Optus was the big winner and largest payer in the December 2021 auction of 850 and 900 MHz spectrum.

The 900 MHz spectrum spectrum 2X25MHz was allocated vis apparatus license equally to all three carriers when GSM was launched. It will be used when it is made available from 1 July 2024 to top up Optus’ rather meagre low band 5G spectrum. Telstra will add the 2X10MHz of 850Mz spectrum to the 2X10MHz (2X15MHz in regional areas) it already has. Optus’ 900MHz spectrum is continuous whereas Telstra’s has blocks of spectrum between Telstra’s holdings and is probably unlikely to agree to swap to allow Telstra to use its spectrum more efficiently.

Optus paid $1,476M for its acquisition and Telstra $616M. Vodafone TPG did not participate in the auction for either contested spectrum or spectrum which was reserved for it at a reserve price.

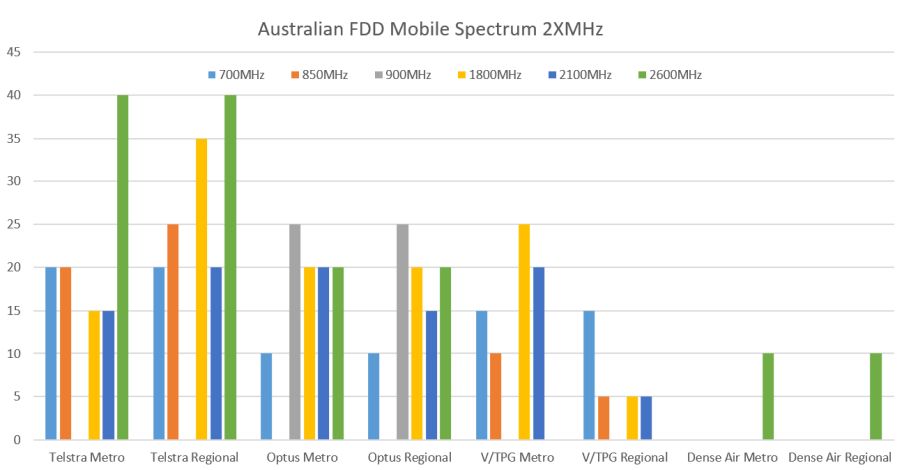

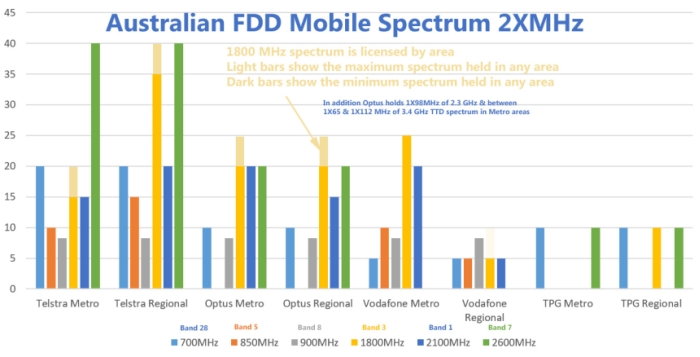

The table below summarises the holding of FDD cellular spectrum following the auction. The total spectrum holdings FDD, TDD and mmWave is on the Spectrum page on this web site Here.

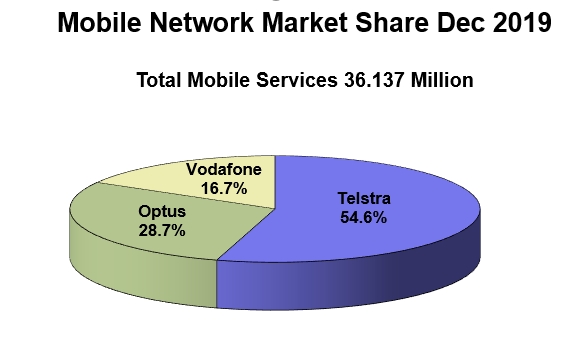

Australian mobile network service connections were reported by the three operators at 36.137 million at December 2019. The market grew by 849,000 service connections in the calendar year.

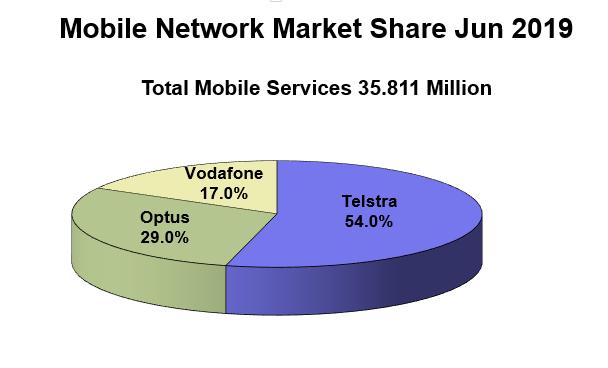

The share of these connections is shown on the pie chart below.

In the 2019 year Telstra gained 1% of market share – 0.5% from Optus and 0.5% from VHA.

In November at ITU’s World Radio Conference 2019 WRC-19 meeting in Sharm-el-Sheik Egypt global spectrum regulators agreed to allocate over 10 GHz of mm wave frequency bands for 5G in the 26, 40, 47 and 66 GHz ranges.

In November at ITU’s World Radio Conference 2019 WRC-19 meeting in Sharm-el-Sheik Egypt global spectrum regulators agreed to allocate over 10 GHz of mm wave frequency bands for 5G in the 26, 40, 47 and 66 GHz ranges.

In Australia the government intends to auction the first of the mm wave spectrum in early 2021. 2.4 GHz of spectrum in the 26 GHz band (24.1 – 27.5 GHZ) will be auctioned and available for 5G networks. The current 5G networks launched by Telstra and Optus are utilising 3.6 GHz spectrum auctioned in December 2018. In this auction 125 MHz was licensed.

The 2.4 GHz of bandwidth to be offered in 2021 is 19 times larger than the current 125 MHz of available 5G spectrum in Australia and is 2.6 times larger than all the spectrum available (925 MHz) for all the nine bands used for all mobile networks today. Using aggregated 100 MHz wide channels which 5G will offer will once deployed provide some outrageous bragging rights speeds.

The problem for mm wave spectrum, which has already been seen in the USA where this spectrum is already in use, is its very limited and unpredictable range. There is some great work being done around beam steering in both base station and mobile antenna systems to optimise mm wave coverage. Despite this, in the near term at least, the mm wave bands will see greatest benefit and use in providing fabulously fast 5G connections and massive capacity in high density areas like airport lounges, sports arenas, shopping centres, large city downtown areas as well as in some industrial settings.

In September 2019 ACMA published its rolling Five Year Spectrum Outlook 2019-23. It covered among other things, its plans for mmWave spectrum.

In September 2019 ACMA published its rolling Five Year Spectrum Outlook 2019-23. It covered among other things, its plans for mmWave spectrum.

28 GHz (27.5–29.5 GHz)

Plans to enable use of fixed wireless access services across the band, sharing the spectrum with fixed satellite earth stations. Change to spectrum allocation

arrangements by Q1 2021.

26 GHz (24.25–27.5 GHz)

A draft spectrum reallocation recommendation has been made to the Minister for Communications to enable use of spectrum in this range for wireless broadband. Proposed allocations in Q1 2021.

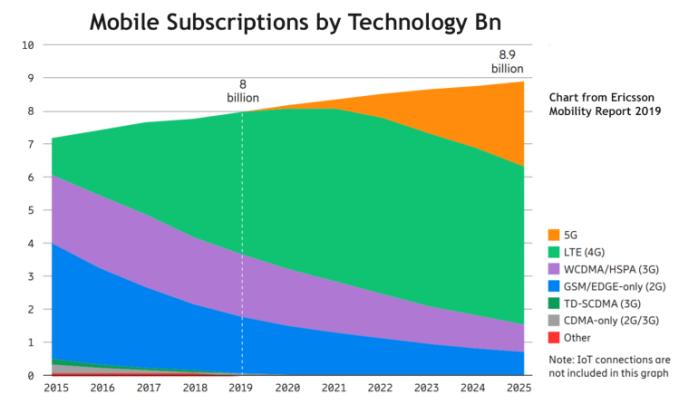

The November 2019 Ericsson Mobility Report just issued shows 8Bn mobile subscriptions worldwide at the end of 2019 growing to 8.9Bn by the end of 2025.

While the growth in subscriptions is limited (the World’s population is 7.75Bn and growing at 1.1% annually) Ericsson say that data carried on world mobile networks will grow by a factor of four from 39 Exabytes per month at the end of 2019 to 160 EB per month (76% of it being video) at the end of 2025. Data consumed per smart phone in the World will go from an average of 7.5GB per month to 24GB over the same period.

Over the next six years Ericsson predicts smart phone subscriptions, which in 2019 are 70% of World subscriptions, will grow from 5.6Bn (2019) to 7.4Bn in 2025 and by then be 83% of all subscriptions. In the same period 5G subscriptions are projected to grow to 2.6Bn and be available to 65% of the World’s population. Ericsson say this is the fastest take up of any mobile generation.

Ericsson separately projects IoT connections to grow from 10.8Bn at the end of 2019 to 24.9Bn in 2025. Most of these will be short range connections principally WiFi, Bluetooth Zigbee and Z-Wave however Ericsson predicts that cellular IoT presently serviced by 3G WCDMA/HSPA and 4G NB-IoT and Cat-M1 networks will grow from 1.2Bn in 2019 to 5.0Bn (20% of total IoT subscriptions) by 2025. Ericsson projects less than 2% (400 million) of IoT connections will be using unlicensed low-power technologies like Sigfox and LoRa by 2025.

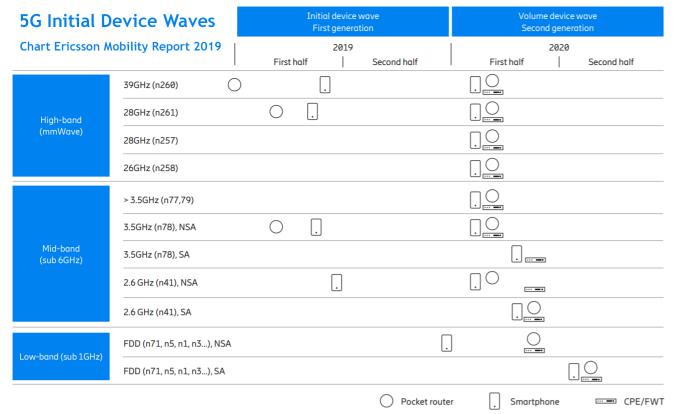

Ericsson charts the short term (2019 and 2020) 5G device availability in its report. It predicts the rapid take up of 5G from 2020 in advanced markets assisted by wide availability of second generation devices in 2020. This new wave of devices will support Stand Alone NR, a wider range of 5G bands, spectrum sharing – particularly with 4G low band for coverage, lower power consumption – fully integrated 5G baseband modems and 5G channel aggregation.

The share of 35.8 million services between the three Australian mobile networks is shown in the pie chart above.

The total Australian services grew by 974,000 in the year to June 2019 based on numbers provided from the respective carriers reports.

The share of services changed very little in the year with Telstra losing 0.1% of share to Vodafone.

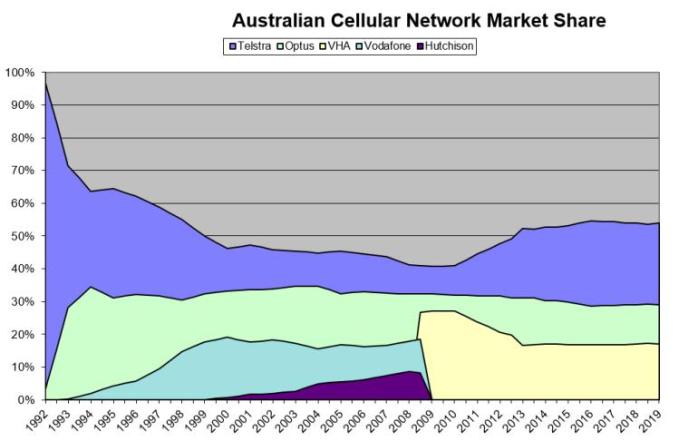

The mobile network share of services since 1992 is shown below. In 1992 Telecom Australia – soon to be Telstra had 100% mobile share.

Ericsson Qualcomm and Swisscom have been co-operating to bring 5G/4G spectrum sharing to Swisscom’s nation mobile network. Swisscom was the first service provider in Europe to launch 5G services commercially last April, using the 3.6 GHz band. Telstra and Optus in Australia have been following a similar trajectory towards 5G.

Ericsson Qualcomm and Swisscom have been co-operating to bring 5G/4G spectrum sharing to Swisscom’s nation mobile network. Swisscom was the first service provider in Europe to launch 5G services commercially last April, using the 3.6 GHz band. Telstra and Optus in Australia have been following a similar trajectory towards 5G.

For local operators rolling out 3.6 GHz 5G site by site is going to take a long time and lots of additional sites to anywhere near match the coverage of the current 4G networks underpinned by the 700MHz Band 28 LTE. What the three big players plan for Switzerland is to dramatically improve the coverage of 5G by sharing low band spectrum currently in heavy use on 4G on Swisscom’s new 5G network. In so doing they plan to provide 5G coverage of 90 percent of the Swiss population by end of 2019.

Ericsson Spectrum Sharing is embedded in Ericsson Radio System. It provides a smooth transition from 4G to 5G nationwide coverage through a network software upgrade. The feature will dynamically share spectrum between 4G and 5G carriers based on traffic demand. The switch between carriers happens within milliseconds. This will allow initially small amounts of low band FDD spectrum to be used on 5G with increasingly more used on 5G as the number of 5G devices grows. The feature is compatible with all 5G FDD capable smartphones and other devices based on the Qualcomm® Snapdragon 5G Mobile Platform, supporting the standardised spectrum sharing functionality.

This would seem to be an ideal fit for Telstra to accelerate the provision of coverage of its 5G network which is presently suffering from a surplus of advertising and a deficit of availability.

You will hear a lot more soon about Dynamic Spectrum Sharing (DSS) and its use in expediting 5G network deployments.

Paul Challoner VP of network product solutions for Ericsson North America says that “DSS changes the game by allowing operators to deploy both 4G and 5G in the same block, and dynamically allocate the right amount of spectrum to each based on demand.’ He went on to say “Using the technology can avoid setting aside large chunks of precious LTE spectrum for 5G before it is fully needed, and instead gradually load 5G users onto their LTE bands.”

There is a very good Ericsson video of a lab demonstration of DSS in action in Stockholm which highlights Swisscom’s early and network wide adoption of the technique. Swisscom plans to have full national 5G coverage by 2020 facilitated by using DSS. The video is HERE.

DSS is part of the 3GPP’s Release 15 specifications and it will appear in network software starting late in 2019 compatible handsets won’t become broadly available until the first half of 2020.

Australia, unlike many of the other leading 5G countries, has no low band dedicated 5G spectrum see graphic right.

Considering our geographic spread achieving wide 5G coverage will be impractical in the short to medium term with just the 3.6 GHz band spectrum. As such once there are sufficient DSS capable 5G mobiles in the market we expect that, like Swisscom, Australian MNO’s will deploy DSS sharing with low band spectrum to provide comparable coverage to that of LTE.

WiFi Alliance has announced WiFi 6 802.11ax standard. It will sit alongside the suite of 802.11 standards developed since 1997.

The new standard is capable of 1.2 Gb/s per MiMo stream in a 120 MHz wide channel.

The summary of WiFi 1-6 standards is below.

| Date | Band | Bandwidth | Max Speed | MIMO | Range |

Range |

WiFi | ||

| Standard | Issued | GHz | MHz | Mb/s | Streams | Modulation | Indoor | Outdoor | Version |

| 802.11-1997 | Jun-97 | 2.4 | 22 | 2 | N/A | DSSS, FHSS | 20 | 100 | WiFi 97 |

| 802.11b | Sep-99 | 2.4 | 22 | 11 | N/A | DSSS | 35 | 140 | WiFi 1 |

| 802.11a | Sep-99 | 5 | 5-20 | 54 | N/A | OFDM | 35 | 120 | WiFi 2 |

| 802.11g | Jun-03 | 2.4 | 5-20 | 38 | 140 | WiFi 3 | |||

| 802.11n | Oct-09 | 2.4/5 | 20 | 288 | 4 | MIMO-OFDM | 70 | 250 | WiFi 4 |

| 40 | |||||||||

| 802.11ac | Dec-13 | 5 | 20 | 346 | 8 | MIMO-OFDM | 35 | 120 | WiFi 5 |

| 40 | |||||||||

| 80 | 1733 | ||||||||

| 160 | |||||||||

| 802.11ax | Est. Dec 2019 | 2.4/5/6 | 20-160 | 10530 | ? | MIMO-OFDM | ? | ? | WiFi 6 |

| 802.11ad | Dec -12 | 60 | 2160 | 6757 | N/A | OFDM | 3 |

The total mobile services in operation on the three mobile networks (Telstra, Optus and Vodafone) in Australia grew by 1.265m (3.8%) to a total of 34.914m at June 2018. The share of network subscriptions has not moved much in the year to June 2018 with Telstra losing 0.7% and Vodafone gaining 0.4% and Optus 0.3%.

The 2017/18 growth is very similar to 2016/17 of 1.07m (3.3%) and continues to reflect the relative saturation of the handset, tablet and mobile broadband markets as they stand.

Growth in future in service numbers (if not revenue) will come from the mobile component of the Internet of Things (IoT) and to a lesser extent fixed internet substitution. These will be enabled by the Category M1 and Narrow Band IoT features of LTE and the start in 2019 of deployment of 5G.

The first formal 5G standard was approved in Lisbon this week. This is for the Non Stand Alone NSA 5G New Radio NR. This part of the standardisation was prioritised, following mobile operator and other industry pressure, to allow earlier large scale trials and commercial deployment of the new 5G RAN possibly as early as 2019.

Bruno Jacobfeuerborn, CTO Deutsche Telekom said “It is crucial that the industry now redoubles its focus on the Standalone mode to achieve progress towards a full 5G system, so we can bring key 5G innovations such as network slicing to our customers.” It is understood that the next key milestone that of Stand Alone SA specification providing new end to end 5G could be completed as early as June 2018.

You can see from the many smiling faces of the folks at standards RAN#78 in Lisbon pictured below that they are happy with their effort which their Chairman Balazs Bertenyi said was “an impressive achievement in a remarkably short time, with credit due particularly to the Working Groups”.

The total mobile services in operation on the three mobile networks of Telstra, Optus and Vodafone in Australia grew by 1.07m (3.3%) to 33.665m at June 2017.

The total mobile services in operation on the three mobile networks of Telstra, Optus and Vodafone in Australia grew by 1.07m (3.3%) to 33.665m at June 2017.

This reflects the relative saturation of the market as it stands. The numbers are likely to increase much faster in the coming years as the cellular mobile component of the Internet of Things (IoT) ramps up.

All carriers are working towards network evolution to support Category M1 (Cat-M1) and later NB-IoT standards targeting, lower speed and cost, low power and wide coverage networks for IoT applications.

Following its call for submissions, a “special” letter from Minister Fifield and their own deliberations the Australian Competition and Consumer Commission ACCC has tentatively decided not to declare a wholesale domestic mobile roaming service. This is the ACCC’s third consideration of the subject.

The views submitted to the ACCC accessed HERE were predictable and largely followed the financial interests of the authors. Telstra, and to a lesser extent Optus, having spent a lot of money in remote areas building both 3G and 4G coverage had most to lose and argued against the declaration.

Arguing in favour was Vodafone which has focussed its capital and marketing in urban areas had much to gain. It is interesting that when the same issue was raised in the UK all operators were opposed to it including Vodafone who’s spokesperson at the time said “National roaming will not provide the people of the UK with better quality voice and mobile internet coverage,” – perhaps he should seek a job with Telstra.

TPG, which is setting about building a new network concentrating coverage only in built up areas, would have benefited the most from gaining regulated access to and additional 2.4M square KM of coverage. TPG argued for declaration.

The groups representing the communications interests of country communities almost universally put the same view as Telstra’s CEO Andy Penn claiming that Telstra’s incentive to invest in rural areas would be greatly reduced or removed altogether if they were forced to carry their competitors along.

So the submission were predictable leaving the ACCC in the “the dammed if you do and dammed if you don’t” position which ACCC Chairman Rod Simms covered in the words “the effect declaration would have on competition in regional, rural and remote areas is uncertain. While declaration may deliver choice for more consumers, declaration has the potential to make some consumers worse off,” and “The ACCC has examined the incentives for mobile network operators to upgrade their networks or invest in expanding coverage both with and without declaration. We heard from many regional groups concerned about coverage. We consider there is evidence that declaration could damage some incentives for operators to invest such that overall coverage is not likely to improve with declaration,”

So the submission were predictable leaving the ACCC in the “the dammed if you do and dammed if you don’t” position which ACCC Chairman Rod Simms covered in the words “the effect declaration would have on competition in regional, rural and remote areas is uncertain. While declaration may deliver choice for more consumers, declaration has the potential to make some consumers worse off,” and “The ACCC has examined the incentives for mobile network operators to upgrade their networks or invest in expanding coverage both with and without declaration. We heard from many regional groups concerned about coverage. We consider there is evidence that declaration could damage some incentives for operators to invest such that overall coverage is not likely to improve with declaration,”

Interesting to see the just completed 700MHz “Incentive” auction in the USA saw 70MHz of spectrum sold for $US19.8Bn or $0.93/MHz/pop.

Interesting to see the just completed 700MHz “Incentive” auction in the USA saw 70MHz of spectrum sold for $US19.8Bn or $0.93/MHz/pop.

This spectrum was given up by 174 broadcasters across the country in a reverse auction. These broadcasters were compensated collectively to the tune of $10Bn. $7.3Bn of the balance will go towards reducing Uncle Sam’s deficit (currently $19Tr).

Of the 100 registered bidders and 50 winners of spectrum number 3 ranked mobile operator T-Mobile purchased the most by far winning the rights to 31MHz nationwide (securing 45 per cent of the total spectrum sold) for $8Bn.

Note that the USA spectrum is for keeps not just for 15 years as is the case with the Australian (and many other market’s) spectrum licenses.

An auction of the unsold 2X15 HMz of 700 MHz spectrum was held in April by Australian Communications and Media Authority ACMA. The auction lasted a week and concluded on 10th April 2017.

TPG won 2X10MHz for $1.26Bn (2.75/MHz/pop) while Vodafone picked up 2X5MHz for the reserve price $286M ($1.25/MHz/pop). The third bidder Optus left empty handed. Telstra was precluded from participating in the auction.

The 700 MHz spectrum licenses will run from 1 April 2018 until 31 December 2029 giving them the same expiry date as the 2013 auctioned 2X30 MHz 700 MHz lots bought by Telstra and Optus for $1.866Bn.

Vodafone will presumably be eager to incorporate this low band spectrum onto its LTE network while TPG has announced it plans to spend an additional $600M to build a 2,000 to 2,500 base station LTE network. TPG also has access to 2X10HMZ of 2.6 GHz spectrum nationally and 2X10MHz of 1800 MHz spectrum in regional areas.

TPG’s Chairman and CEO David Teoh is confident that such a small outlay will result in a saleable network which he says will be EBITDA positive with just 500,000 services because TPG will:

• Be able to deploy current advanced technology in its network

• Reque fewer mobile towers

• Have no legacy generations of equipment to support; and

• Have no existing customer revenue to protect.

You would wish TPG good fortune in their quest into mobile operatordom and they will need it.

The last company in Australia to pay well over the odds for spectrum to build and operate their own network to graduate from virtual to a real network operator was OneTel and that did not end well. As well TPG will likely be fishing in the same pool of cost conscious customers as Vodafone Australia. Vodafone has more than 10 times TPG’s claimed EBITDA break even customer base of 500,000 but even with its now stabilised and mature network with 96% population coverage it continues to record losses ($672M total in the last two years).

A summary of the spectrum holdings by mobile operators in Australia following this auction is below.

As requested by a group comprising the major mobile operators and suppliers at MWC in Barcelona the 3GPP has agreed to bring forward the standardisation of the Non-standalone (NSA) 5G NR mode for the enhanced Mobile BroadBand (eMBB) use-case.

3GPP RAN Chairman said “In Non-standalone mode the connection is anchored in LTE while 5G NR carriers are used to boost data-rates and reduce latency. With the updated workplan, NSA will be finalized by March 2018. At the same time, the group re-instated its commitment to complete the Standalone (SA) 5G NR mode by September 2018 and put in place a plan to achieve that.”

The advantage of the change is possible earlier adoption of 5G New Radio NR carriers with their superior speed, latency and capacity. The risk is that the overall 5G standardisation and hence implementation is delayed.