Archive for April 2017

Interesting to see the just completed 700MHz “Incentive” auction in the USA saw 70MHz of spectrum sold for $US19.8Bn or $0.93/MHz/pop.

Interesting to see the just completed 700MHz “Incentive” auction in the USA saw 70MHz of spectrum sold for $US19.8Bn or $0.93/MHz/pop.

This spectrum was given up by 174 broadcasters across the country in a reverse auction. These broadcasters were compensated collectively to the tune of $10Bn. $7.3Bn of the balance will go towards reducing Uncle Sam’s deficit (currently $19Tr).

Of the 100 registered bidders and 50 winners of spectrum number 3 ranked mobile operator T-Mobile purchased the most by far winning the rights to 31MHz nationwide (securing 45 per cent of the total spectrum sold) for $8Bn.

Note that the USA spectrum is for keeps not just for 15 years as is the case with the Australian (and many other market’s) spectrum licenses.

An auction of the unsold 2X15 HMz of 700 MHz spectrum was held in April by Australian Communications and Media Authority ACMA. The auction lasted a week and concluded on 10th April 2017.

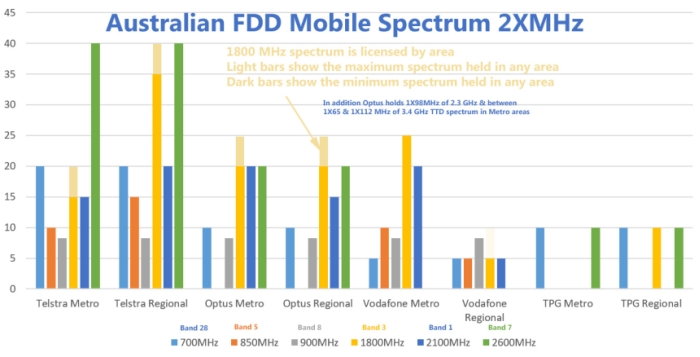

TPG won 2X10MHz for $1.26Bn (2.75/MHz/pop) while Vodafone picked up 2X5MHz for the reserve price $286M ($1.25/MHz/pop). The third bidder Optus left empty handed. Telstra was precluded from participating in the auction.

The 700 MHz spectrum licenses will run from 1 April 2018 until 31 December 2029 giving them the same expiry date as the 2013 auctioned 2X30 MHz 700 MHz lots bought by Telstra and Optus for $1.866Bn.

Vodafone will presumably be eager to incorporate this low band spectrum onto its LTE network while TPG has announced it plans to spend an additional $600M to build a 2,000 to 2,500 base station LTE network. TPG also has access to 2X10HMZ of 2.6 GHz spectrum nationally and 2X10MHz of 1800 MHz spectrum in regional areas.

TPG’s Chairman and CEO David Teoh is confident that such a small outlay will result in a saleable network which he says will be EBITDA positive with just 500,000 services because TPG will:

• Be able to deploy current advanced technology in its network

• Reque fewer mobile towers

• Have no legacy generations of equipment to support; and

• Have no existing customer revenue to protect.

You would wish TPG good fortune in their quest into mobile operatordom and they will need it.

The last company in Australia to pay well over the odds for spectrum to build and operate their own network to graduate from virtual to a real network operator was OneTel and that did not end well. As well TPG will likely be fishing in the same pool of cost conscious customers as Vodafone Australia. Vodafone has more than 10 times TPG’s claimed EBITDA break even customer base of 500,000 but even with its now stabilised and mature network with 96% population coverage it continues to record losses ($672M total in the last two years).

A summary of the spectrum holdings by mobile operators in Australia following this auction is below.