed record. Using 800 MHz of 26GHz mmWave spectrum and 100 MHz of mid-band 3.5GHz spectrum in a test device fitted with Qualcomm’s latest X70 modem they achieved 7.3Gbps download speed.

The X70 modem which is fabricated on TMSC’s 4nm node silicon will appear in 2023 flagship devices like Samsung Galaxy S23. It is capable, Qualcomm says in the product brief Here of 10Gbps. Thus there is still some room for bragging rights if Telstra, Ericsson and Qualcomm, who co-operated in this demonstration, can cobble up some more mmWave spectrum.

In the real world outside the lab and test devices few are getting excited about mmWave largely due to the limited range and slow deployment in most markets. This has led to many flagship devices (e.g. iPhone 14, Galaxy S22) released outside of the USA not being equipped with the RF and antenna systems needed to support mmWave despite the devices having modem chips like the Qualcomm X65 which do.

More than two years after it had enabled the technology in its network Telstra announced in November 2022 that, with a recently applied firmware update to Android 13, Samsung S22 mobiles are able to use Stand Alone (SA) 5G.

More than two years after it had enabled the technology in its network Telstra announced in November 2022 that, with a recently applied firmware update to Android 13, Samsung S22 mobiles are able to use Stand Alone (SA) 5G.

The Australian Samsung S22s use the Qualcomm Snapdragon 8 Gen1 which incorporates the SA capable Snapdragon X65 5G Modem.

5G SA allows end to end signalling using 5G. Currently all other 5G devices and configurations use Non Stand Alone (NSA) which employs 4G LTE signalling on 5G calls.

5G SA will improve the mobile user experience particularly in more challenging use cases including gaming and by providing more consistent performance and immersive interactions using Augmented Reality (AR) and Virtual Reality (VR).

SA also allows 5G networking slicing, which enables the allocation and control of bandwidth, storage and data processing power for a particular customer, a specific group of customers or applications on the network.

Telstra Exchange site has a more detailed explanation on the benefits of SA Here.

TPG have just announced that they will be shutting the TPG/Vodafone 3G network in December 2023.

TPG have just announced that they will be shutting the TPG/Vodafone 3G network in December 2023.

They say that less than 1% of their traffic is currently on 3G while 86% is on 4G and 13.5% on 5G.

While it is many years since 2G/3G only mobiles stopped being sold there would be more 4G mobiles like the iPhone 6 which Apple stopped selling in 2016 and stopped software updates in 2019 which don’t support Voice Over LTE VoLTE. These phones will continue to provide data connection but not normal cellular voice calls once 3G closes down. There would also be an installed base of 3G only data devices currently adequately supporting low data rate services which will need to be replaced.

Telstra announced in 2019 that it would close 3G in June 2024. Optus is re-farming its 2100MHz 3G spectrum but has not announced if or when it will close 3G on 900MHz. Optus purchased the spectrum license for the 900MHz at the December 2021 auction so could keep 3G alive on this spectrum if it chose to.

Other significant Australian network technology shut downs have been.

- Telstra closed 007 PAMTS (ZeroG) in 1993

- Telstra closed AMPS (1G) in September 2000

- Telstra closed CDMA (2G/3G) in April 2008

- Telstra closed GSM/GPRS/HSPA (2G) in December 2016

- Optus closed GSM/GPRS/HSPA (2G) in August 2017

- Vodafone closed GSM/GPRS/HSPA in March 2018

- Vodafone will close WCMDA (3G) in December 2023

- Telstra will close WCDMA (3G) in June 2014

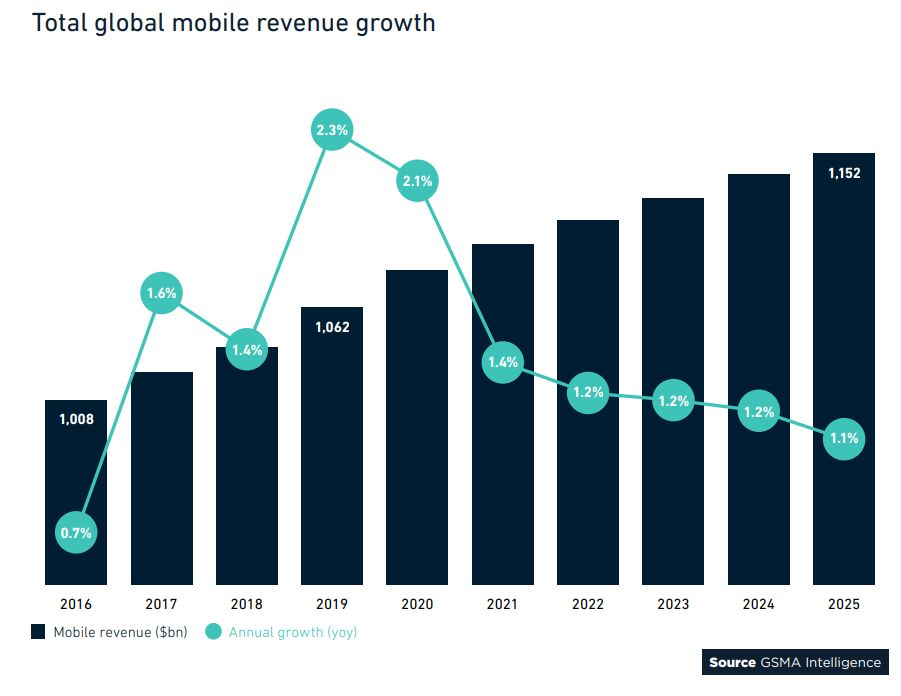

GSMA’s prediction for world mobile revenue (below) is for very slow growth going forward to 2025.

With relatively small increases in services in the developed world increases in revenue will likely come from IoT and new services enable by 5G. These will be offset by increased competition driving prices down as consumers chase better deals on what has become a largely commoditised data access service. After years of low low inflation and interest rates the recent spikes in inflation and the cost of everything are likely to drive some previously unpredicted growth in revenue.

Dell’Oro Group who keep an keen eye on the infrastructure market reported a small contraction in 4G and 5G radio access equipment sales in 2Q 2022. This is likely due to supply chain disruptions, deteriorating economic conditions and trade embargoes.

The largest world market in China is dominated by Huawei and ZTE who have 90-95% while the market outside China is mainly served by Huawei, Ericsson, Nokia, ZTE, and Samsung with Ericsson having the largest share at 39%. Both Nokia and Samsung are however gaining RAN equipment supply market share outside of China.

Not to be excessively concerned however as Dell’Oro still predicts that RAN sales will record growth for the full year 2022 for the fifth consecutive year.

GSMA in their 2020 Global Mobile Trends has their historic data and predictions for total mobile network CAPEX through to 2025 below. As expected the CAPEX is dominated by 5G and it shows the increasing CAPEX and the relatively high CAPEX to Revenue ratio resulting from the focus on 5G roll-out.

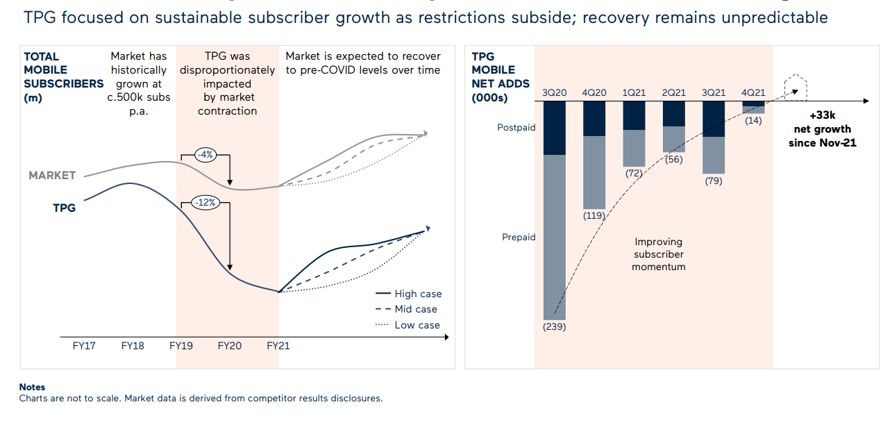

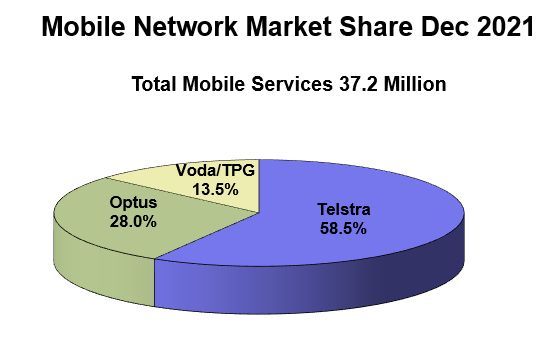

In numbers reported to December 2021 Vodafone/TPG has suffered loss of network services share due to COVID. This TPG says resulted from their larger share of customers temporarily resident in Australia. From December 2019 to April 2020 arrivals to Australia fell from 2 million per month to 20,000.

The effect was highlighted in TPG’s Annual Report for FY 2021 as follows.

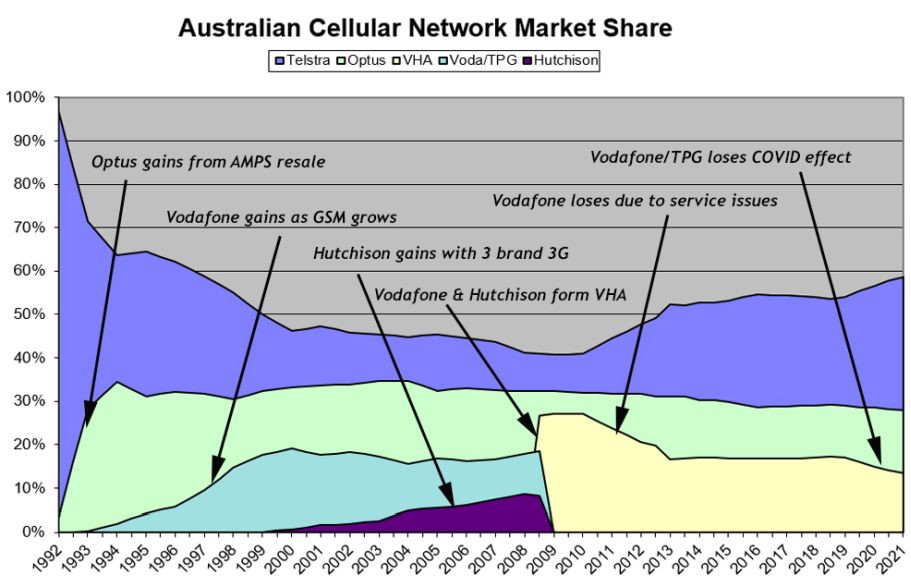

The loss of share is reflected in the long term network share graph below. TPG/Vodafone’s loss seems to be Telstra’s gain.

At end December 2021 the three networks reported services in operation totalling 37.2 million with the share as shown on the pie chart below.

The GSA (https://gsacom.com), which keeps a keen eye on these things, recently updated their data on World LTE and 5G deployments.

They reported that there are 812 operators with commercially launched public LTE networks offering broadband fixed wireless access and or mobile services.

496 operators in 150 countries/territories have been investing in 5G networks in the form of tests, pilots, licence acquisitions, planned and

actual deployments. Of these, 218 operators in 87 countries/territories have launched commercial 3GPP-compatible 5G services (mobile or fixed wireless access. Only 24 of the 218 have launched Stand Alone SA 5G.

In addition to these commercial public networks GSA says that there have been 338 private networks launched using LTE or 5G technologies.

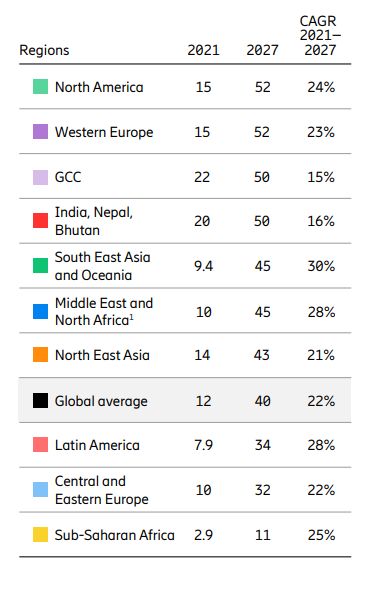

Always interesting is Ericsson’s data on cellular network traffic growth. They are uniquely positioned to observe and record this statistic.

Their 2022 June report shows the around 60% per annum increase prior to COVID Pandemic has reduced to a still respectable 40% since.

Elsewhere they report that the average cellular data per subscription world wide in 2022 is 15GB per month. The data usage varies considerably in different World regions as Ericsson’s table below shows.

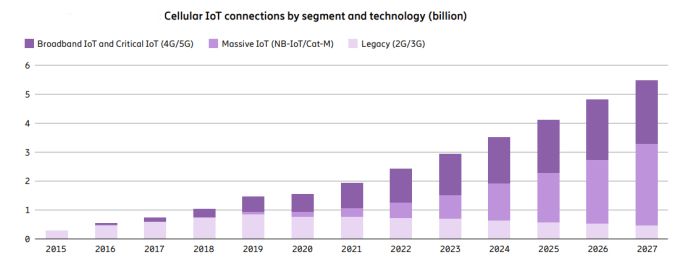

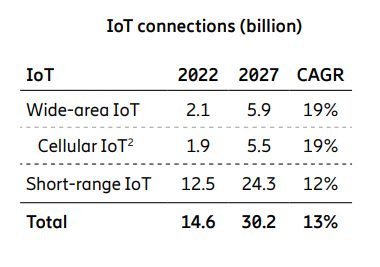

Ericsson Mobility Report June 2022 has some interesting data and predictions on IoT.

Ericsson is primarily interested in, and reporting on medium and long range IoT technologies. Currently these are legacy 2G and 3G plus cellular NB-IoT and Cat-M and broadband IoT via 4G and 5G. They have projected these technologies to move from 1.9 billion connections worldwide in 2021 to 5.5 billion in 2027. Connections on legacy 2G and 3G are declining. These are moving to NB-IoT Cat-M1 and LTE and 5G and new services are going onto these newer networks as shown on graph below

85% of IoT connections are currently on short range technologies Zigbee, Z Wave, Bluetooth, and WiFi. Ericsson predict that this will reduce to 80% by 2027 with some migration to new longer range and increasingly competent cellular networks. Ericsson have also predicted growth from a lower base for competing wide area IoT technologies such as LoRaWAN and Sigfox.

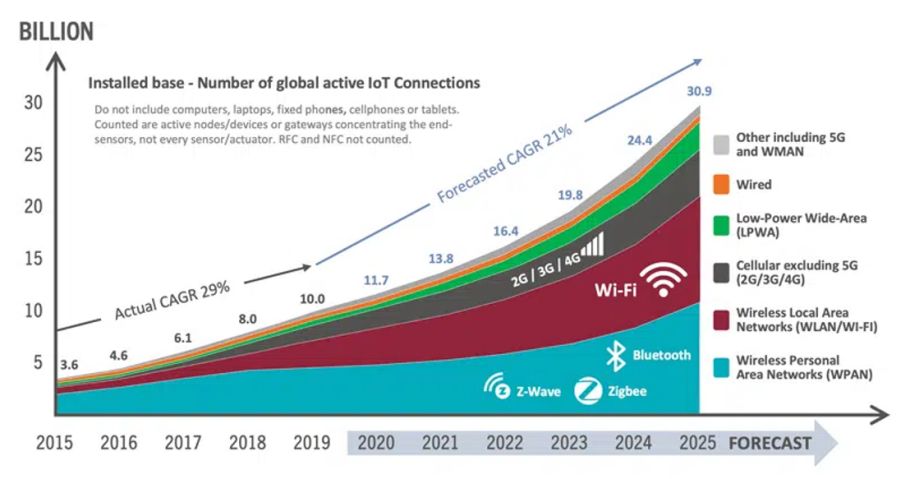

An earlier forecast had total IoT connections reaching 30Bn by 2025 with a similar mix of technologies. CAGR growth of between 15 and 20% looks likely.

The Ericsson Mobility Report June 2022 shows 8.2 billion mobile subscriptions held by 6.1 billion subscribers worldwide at the end of 2021. With the World’s population at 7.75 billion almost 79% of the population are mobile subscribers. Ericsson data says that 77% of the subscriptions are for smartphones and that 83% have mobile broadband.

The Ericsson Report predicts by the end of 2022 there will be 1 billion 5G subscriptions and that 4G LTE subscriptions will peak then at 5 billion. Combined 4G & 5G will be 72% of subscriptions and that will increase to 86% in five years to 2027 when 4G and 5G subscriptions will be about the same in number.

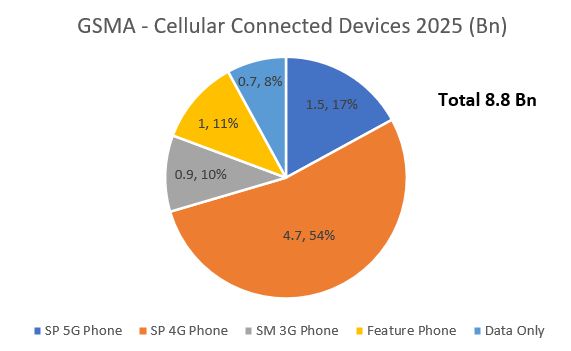

GSMA in their Mobile Trends 2020 predicted similar total 8.8Bn connections at 2025 shown below. GSMA were less bullish on the migration to 5G and they provided a split of Smart Phone (SP) 3-5G and feature phones and data only devices like PC’s tablets etc.

Telstra and the Australian government secured the required regulatory approvals from governments in the region to acquire Digicel Pacific nearly nine months after announcing a move to take over the company.

Telstra and the Australian government secured the required regulatory approvals from governments in the region to acquire Digicel Pacific nearly nine months after announcing a move to take over the company.

The interest and support from the Australian Government resulted from concerns (founded or unfounded) about the property being acquired from Irish billionaire owner Denis O’Brien by a Chinese state-owned enterprise.

Digicel Pacific has operations in Papua New Guinea, Fiji, Nauru, Samoa, Tonga and Vanuatu with a total of 2.8 million subscriptions generating revenue in FY 2022 of $466M. It has 1,700 employees which Telstra plans to retain. Digicel which is incorporated in Bermuda, retains operations serving 10 million customers in 25 countries including Jamaica, Haiti, Trinidad and Tobago, Barbados, Cayman Islands, Panama and El Salvador.

Telstra International will manage the company as a stand-alone business, which will be overseen by a Telstra-controlled board chaired by enterprise unit executive David Burns.

Telstra paid $270 million in equity towards the $1.6 billion purchase price. The Australian government, through Export Finance Australia, paid the $1.3 billion balance. Telstra owns 100 per cent of the ordinary equity.