Archive for July 2022

The GSA (https://gsacom.com), which keeps a keen eye on these things, recently updated their data on World LTE and 5G deployments.

They reported that there are 812 operators with commercially launched public LTE networks offering broadband fixed wireless access and or mobile services.

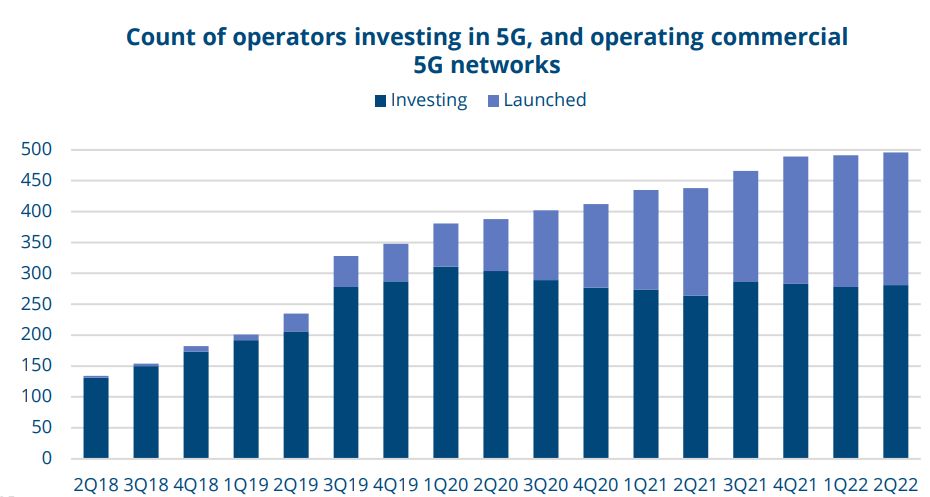

496 operators in 150 countries/territories have been investing in 5G networks in the form of tests, pilots, licence acquisitions, planned and

actual deployments. Of these, 218 operators in 87 countries/territories have launched commercial 3GPP-compatible 5G services (mobile or fixed wireless access. Only 24 of the 218 have launched Stand Alone SA 5G.

In addition to these commercial public networks GSA says that there have been 338 private networks launched using LTE or 5G technologies.

Always interesting is Ericsson’s data on cellular network traffic growth. They are uniquely positioned to observe and record this statistic.

Their 2022 June report shows the around 60% per annum increase prior to COVID Pandemic has reduced to a still respectable 40% since.

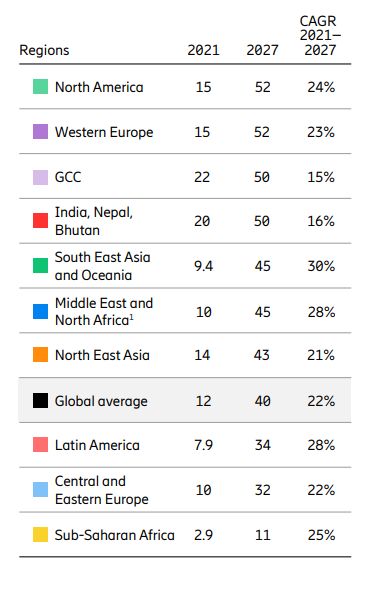

Elsewhere they report that the average cellular data per subscription world wide in 2022 is 15GB per month. The data usage varies considerably in different World regions as Ericsson’s table below shows.

Ericsson Mobility Report June 2022 has some interesting data and predictions on IoT.

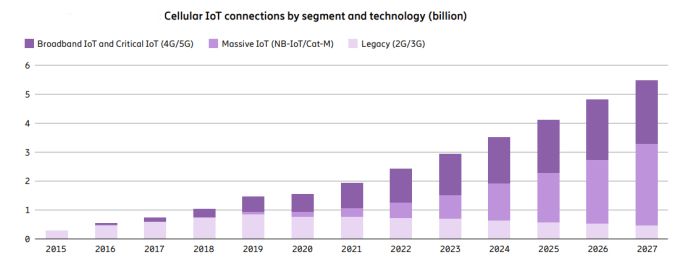

Ericsson is primarily interested in, and reporting on medium and long range IoT technologies. Currently these are legacy 2G and 3G plus cellular NB-IoT and Cat-M and broadband IoT via 4G and 5G. They have projected these technologies to move from 1.9 billion connections worldwide in 2021 to 5.5 billion in 2027. Connections on legacy 2G and 3G are declining. These are moving to NB-IoT Cat-M1 and LTE and 5G and new services are going onto these newer networks as shown on graph below

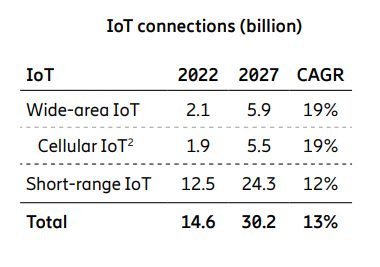

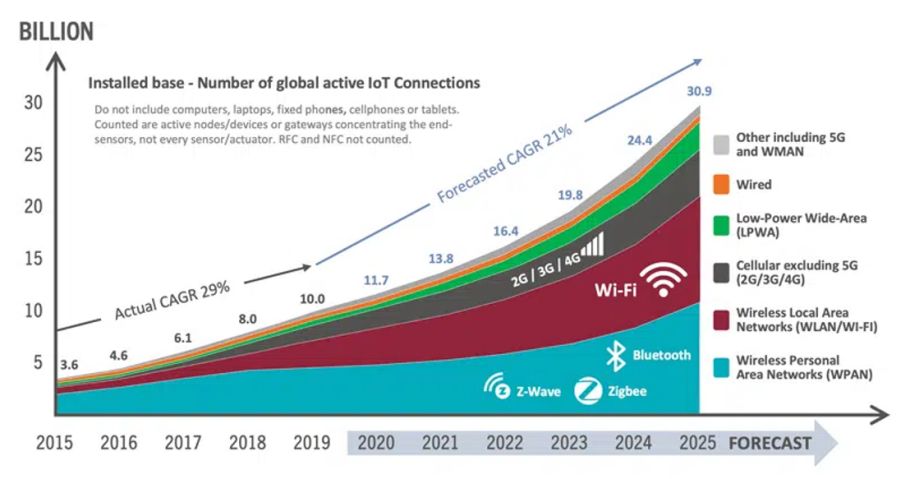

85% of IoT connections are currently on short range technologies Zigbee, Z Wave, Bluetooth, and WiFi. Ericsson predict that this will reduce to 80% by 2027 with some migration to new longer range and increasingly competent cellular networks. Ericsson have also predicted growth from a lower base for competing wide area IoT technologies such as LoRaWAN and Sigfox.

An earlier forecast had total IoT connections reaching 30Bn by 2025 with a similar mix of technologies. CAGR growth of between 15 and 20% looks likely.

The Ericsson Mobility Report June 2022 shows 8.2 billion mobile subscriptions held by 6.1 billion subscribers worldwide at the end of 2021. With the World’s population at 7.75 billion almost 79% of the population are mobile subscribers. Ericsson data says that 77% of the subscriptions are for smartphones and that 83% have mobile broadband.

The Ericsson Report predicts by the end of 2022 there will be 1 billion 5G subscriptions and that 4G LTE subscriptions will peak then at 5 billion. Combined 4G & 5G will be 72% of subscriptions and that will increase to 86% in five years to 2027 when 4G and 5G subscriptions will be about the same in number.

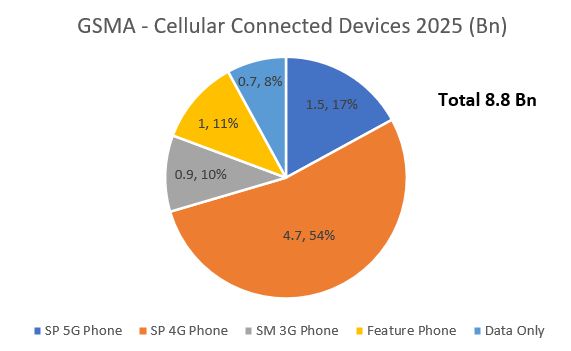

GSMA in their Mobile Trends 2020 predicted similar total 8.8Bn connections at 2025 shown below. GSMA were less bullish on the migration to 5G and they provided a split of Smart Phone (SP) 3-5G and feature phones and data only devices like PC’s tablets etc.

Telstra and the Australian government secured the required regulatory approvals from governments in the region to acquire Digicel Pacific nearly nine months after announcing a move to take over the company.

Telstra and the Australian government secured the required regulatory approvals from governments in the region to acquire Digicel Pacific nearly nine months after announcing a move to take over the company.

The interest and support from the Australian Government resulted from concerns (founded or unfounded) about the property being acquired from Irish billionaire owner Denis O’Brien by a Chinese state-owned enterprise.

Digicel Pacific has operations in Papua New Guinea, Fiji, Nauru, Samoa, Tonga and Vanuatu with a total of 2.8 million subscriptions generating revenue in FY 2022 of $466M. It has 1,700 employees which Telstra plans to retain. Digicel which is incorporated in Bermuda, retains operations serving 10 million customers in 25 countries including Jamaica, Haiti, Trinidad and Tobago, Barbados, Cayman Islands, Panama and El Salvador.

Telstra International will manage the company as a stand-alone business, which will be overseen by a Telstra-controlled board chaired by enterprise unit executive David Burns.

Telstra paid $270 million in equity towards the $1.6 billion purchase price. The Australian government, through Export Finance Australia, paid the $1.3 billion balance. Telstra owns 100 per cent of the ordinary equity.