Archive for November 2019

In November at ITU’s World Radio Conference 2019 WRC-19 meeting in Sharm-el-Sheik Egypt global spectrum regulators agreed to allocate over 10 GHz of mm wave frequency bands for 5G in the 26, 40, 47 and 66 GHz ranges.

In November at ITU’s World Radio Conference 2019 WRC-19 meeting in Sharm-el-Sheik Egypt global spectrum regulators agreed to allocate over 10 GHz of mm wave frequency bands for 5G in the 26, 40, 47 and 66 GHz ranges.

In Australia the government intends to auction the first of the mm wave spectrum in early 2021. 2.4 GHz of spectrum in the 26 GHz band (24.1 – 27.5 GHZ) will be auctioned and available for 5G networks. The current 5G networks launched by Telstra and Optus are utilising 3.6 GHz spectrum auctioned in December 2018. In this auction 125 MHz was licensed.

The 2.4 GHz of bandwidth to be offered in 2021 is 19 times larger than the current 125 MHz of available 5G spectrum in Australia and is 2.6 times larger than all the spectrum available (925 MHz) for all the nine bands used for all mobile networks today. Using aggregated 100 MHz wide channels which 5G will offer will once deployed provide some outrageous bragging rights speeds.

The problem for mm wave spectrum, which has already been seen in the USA where this spectrum is already in use, is its very limited and unpredictable range. There is some great work being done around beam steering in both base station and mobile antenna systems to optimise mm wave coverage. Despite this, in the near term at least, the mm wave bands will see greatest benefit and use in providing fabulously fast 5G connections and massive capacity in high density areas like airport lounges, sports arenas, shopping centres, large city downtown areas as well as in some industrial settings.

In September 2019 ACMA published its rolling Five Year Spectrum Outlook 2019-23. It covered among other things, its plans for mmWave spectrum.

In September 2019 ACMA published its rolling Five Year Spectrum Outlook 2019-23. It covered among other things, its plans for mmWave spectrum.

28 GHz (27.5–29.5 GHz)

Plans to enable use of fixed wireless access services across the band, sharing the spectrum with fixed satellite earth stations. Change to spectrum allocation

arrangements by Q1 2021.

26 GHz (24.25–27.5 GHz)

A draft spectrum reallocation recommendation has been made to the Minister for Communications to enable use of spectrum in this range for wireless broadband. Proposed allocations in Q1 2021.

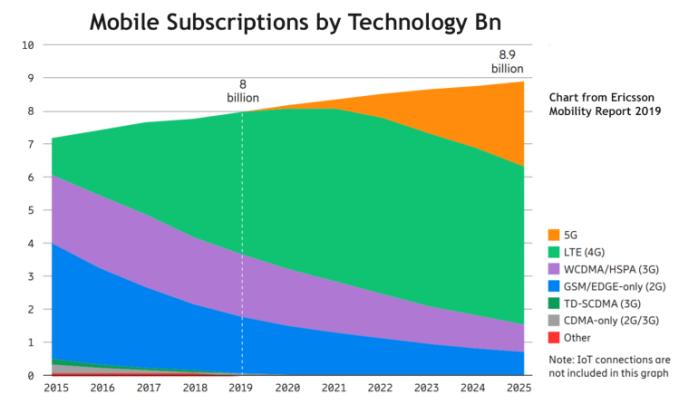

The November 2019 Ericsson Mobility Report just issued shows 8Bn mobile subscriptions worldwide at the end of 2019 growing to 8.9Bn by the end of 2025.

While the growth in subscriptions is limited (the World’s population is 7.75Bn and growing at 1.1% annually) Ericsson say that data carried on world mobile networks will grow by a factor of four from 39 Exabytes per month at the end of 2019 to 160 EB per month (76% of it being video) at the end of 2025. Data consumed per smart phone in the World will go from an average of 7.5GB per month to 24GB over the same period.

Over the next six years Ericsson predicts smart phone subscriptions, which in 2019 are 70% of World subscriptions, will grow from 5.6Bn (2019) to 7.4Bn in 2025 and by then be 83% of all subscriptions. In the same period 5G subscriptions are projected to grow to 2.6Bn and be available to 65% of the World’s population. Ericsson say this is the fastest take up of any mobile generation.

Ericsson separately projects IoT connections to grow from 10.8Bn at the end of 2019 to 24.9Bn in 2025. Most of these will be short range connections principally WiFi, Bluetooth Zigbee and Z-Wave however Ericsson predicts that cellular IoT presently serviced by 3G WCDMA/HSPA and 4G NB-IoT and Cat-M1 networks will grow from 1.2Bn in 2019 to 5.0Bn (20% of total IoT subscriptions) by 2025. Ericsson projects less than 2% (400 million) of IoT connections will be using unlicensed low-power technologies like Sigfox and LoRa by 2025.

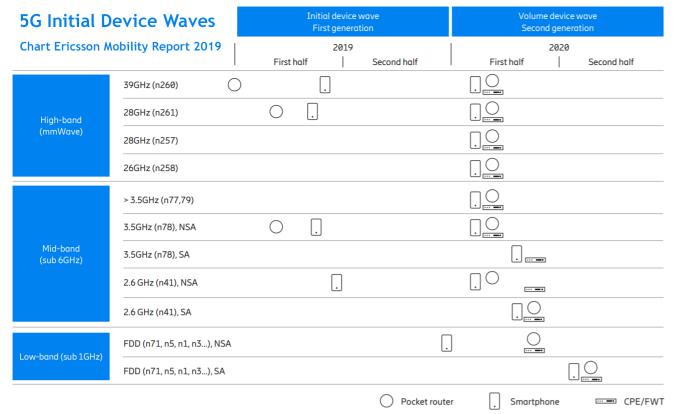

Ericsson charts the short term (2019 and 2020) 5G device availability in its report. It predicts the rapid take up of 5G from 2020 in advanced markets assisted by wide availability of second generation devices in 2020. This new wave of devices will support Stand Alone NR, a wider range of 5G bands, spectrum sharing – particularly with 4G low band for coverage, lower power consumption – fully integrated 5G baseband modems and 5G channel aggregation.

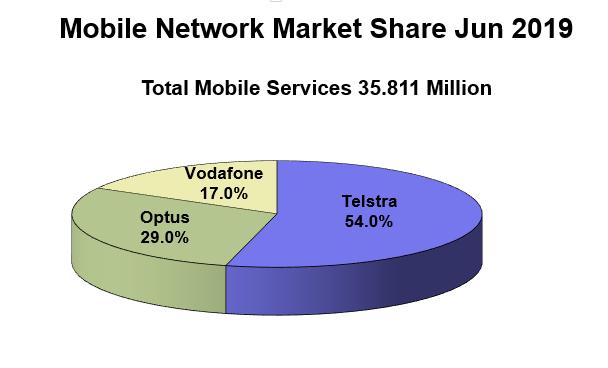

The share of 35.8 million services between the three Australian mobile networks is shown in the pie chart above.

The total Australian services grew by 974,000 in the year to June 2019 based on numbers provided from the respective carriers reports.

The share of services changed very little in the year with Telstra losing 0.1% of share to Vodafone.

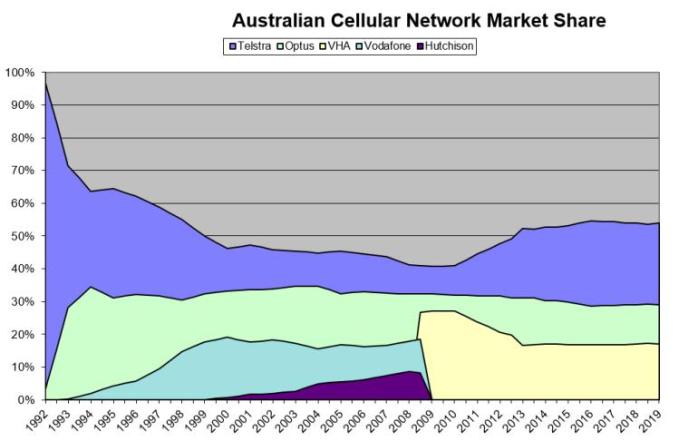

The mobile network share of services since 1992 is shown below. In 1992 Telecom Australia – soon to be Telstra had 100% mobile share.

Ericsson Qualcomm and Swisscom have been co-operating to bring 5G/4G spectrum sharing to Swisscom’s nation mobile network. Swisscom was the first service provider in Europe to launch 5G services commercially last April, using the 3.6 GHz band. Telstra and Optus in Australia have been following a similar trajectory towards 5G.

Ericsson Qualcomm and Swisscom have been co-operating to bring 5G/4G spectrum sharing to Swisscom’s nation mobile network. Swisscom was the first service provider in Europe to launch 5G services commercially last April, using the 3.6 GHz band. Telstra and Optus in Australia have been following a similar trajectory towards 5G.

For local operators rolling out 3.6 GHz 5G site by site is going to take a long time and lots of additional sites to anywhere near match the coverage of the current 4G networks underpinned by the 700MHz Band 28 LTE. What the three big players plan for Switzerland is to dramatically improve the coverage of 5G by sharing low band spectrum currently in heavy use on 4G on Swisscom’s new 5G network. In so doing they plan to provide 5G coverage of 90 percent of the Swiss population by end of 2019.

Ericsson Spectrum Sharing is embedded in Ericsson Radio System. It provides a smooth transition from 4G to 5G nationwide coverage through a network software upgrade. The feature will dynamically share spectrum between 4G and 5G carriers based on traffic demand. The switch between carriers happens within milliseconds. This will allow initially small amounts of low band FDD spectrum to be used on 5G with increasingly more used on 5G as the number of 5G devices grows. The feature is compatible with all 5G FDD capable smartphones and other devices based on the Qualcomm® Snapdragon 5G Mobile Platform, supporting the standardised spectrum sharing functionality.

This would seem to be an ideal fit for Telstra to accelerate the provision of coverage of its 5G network which is presently suffering from a surplus of advertising and a deficit of availability.