Archive for March 2014

We are moving towards the availability of the digital dividend 700MHz spectrum with the restacking of the UHF TV channels on Band IV channels on or below TV Channel 51. Telstra and Optus are now rolling out APT700 Band 28 capable infrastructure on their base stations.

The APT700 Band 28 spectrum was auctioned in May 2013 and can be used from January 2015 by Telstra who licensed 2X20MHz for $1.24Bn and Optus who acquired 2X10MHz for $622M.

At present there are only a few devices which operate on the APT700 LTE band however this is expected to change as more countries adopt, license and deploy equipment in the band. At present according to Ericsson’s APT700 Market Update 27 countries with combined population of 2.2 billion have adopted APT700. Along with Australia and New Zealand these include the large markets in India, Pakistan, Brazil, Mexico, Indonesia and Japan. Both the new Samsung Galaxy S5 and HTC One M8 sold in Australia do support Band 28. We will have to wait until August/September to see if the new iPhone 6 will follow with APT700 support.

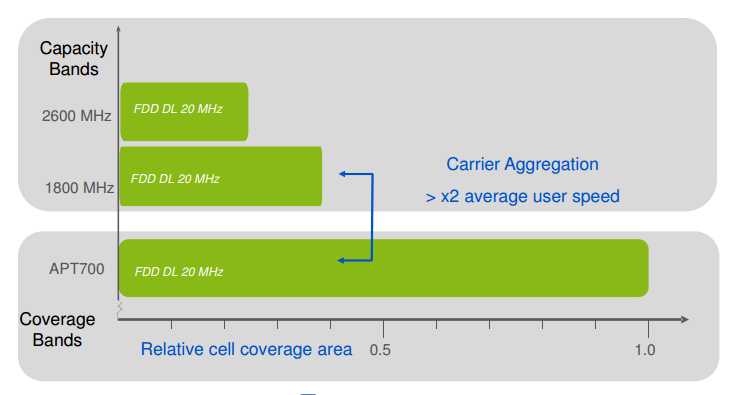

The Ericsson chart below shows the way in which the APT700 can be deployed along with the current 1800MHz and the other Optus and Telstra licensed 2600MHz spectrum to provide LTE with wider and deeper coverage. The adoption of LTE Advanced 3GPP Release 10 channel aggregation will provide far greater capacity than exists today on either 4G LTE or 3G HSPA networks.

Telstra is in the box seat with this LTE Advanced deployment having 2X20 at 700MHz, 2X15MZ (2X20MHz outside Sydney and Melbourne) at 1800MHz along with 2X40MHz of 2600MHz. Optus is well placed with 2X10MHz of APT700, 2X20MHz of 1800MHz in capital cities except Canberra and 2X20 MHz of 2600MHz. Optus has other attractive capacity and speed options with LTE TDMA. Vodafone, which did not participate in the May 2013 4G spectrum auction, has good holdings of 2X25 MHz of 1800MHz spectrum in the capitals but will lack depth and range of 4G which Telstra and Optus can offer using the “waterfront” APT700 spectrum.

There is an excellent Wiki on the APT700 band here.

Interesting to see the outcome of the unsold – some say overpriced at $933M – 2X15MHz of APT700 spectrum. Emergency services are making a strong push to be given this spectrum which would be a tragic outcome.

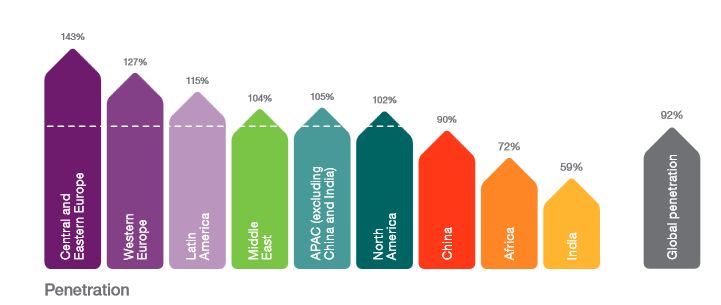

Ericsson Mobility Report February 2014 shows world mobile subscriptions grew to 6.7 Bn by December 2013 with the number of subscribers standing at 4.5 billion. World mobile penetration (subscriptions per head of population) grew to 92%.

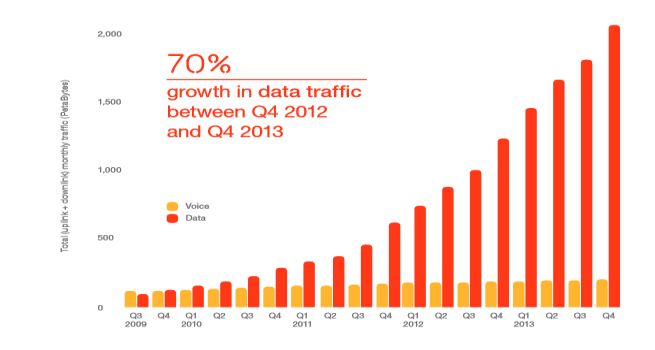

Ericsson reported that mobile broadband subscriptions grew by 40% in 2013 to 2.1 billion and that total data traffic on mobile networks grew by 70% over the same period.

In 2013 around 1 billion smartphones were sold accounting for 60% of phones sold. At the end of 2013 smartphones accounted for 30% of phones in use. As the number of smartphones continues to rise rapidly the volume of data traffic on mobile networks (2 PetaBytes per month in December 2013) will increase evenfaster than the current 70% p.a.

Ericsson points to the revolution in mobile networks underway in emerging economies which they say will see world subscriptions on 2G networks, dominantly used for voice and SMS, go from the current 73% to a point in 2019 when 80% of subscriptions will be on 3G and 4G mobile data capable networks. In these emerging economies mobile data will be far and away the dominant internet access mechanism.

Open Signal has a huge sample of mobile data speeds taken from networks around the world. The data is gathered from free Android and iPhone apps which test network speed and quality and then record and forward the information for compilation by Open Signal. The data are accessible on line and can be viewed here.

Open Signal has a huge sample of mobile data speeds taken from networks around the world. The data is gathered from free Android and iPhone apps which test network speed and quality and then record and forward the information for compilation by Open Signal. The data are accessible on line and can be viewed here.

Obviously the information is a moving feast and it represents the experience of just Android and iPhone users who have taken the trouble to download and run the app. None the less these should be pretty good selection of mobile users to choose to get an a good idea of the networks data speeds and quality.

Below is a table compiled from the Open Signal data for Australia for each operator and totally and for 3G and 4G separately and totally. Just for interest it shows the total results for a couple of other relatively 4G advanced countries USA Sweden and UK.

| 3G | 4G | All | |||||||

| Down Mbps | Up Mbps | Ping mS | Down Mbps | Up Mbps | Ping mS | Down Mbps | Up Mbps | Ping mS | |

| Optus | 2.4 | 0.9 | 311 | 18.4 | 5.9 | 103 | 3.0 | 1.1 | 305 |

| Telstra | 4.2 | 1.1 | 288 | 21.0 | 4.9 | 89 | 8.2 | 2.0 | 241 |

| Vodafone | 3.2 | 1.2 | 232 | 36.6 | 4.3 | 71 | 4.9 | 1.3 | 224 |

| All Aus | 3.2 | 1.0 | 286 | 22.0 | 5.0 | 89 | 5.5 | 1.5 | 263 |

| All UK | 4.1 | 1.5 | 300 | ||||||

| All USA | 3.9 | 3.0 | 231 | ||||||

| All Sweden | 8.7 | 2.3 | 248 | ||||||

The data shows that as expected Telstra has the fastest network overall. Telstra is 2.7 times faster than Optus and 67% faster than Vodafone. This results from Telstra’s earlier start with LTE (Sept 2011 Vrs Jul 20 12 for Optus and Jun 2013 for Vodafone). As a result Telstra has over 4 million LTE devices, probably double that of Optus, and four times the number reported by Vodafone. With 4G speeds recorded as just under 7 times that of 3G in the downlink and 5 times faster in the uplink the more of the faster services you have the better your overall speed.

It is interesting that the data supports the claims made by Vodafone that theirs is the fastest 4G network. Vodafone shows up as 75% faster than Telstra and twice as fast as Optus. You would expect this since Vodafone have only one quarter of the 4G services of Telstra and in the two large markets of Sydney and Melbourne they have more continuous 1800 MHz spectrum (2X20 MHz Vrs 2X15MHz for Telstra).

These numbers will move around. As Vodafone increases its 4G base you would expect to see its overall speed increase and its superiority of 4G speed diminish as the limited spectrum is shared by a larger base of devices. Optus and Telstra will benefit from deployment of their new 700MHz and 2600MHz spectrum from early 2015 and the ability of LTE Advanced to bond discontinuous spectrum. Optus has the additional potential to link its holdings of 2.3 and 3.4 GHz spectrum. For example Optus has reported a “Giga Site” trial employing 287 MHz of spectrum in the 700-MHz, 900-MHz, 1800-MHz, 2.1-GHz, 2.3-GHz, 2.6-GHz and 3.5-GHz bands to achieve a 2.3 Gbps mobile data channel – how it that for bragging rights. Just who will produce commercial devices for this and when we will have to wait and see.