Archive for February 2015

David Thodey will retire as CEO of Telstra on 1st May and will be replaced by current CFO Andy Penn.

David Thodey who is 60 was born in Perth and educated in New Zealand. He was recruited from IBM to Telstra in April 2001 as Group Managing Director of Mobiles. He went on to head up Telstra Enterprise and Government from December 2002 and was appointed as CEO in May 2009 following the turbulent reign of Sol Trujillo.

David Thodey normalised the government relationship and more than doubled the value of the company in his years at the helm through some astute deals most notably the $11Bn NBN and NBN2 arrangements.

In the mobile space David Thodey built on the excellent network quality NextG legacy left by Trujillo continuing to spend to improve speed, coverage and capacity with 4G LTE and more recently 700MHz Carrier Aggregation 4GX. With this strategy Telstra has been able to increase its mobile market share (from 41.4% in 2009 to 52.2% today) while pricing at a premium over Optus and Vodafone.

Vodafone has just announced that it has completed trials of voice over LTE (VoLTE) services on its network and expects to launch the service this year. CTO Benoit Hanssen said “Vodafone will be one of the first to launch VoLTE in Australia”.

Vodafone has just announced that it has completed trials of voice over LTE (VoLTE) services on its network and expects to launch the service this year. CTO Benoit Hanssen said “Vodafone will be one of the first to launch VoLTE in Australia”.

Telstra and Optus are known to have trialled the technology and Telstra demonstrated VoLTE calling on its live 4GX network in November 2014. .

According to Global Suppliers Association GSA VoLTE has been launched on 14 networks with 80 operators (including Vodafone, Telstra and Optus) in 42 countries investing in the technology.

VoLTE will provide not just voice but a suite of Rich Communication Services RCS based on IP Multimedia System IMS standards once implemented. IMS supports SMS, high definition voice, video telephony, multimedia sharing during voice calls and more. VoLTE roughly halves the call setup time and removes the necessity for a 4G phone to move to 3G for a voice call as is the case today.

As well as an LTE network operators need an evolved packet core network which is VoLTE capable and to install a IMS core to support the services. The LTE phones also need to support IMS. At present VoLTE compatible smartphones include the iPhone 6 and 6 Plus, the Samsung Galaxy S5 and Galaxy Note 4 and Huawei Ascend Y550. New release high end phones which inlcude the Qualcomm SoC like Snapdragon 800 series or VoLTE modem chips will support VoLTE.

Unlike the many other over the top OTT messaging, voice and video services like Skype, iOS Facetime, Viber, WhatsApp Nimbuzz, Tango, LINE etc. VoLTE is 3GG standards based (3GPP IR.92). The capability is thus integrated in the device and in the network and optimised for performance, capacity, power drain etc.

Operators are generally not rushing to bring VoLTE to market as it does require robust LTE network coverage, a population of VoLTE capable phones as well as investment in IMS capable core network. As in Australia where operators, by and large, have good coverage 3G networks to carry voice then the incentive to spend capital to move this voice to LTE has not been strong. Now as more devices are available and 4G network coverage is improving with the inclusion of 700 MHz (850MHz for Vodafone) on LTE the time is starting to be right for the move.

It will be interesting to see the marketing and customer take up of VoLTE/IMS features beyond HD voice. Standards based video telephony has been a feature of WCDMA and was initially much hyped in 2003 but you never hear about it today. IMS likewise has been around for a long time with not much traction. Time will tell.

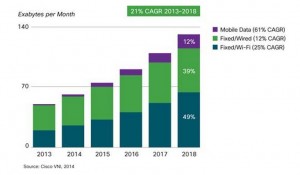

Global mobile data is growing strongly. Cisco here predicted in February 2014 a 10X increase in mobile data from 2.5 Exabytes (1000GB)per month to 24EB/m by 2019. This is similar to the Ericsson projections referred to in the post below.

Global mobile data is growing strongly. Cisco here predicted in February 2014 a 10X increase in mobile data from 2.5 Exabytes (1000GB)per month to 24EB/m by 2019. This is similar to the Ericsson projections referred to in the post below.

Total IP data is also experiencing strong growth. In June 2014 Cisco here had total world IP data in 2014 at 62EB per month growing to 132EB/m by 2018 (2.2X in four years).

From data in these Cisco reports mobile represented 4% of world data in 2014 but by 2018 this will climb to 12%.

So while they are fast growing, mobile networks are, and will remain a minority generator of world IP traffic.

The Cisco graph right also shows the growing part that WiFi has in the carriage of data. This WiFi increase will be driven by ever faster WiFi networks like those on 802.11ac providing replacement in speed and performance of wired connections for video consumption. This combined with video consumption on tablets and from dongles like Chromecast and ever increasing use of WiFi hotspots.

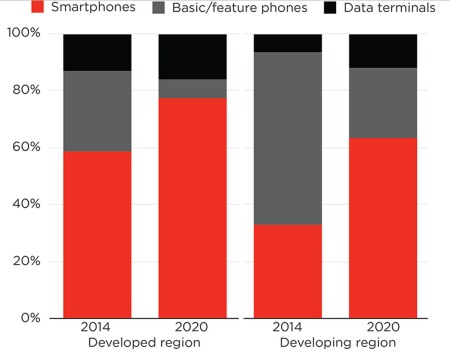

GSMA Intelligence reports the percentage of mobile subscriptions which use smart phones Vrs feature and basic phones and data terminals (USB and WiFi dongles) in the graph right..

In the Ericsson Mobility Report November 2014 the company reported that 38% (2.7 Bn out of the total world’s 7.1Bn sunscriptions) where on smart phones. Ericsson projected this to grow to 64% (6.1Bn out of a total of 9.5Bn total phones) by 2020 and for smartphone data to go from an average of 900MB to 2.9GB per month in the same period. This increase in smartphones combined with the increase in average data usage Ericsson say will increase world mobile data use by 8X from 2014 to 2020.

Telstra’s CFO Andy Penn stated on 13th February following Telstra’s half year results announcement that 80% of mobiles in Australia were smart phones. This places Australia a little ahead of the smart phone takeup reported by GSMA Intelligence for the developed world.

The latest USA spectrum auctions just concluded yielded $44.9Bn mostly for 2X25MHz of AWS spectrum. The most sought paired bands 1755 to 1780MHz and 2155 to 2180MHz are adjacent to the standard AWS Band 4 see all bands list here

The latest USA spectrum auctions just concluded yielded $44.9Bn mostly for 2X25MHz of AWS spectrum. The most sought paired bands 1755 to 1780MHz and 2155 to 2180MHz are adjacent to the standard AWS Band 4 see all bands list here

The price per MHz per head of population (MHz/Pop) covered for the paired spectrum was $USD2.65. This compares with around $USD0.46 for the original 2X45MHz of AWS spectrum when it was auctioned in 2006 and 2008.

The last Australian auctions for 700 and 2600MHz 4G spectrum which concluded in May 2013 yeilded $AUD1.965Bn. There was much debate at the time that the government set reserve for the prime “water front” 700MHz spectrum at $311M per 2X5Mhz lot was to high and subsequently 2X15MHz was passed in at auction. The portions of 700MHz which were sold went for the reserve price which amounts to $AUD1.35 /MHz/Pop. The AWS3 USA spectrum license is for 12 years and the Australian ones including the 700MHz are for 15 years.

Considering that by any measure the Band 28 APT 700MHz spectrum is far more desirable compared to USA AWS 2100/1700 MHz the price set now looks more like a bargain by comparison. Of course the real bargain in Australia was the 2600MHz 2X70MHz of which was sold for $98M which is just 3 cents /MHz/Pop.

The message is that wherever you look cellular spectrum is more in demand and (especially for low band lots) significantly more valuable. Like water fronts they don’t make any more.

Following the expiry of the “quiet time” after the AWS3 auction AT&T has joined the chorus of critics of the auction rules and outcome, warning that frequencies should go to companies that are willing to deploy networks – “not speculators or stockpilers”.

AT&T were pointing at Dish Networks primarily a satellite Pay TV company which won $13 billion worth of licences with a $3 billion ’small business’ discount,” Dish with around $14Bn p.a. in earnings would hardly qualify as a small business in most places.