Archive for November 2013

Facebook is about to become an Associate Member of the GSMA. Facebook will be joining the likes of Ericsson, Alcatel Lucent and other mobile suppliers as associates in the operators club that is the GSMA.

Facebook is about to become an Associate Member of the GSMA. Facebook will be joining the likes of Ericsson, Alcatel Lucent and other mobile suppliers as associates in the operators club that is the GSMA.

Over the Top OTT players are making increasing inroads into mobile carriers revenue on one hand while helping to drive demand for smartphones and data connectivity on the other. Facebook is not such an overt competitor to mobile carrier’s services as say Skype or WhatsApp and they add to mobile operator’s data traffic and provide a popular service for smartphone users. As such Facebook should be more comfortable inside the GSMA tent than many other OTT players and companies like Apple and Google all of who benefit massively, as well as contributing to the booming mobile industry.

It is interesting that in a Mobile Squared White Paper on OTT here it is claimed that the Microsoft owned Skype is costing the telcos $36Bn a year (and counting) in lost revenues mainly providing service for which its own annual revenue is $2Bn. It seems likely that Skype would be as welcome in the GSMA as wolf in the hen house. But you never know.

Research firm Ovum predicts that SMS numbers world wide will peak at 7.8 trillion in 2014 and then gradually decline as more people use newer OTT forms of text messaging. Ovum also estimates that social messaging will reduce mobile operators messaging revenue by $USD32.6 billion in 2013.

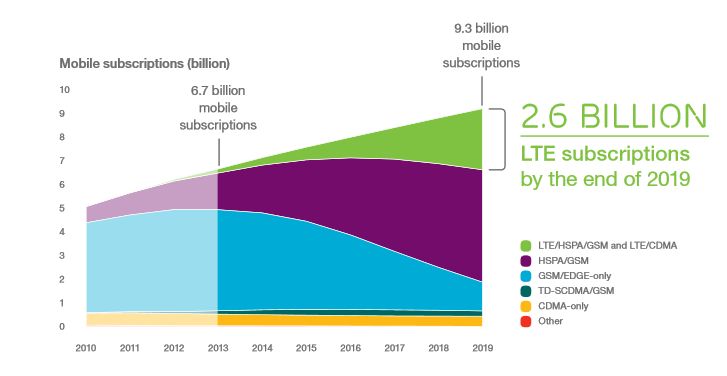

Ericsson Mobility Report November 2013 predicts that by 2019 5.6 Bn (60%) of the world’s 9.3 Bn mobiles will be smartphones up from 1.9 Bn (28%) in 2013. Ericsson also predict that connected PC’s and tablets plus mobile router subscriptions will rise from 300M in 2013 to 800M in 2019. The full report is here. Their predictions for router and tablet subscriptons they say is lower than previous reports due to the increase in the use of tethering mobile phones to these devices.

The growth in smartphones and mobile connected computers Ericsson predicts will increase mobile data traffic by a factor of 10 from 1.8 ExaBytes in 2013 to around 18 ExaBytes (18X1018 Bytes) by 2019. Already in 2013 mobile data traffic on networks is 10 times that of voice. So voice is well on the way to becoming irrelevent to network capacity while at the same time remaining a nice little earner for network operators unless or until the OTT players spoil the party.

The growth in smartphones and mobile connected computers Ericsson predicts will increase mobile data traffic by a factor of 10 from 1.8 ExaBytes in 2013 to around 18 ExaBytes (18X1018 Bytes) by 2019. Already in 2013 mobile data traffic on networks is 10 times that of voice. So voice is well on the way to becoming irrelevent to network capacity while at the same time remaining a nice little earner for network operators unless or until the OTT players spoil the party.

The Ericsson predictions show the rapid swing to 3G and 4G technologies with only around 20% of mobiles remaining on 2G by 2019.

Gosh 4G spectrum is cheap in New Zealand maybe we should buy some and import it!

Gosh 4G spectrum is cheap in New Zealand maybe we should buy some and import it!

With the conclusion of the 700 MHz 4G spectrum auction in NZ in October resulting in Telecom NZ and Vodafone each picking up 2X15MHz – the maximum allowed under the auction rules. They each paid $NZ66 ($A57.6). This was the reserve price. Third NZ operator 2 Degrees picked up 2X10MHz also at the reserve price $NZ44 million and 2X5Mhz remained unsold.

The band APT700 3GPP Band 28 is the same as will be used in Australia and elsewhere in Asia Pacific. The same 700 MHz spectrum was auctioned in Australia in May 2013 and also sold at the government set reserve price. The difference was that then Australian Labor Government needed the cash and set a reserve price of $A311 million per 2X5MHz lot compared to $NZ22 million ($A18.1) in New Zealand. Well OK there are only 4.4 million people in NZ compared to 22.7 million in Oz but that still makes the spectrum price in NZ 30% of the Australian price on a per head of population basis.

Android accounted for 81% of the world’s 251 million smart phone sales in Q3 2013 according to Strategy Analytics figures just released.

Android accounted for 81% of the world’s 251 million smart phone sales in Q3 2013 according to Strategy Analytics figures just released.

Overall mobile phone sales slipped slightly in Q3 2013 to 418 million. On the other hand smart phones, which now account for 60% of phones sales and around 90% of phone sale revenue, increased YoY by over 45%. Samsung is a major contributor to, and beneficiary of, the success of Android. It holds 35% of the smart phone market.

For what it is worth the form guide for this three horse race:

With the recent Google release of Android 4.4 KitKat which is aimed at running on lower specification smart phones which will drive growth in the less developed markets you can only see Android continuing its dominance. Microsoft, mainly though the efforts on Nokia, is gaining market share in particular through some very capable and well speced low priced phones. While Apple continues to operate at the top of the price list in the process retaining very healthy margins and profitability it is unlikely to make inroads into Android’s lead.

| Global Smartphone Operating System Shipments (Millions of Units) | |||

| Q3 ’12 | Q3 ’13 | ||

| Android | 129.6 | 204.4 | |

| Apple | 26.9 | 33.8 | |

| Microsoft | 3.7 | 10.2 | |

| BlackBerry | 7.4 | 2.5 | |

| Others | 5.2 | 0.5 | |

| Total | 172.8 | 251.4 | |

| Global Smartphone Operating System Market share % | |||

| Q3 ’12 | Q3 ’13 | ||

| Android | 75.0% | 81.3% | |

| Apple | 15.6% | 13.4% | |

| Microsoft | 2.1% | 4.1% | |

| BlackBerry | 4.3% | 1.0% | |

| Others | 3.0% | 0.2% | |

| Total | 100.0% | 100.0% | |

| Source: Strategy Analytics | |||