Archive for August 2022

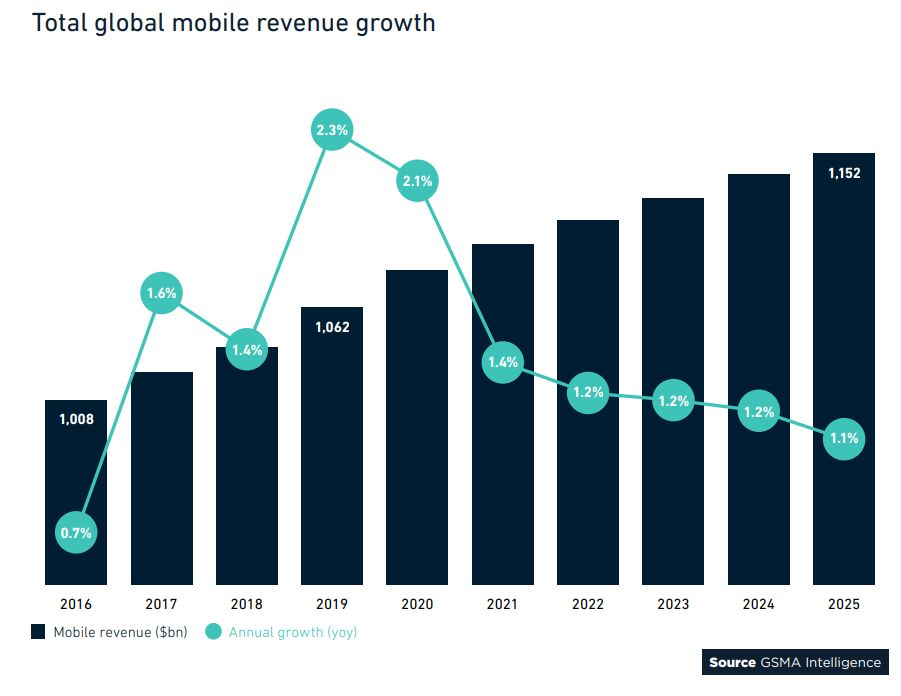

GSMA’s prediction for world mobile revenue (below) is for very slow growth going forward to 2025.

With relatively small increases in services in the developed world increases in revenue will likely come from IoT and new services enable by 5G. These will be offset by increased competition driving prices down as consumers chase better deals on what has become a largely commoditised data access service. After years of low low inflation and interest rates the recent spikes in inflation and the cost of everything are likely to drive some previously unpredicted growth in revenue.

Dell’Oro Group who keep an keen eye on the infrastructure market reported a small contraction in 4G and 5G radio access equipment sales in 2Q 2022. This is likely due to supply chain disruptions, deteriorating economic conditions and trade embargoes.

The largest world market in China is dominated by Huawei and ZTE who have 90-95% while the market outside China is mainly served by Huawei, Ericsson, Nokia, ZTE, and Samsung with Ericsson having the largest share at 39%. Both Nokia and Samsung are however gaining RAN equipment supply market share outside of China.

Not to be excessively concerned however as Dell’Oro still predicts that RAN sales will record growth for the full year 2022 for the fifth consecutive year.

GSMA in their 2020 Global Mobile Trends has their historic data and predictions for total mobile network CAPEX through to 2025 below. As expected the CAPEX is dominated by 5G and it shows the increasing CAPEX and the relatively high CAPEX to Revenue ratio resulting from the focus on 5G roll-out.

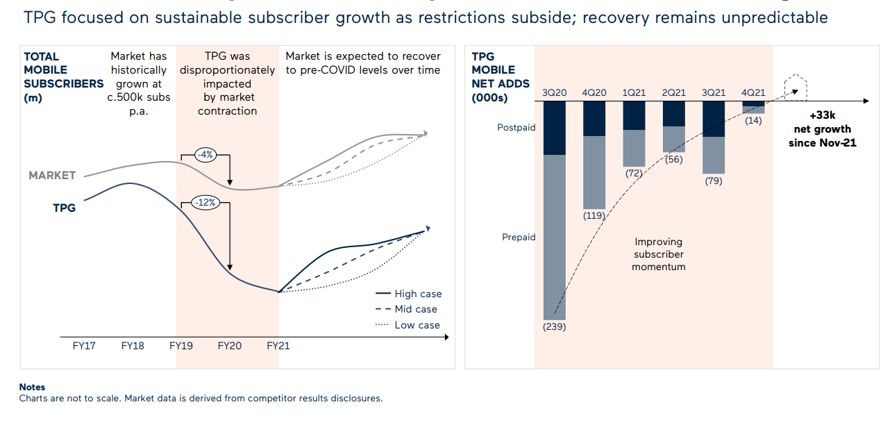

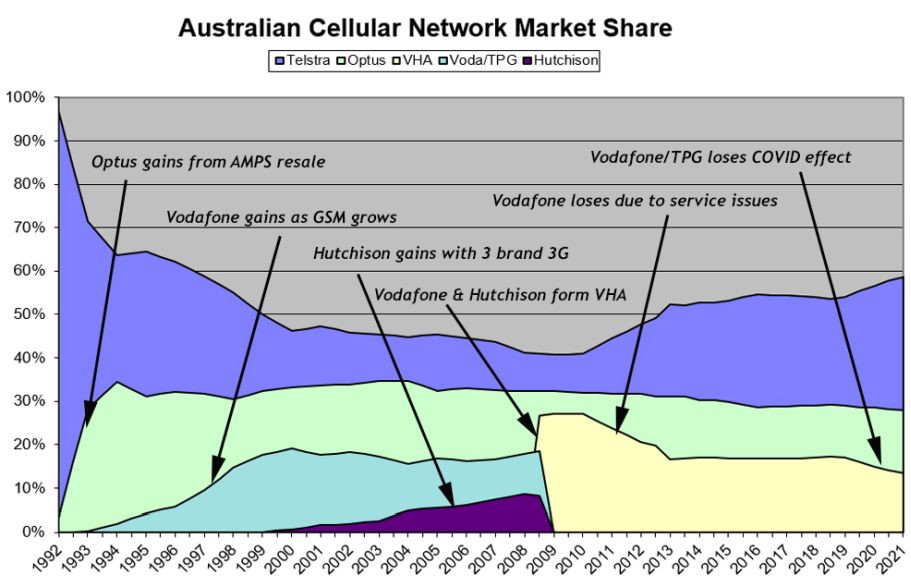

In numbers reported to December 2021 Vodafone/TPG has suffered loss of network services share due to COVID. This TPG says resulted from their larger share of customers temporarily resident in Australia. From December 2019 to April 2020 arrivals to Australia fell from 2 million per month to 20,000.

The effect was highlighted in TPG’s Annual Report for FY 2021 as follows.

The loss of share is reflected in the long term network share graph below. TPG/Vodafone’s loss seems to be Telstra’s gain.

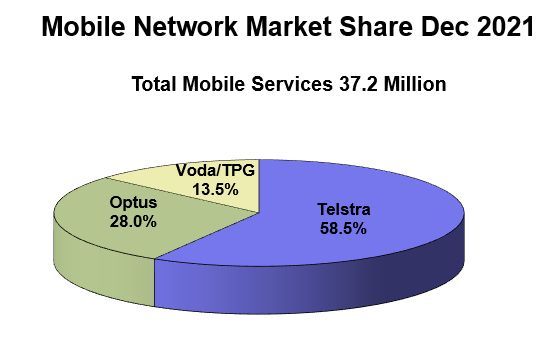

At end December 2021 the three networks reported services in operation totalling 37.2 million with the share as shown on the pie chart below.