With everyone who is anyone in the mobile world (108,00 in all) gathered last week at Fira Gran Via in Barcelona there were numbers a plenty on the progress and predictions for the future for the industry.

With everyone who is anyone in the mobile world (108,00 in all) gathered last week at Fira Gran Via in Barcelona there were numbers a plenty on the progress and predictions for the future for the industry.

Some of the big numbers mentioned at WMC by some of the eminent industry people there include:

- At the end of 2016 there were 7.9Bn total mobile subscriptions

- 51% of theses subscriptions are for a smart phones

- These 7.9Bn subscriptions were used by 4.8Bn unique subscribers

- Average subscriber penetration in the developed world is 84%

- In the developed markets penetration in the 16-64 age bracket is 97% i.e. it is saturated

- In the developing markets penetration is 62%

- There is growth in the developing world with 900 million new subscribers expected by 2025

- There are expected to be 5Bn mobile subscribers by the end of 2017

- The industry has spent $1,000Bn on capital from 2010 to 2016

- It is expected that a further $700Bn in capital will be spent from now up to 2020

- $1,230Bn is expected to be spent in capital on 5G by 2026

- There are expected to be 1.1 billion 5G mobiles in service by 2025

- World revenue from mobile service in 2016 was $1,050Bn

- Average data consumed by smartphone users is currently 1.6GB per month

- This will increase to 7GB by 2021

- Video over mobile traffic will increase by 50% each year

- By 2022 video will comprise 75% of traffic on mobile networks

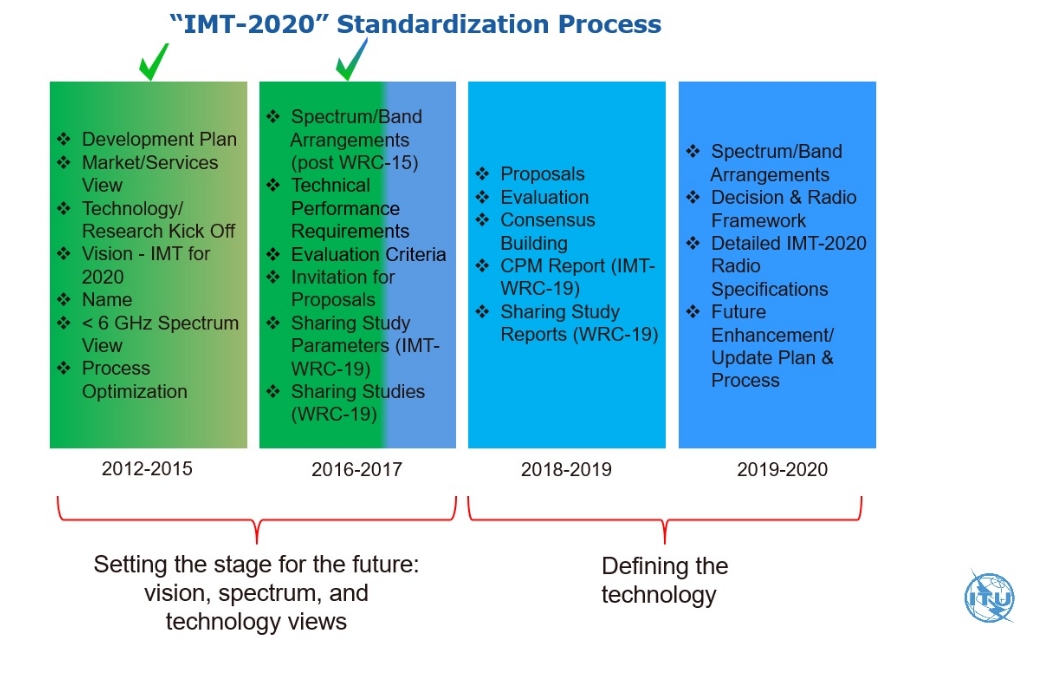

The GSMA run annual World Mobile Congress just completed in Barcelona saw 22 of the largest operators and suppliers calling for a one year acceleration of the standardisation process of NR (New Radio) 5G Radio Access Network RAN. Included in the Group of 22 are Telstra and its mobile network technology supplier Ericsson.

The current 5G timetable would see networks based on the new RAN NR Release 15 standard deployed from 2020 however many operators and network equipment suppliers are demonstrating 5G like LTE Advance (4.5G) and pre-standard 5G equipment and performance already. These trials and demonstrations and their attendant press releases and market positioning publicity will only accelerate as 2020 approaches.

The current 5G timetable would see networks based on the new RAN NR Release 15 standard deployed from 2020 however many operators and network equipment suppliers are demonstrating 5G like LTE Advance (4.5G) and pre-standard 5G equipment and performance already. These trials and demonstrations and their attendant press releases and market positioning publicity will only accelerate as 2020 approaches.

The ITU for its part HERE has set the draft requirements the new technology. The requirements are expected to be finally approved by ITU-R Study Group 5 at its next meeting in November 2017. The requirements for 5G can be summarised as follows:

- Peak data rate: 20 Gbps down / 10 Gbps up

- Peak spectral efficiency: 30 bits/Hz down (8×8 MIMO) / 15 bits/Hz up (4×4 MIMO)

- Area traffic capacity in downlink 10 Mbit/s/m2 for an indoor hotspot for eMBB evolved Mobile Broaband

- User experienced data rate 100 Mbps down / 50 Mbps (5% of the peak data rate)

- Latency: 4 ms for eMBB and 1 ms for URLLC Ultra-Reliable and Low-Latency Communications

- Mobility: Up to 500 km/h with varying requirements for uplink spectral efficiency at different speeds

- Minimum bandwidth: 100 MHz

- Maximum aggregated bandwidth: 1 GHz in bands above the 6 GHz

You can understand that operators would be keen to deploy the more efficient, higher capacity and diverse capability 5G NR equipment as soon as possible to avoid having to spend money on, capable but not as good, 4G LTE equipment much of which will have a reduced service life due to 5G. As well the mobile network equipment providers would like to have the current slow down in their orders for 4G due to impending 5G adoption be as short as possible.

The operator and supplier group is proposing that the Non-Standalone NR be fast tracked by a year allowing them to augment existing LTE RAN and evolved packet core with standards compliant 5G NR in 2019. There is however much work to be done to define the standard summarised in the ITU chart below so it will be interesting to see if the group’s entreaties to speed up the process have any effect.

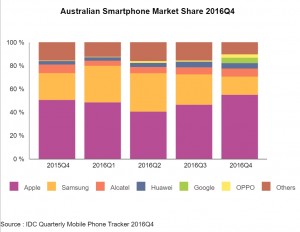

International Data Corporation’s (IDC) Quarterly Mobile Phone Tracker, shows 2.93m mobile phones were sold in Australia in the three months to December 2016.

International Data Corporation’s (IDC) Quarterly Mobile Phone Tracker, shows 2.93m mobile phones were sold in Australia in the three months to December 2016.

95% or 2.79m of these were smart phones so there is a diminishing market for basic mobiles.

Apple iOS phones represented 55% of the sales while Android phones were 44.6%.

Apple iOS has worldwide market share of around 12% as reported by BMO Capital Markets and its Australian share of 55% is second only to Japan’s.

Kantar Worldpanel Comtech’s latest mobile OS market share of device sold in the 3 months to January 2017 shows for Australia iOS up 1.2% YoY to 42.4%. Android also increased 3.1% to 55.7%.

The report shows that predictably with no new Windows devices coming onto the market its share has tanked leaving OS share as a two horse race.

iOS is traditionally strong in USA, UK, Japan and Australia nearly matching Android sales in these markets. In Europe Kantar shows 22.7% for iOS and 74.3% for Android. China like the world average is more a 17/30 split of iOS to Android.

Windows has experienced a share decline across the board. In Australia Windows dropped from 5.4 to 1.0% in a year a statistic which is repeated in most markets.

An ITU research report Connecting the Unconnected released at the World Economic Forum in Davos (Switzerland) says that 3.9 billion people, more than half the World’s population have still never been online. This despite the vast increases in relatively cheap particularly wireless based connectivity and devices.

An ITU research report Connecting the Unconnected released at the World Economic Forum in Davos (Switzerland) says that 3.9 billion people, more than half the World’s population have still never been online. This despite the vast increases in relatively cheap particularly wireless based connectivity and devices.

The ITU predicts that one billion of the currently unconnected will come online by 2020 but that they will be dominantly urban based and already within reach of existing wireless and wireline infrastructure.

58% of the unconnected are women and 60% live in rural areas. The ITU is calling for concerted action to address the shortfall and to lift access to the online world and the skills and opportunities it would bring to the rural poor of the World.

According to recently released analysis from IHS Markit global smartphone numbers in use will grow from four billion in 2016 to more than six billion by 2020. They also say that the four billion smartphones (of a total of 7 billion mobile devices today) represent over 60% of all smart connected consumer devices.

According to recently released analysis from IHS Markit global smartphone numbers in use will grow from four billion in 2016 to more than six billion by 2020. They also say that the four billion smartphones (of a total of 7 billion mobile devices today) represent over 60% of all smart connected consumer devices.

IHS Director Ian Fogg says “Mobile devices and services are now the hub for people’s entertainment and business lives, as well as for communication. The smartphone has replaced the PC as the most important smart connected device.”

With the likely Tsunami of smart connected devices as part of the IoT and supported in the mobile space by 4G Advanced and 5G it is predicted by Machina Research that there will be 25 billion connected devices by 2020. If this comes to pass then the current smartphone dominance will be no more.

The often quoted industry source App Annie has reported mobile app download revenue continuing to increase by 40% in 2016 to $35Bn USD. The estimate of total content revenue which adds in app purchasing and advertising and 3rd party Android app store revenue is $89Bn.

The often quoted industry source App Annie has reported mobile app download revenue continuing to increase by 40% in 2016 to $35Bn USD. The estimate of total content revenue which adds in app purchasing and advertising and 3rd party Android app store revenue is $89Bn.

Games dominates the category with 75% of app download revenue in iOS and 90% of Android revenue coming from games.

Statistica reported that in June 2016 Google Play Store had 2.2M apps, Apple App Store 2.0M, Windows Store 0.7M, Amazon Appstore 0.6M and Blackberry World 0.23M.

On 26 October 2016, the ACCC released a discussion paper seeking views on a range of issues relevant to whether the ACCC should declare a domestic mobile roaming service. Submissions to the ACCC on the subject are posted on the ACCC’s web site HERE.

On 26 October 2016, the ACCC released a discussion paper seeking views on a range of issues relevant to whether the ACCC should declare a domestic mobile roaming service. Submissions to the ACCC on the subject are posted on the ACCC’s web site HERE.

On 2 December Communications Minister Mitch Fifield formally wrote to the ACCC Chairman Rod Sims on the subject. Fifield’s letter which makes some good points is HERE.

Vodafone has been the most vocal advocate for declared roaming. As the operator which has spent the least by an actual country mile on regional coverage in Australia the advantage which gaining access to Telstra and, to a lesser extent, Optus’ far wider coverage footprint is obvious. TPG, either riding as an MVNO on Vodafone’s network, or potentially as a MNO would also gain greatly from declared roaming so has publicly supported it – MRDA

Tesltra, which has most to lose, and Optus have joined the shouting match on the other side claiming that their incentive to invest in rural areas would be greatly reduced or removed altogether if they were forced to carry their competitors along. This is a point which is not lost on many regional organisations. Telstra asserts that any lack of choice of operators in regional Australia is “the result of decisions by our competitors to not invest in those areas”.

Minister Mitch Fifield has directed the Australian Communications and Media Authority ACMA to set a price of $1.25 per MHz per head of population on the remaining 2X15MHz of 700 MHz digital dividend mobile spectrum which was unsold in the May 2013 auction.

Minister Mitch Fifield has directed the Australian Communications and Media Authority ACMA to set a price of $1.25 per MHz per head of population on the remaining 2X15MHz of 700 MHz digital dividend mobile spectrum which was unsold in the May 2013 auction.

In 2013 the reserve price was set by then Minister Stephen Conroy at $1.36 /MHz/pop resulting in Telstra paying $1.244 Bn for 2X20MHz and Optus $0.622 Bn for 2X10 MHz. The new Fifeild reserve price is essentially the same as Conroy’s adjusted for the lesser period of the license.

Telstra will be prevented from buying any of the remaining spectrum as the Minister has followed the recommendations of the ACCC HERE and set a limit of 2X20MHz for any one operator for the spectrum.

Optus may choose to to add to its 2X10MHz acquired in 2013 and now widely used in its LTE 4G network.

Vodafone, which did not participate in the 2013 auction, made an offer of $594M to the Government in May 2016 for 2X10MHz of the 700 MHz spectrum. This offer was rejected instead leading to the proposed auction. Vodafone has the least spectrum of the three operators and is keen no doubt to acquire some of the remaining 700 MHz spectrum.

TPG is another would be mobile network operator who, it is said, may be interested in the spectrum. TPG has just won the fourth mobile license in Singapore with a $99M AUD bid gaining access to 60MHz of spectrum on the island in the process. Now as a mobile operator in Singapore TPG will be eligible to bid for 700MHz spectrum which will be auctioned, among other bands, in 2017 and available from 1 January 2018. The Singapore price on the 700MHz lots comes out at $.35 AUD /MHz/pop less than one third of Mitch Fifield’s ask. Considering the Singapore license cost and conditions and the network roll-out capital costs to achieve full island in-building and tunnel coverage in 30 months TPG may be stretched.

ACMA has called for applications for the spectrum auction which close on 13th February 2017. The auction is expected to start on 4th April 2017.

If the spectrum sells at the reserve price (as happened in 2013) then the Government would bank around $858M though instalment options are apparently being considered.

Telstra’s GSM network closed on 1st December as pre-advised two years ago. The network, the first of the three GSM networks, lauched on 27th April 1993. Having carried, by Telstra’s estimate, 87 billion calls in its 23 years it has had a pretty good life as technologies go.

Telstra’s GSM network closed on 1st December as pre-advised two years ago. The network, the first of the three GSM networks, lauched on 27th April 1993. Having carried, by Telstra’s estimate, 87 billion calls in its 23 years it has had a pretty good life as technologies go.

The technology was launched with some fanfare in 1993 but was not met with great market success in the early years because the then Telstra 1G AMPS network provided wider coverage. As well the early GSM phones suffered from “new technology blues” with inferior battery life and call quality compared to the AMPS units at the time. So tough was the selling proposition for GSM in the early days that it took more than four years after GSM launch i.e. until July 1997 for the number of customers on all three GSM networks in Australia to equal the number on the old AMPS network.

The Telstra GSM network reached peak services of 7.2 million in March 2006 the same month that GSM services on all three networks peaked at 16.7 million. They have all seen a slow decline since with GSM becoming a back up for 3G phones. 3G phones initially launched in the 2100MHz band so the coverage was inferior to the low band 900MHz used from the outset on GSM.

For Telstra however following the launch of NextG 3G at 850MHz on 6th October 2006 across their full base station footprint there was very seldom a need for a mobile to look for the GSM coverage security blanket again. Telstra claimed early last year that less than 1% of its calls were being carried on its GSM network and that its 3G and 4G networks had four times the coverage of GSM.

Telstra said it had not sold GSM only phones for many years. Their view was that for mobile telephony it would not be missed. Some embedded low speed, low volume GSM data device users are likely the most inconvenienced by the shut down. These devices can be moved to Optus or Vodafone with a SIM change however the Optus GSM network will shut down in April 2017 and Vodafone’s on 30th September 2017 so only a temporary reprieve.

BMO Capital Markets reports that Apple, despite falling to 12% smartphone share, now accounts for almost 104 per cent of smartphone profits. This means that collectively all the Android smartphone makers make a loss.

Apple reported a profit of $USD45.7Bn for year to September 2016 on revenue of $215.6Bn. 2/3rds of Apple’s revenue comes from the sale of iPhones.

Clearly the largest Android smartphone maker Samsung which has 20% of the smartphone market is reported by BMO to make an operating profit of just 0.9% – not helped no doubt by the recent recall and subsequent scrapping of its Galaxy Note 7 product.

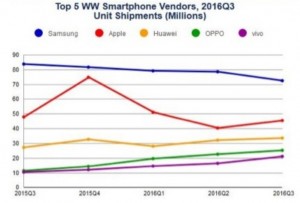

The IDC Worldwide Quarterly Mobile Tracker graph of the top five smartphone makers left shows the continued downward trend of Samsung and Apple and the rise of the big three Chinese makers.

The IDC Worldwide Quarterly Mobile Tracker graph of the top five smartphone makers left shows the continued downward trend of Samsung and Apple and the rise of the big three Chinese makers.

If you are wondering about Vivo they have been around in Guangdong since 2009 and recently overtook fellow Chinese maker Xiaomi for 5th spot in the smartphone league. They supply mainly to the China and India markets – see Cnet information HERE.

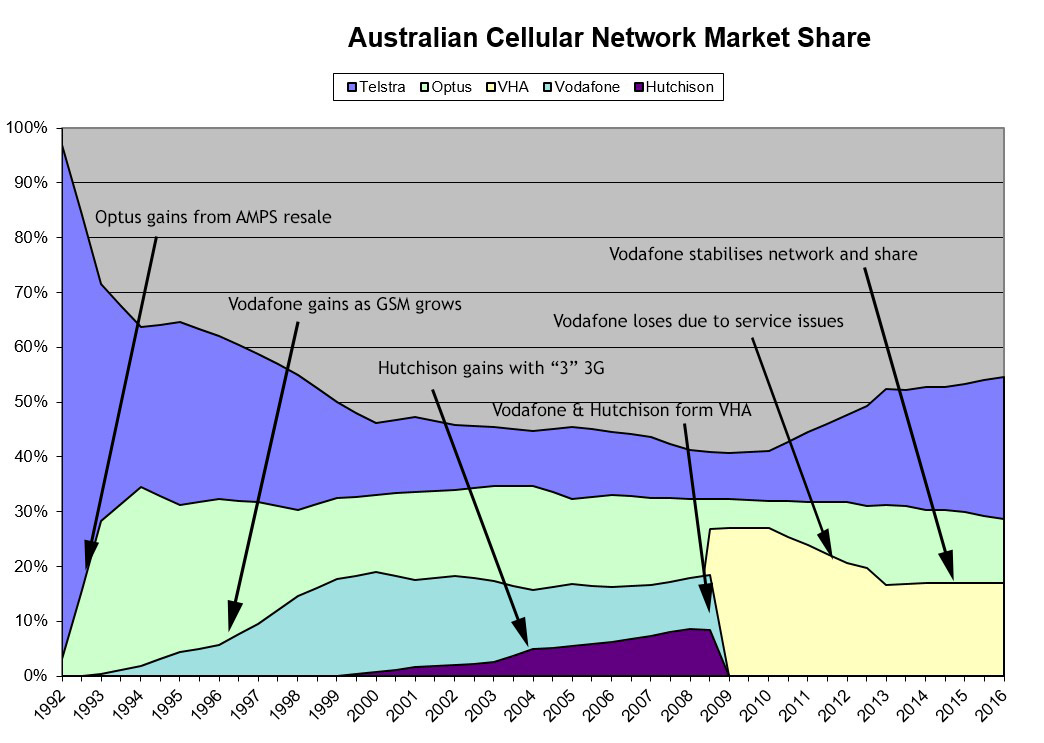

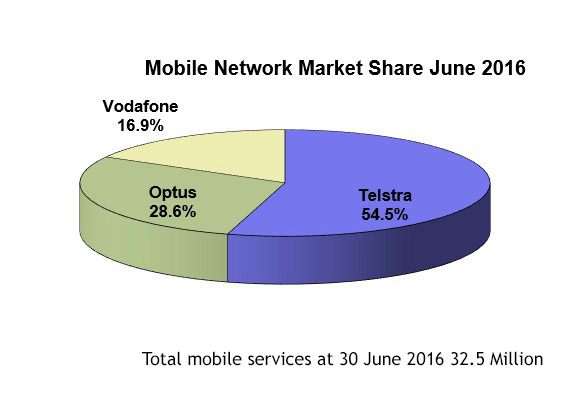

The total Australian mobile services in operation increased to 32.536 million at June 2016.

The total Australian mobile services in operation increased to 32.536 million at June 2016.

Telstra reported a total of 17.734 million services on its mobile network as at June 2016 (including 530,000 wholesale). Despite its network issues earlier in the year Telstra reported HERE an increase of mobile services of 560,000 in the year to 30 June 2016.

Optus reported HERE a loss of 43,000 services to 9.336 million in the 12 months to June 2016 while Vodafone HERE reported a gain of 239,000 services to 5.5 million in the same period.

Telstra’s market share at June 2016 was 54.5% which is the highest it has been since last century. Time will tell if the effects of Telstra’s network outages will have a delayed effect on its market share.

The history of mobile network market share since 1992 when competition was introduces to the Australian market is shown below.

Research firm Telsyte reported on 15th March that 7.8 million smart phones were sold in Australia in 2015 down 11% YoY.

Research firm Telsyte reported on 15th March that 7.8 million smart phones were sold in Australia in 2015 down 11% YoY.

49% of these were Android devices, 46% iOS and 5% other operating systems.

Telsyte believes that there were 17.6 million smartphone users and 3.5 million non smart phone users in Australia at the end of 2015.

With the lowering cost of smartphones (other than iPhones) and the closure of Telstra and Optus’ GSM networks in December 2016 and April 2017 respectively the rate of people moving to smartphones is likely to increase.

The GSA has announced that global LTE has passed 1 billion of the worlds 7.4 billion subscriptions. GSA say that at the end of 2015 there were 440 networks which were LTE equipped with 116 including the three Australian networks providing carrier aggregation LTE-A service. GSA predicts that by 2020, when it is widely expected that the first 5G networks will launch, that 4G LTE will reach equal subscriptions with the WCDMA/HSPA 3G.

In Australia LTE subscriptions at the end of 2015 at 16.25 million (of the total of 31.7 million) were already more than 3G. The subscriptions by technology data for Australia is shown to the right.

In Australia LTE subscriptions at the end of 2015 at 16.25 million (of the total of 31.7 million) were already more than 3G. The subscriptions by technology data for Australia is shown to the right.

The respected Ericsson Mobility Report for 2015 shows the historic and projected mobile subscriptions by technology.

Ericsson’s recording and projections of subscriptions by type from the same Mobility Report HERE are also interesting.

Mobile data speed braging rights have been lifted a notch with Telstra and Ericsson claiming to have achieved 950Mbps on lab setup LTE(A). To reach this speed they used 100MHz of spectrum (20MHz each in 700, 1800, 2100MHz bands and 40MHz in 2600MHz band). They used 256 QAM modulation and UDP protocol. They managed 843MHz using TCP.

There are no phones or devices available which can reach these speeds and a Cobham Aeroflex TM500 Test Mobile was employed. At present the Telstra 4GX LTE(A) network can deliver up to 450Mbps in some areas to Category 9 phones most notably Galaxy Note 5 and Galaxy S6 Edge+. They also support 600Mbps in some parts of their 4GX network to Netgear Category 11 capable mobile hotspots.

The LTEA standards provide for a maximum of 100MHz of aggregated spectrum and with UE Category 8 devices with a compatible network using 8X8 MIMO the raw data speed achievable is 2,998.6Mbps so still some room for LTE(A) “world records” even before 5G is realised.

ACMA, after extensive consultation with industry, are proceeding to auction 2X60MHz of 1800MHz spectrum in mostly in non capital city areas. The spectrum (uplink 1725 to 1785MHz and downlink 1820 to 1880MHz) is now widely used world wide as Band 3 LTE.

ACMA, after extensive consultation with industry, are proceeding to auction 2X60MHz of 1800MHz spectrum in mostly in non capital city areas. The spectrum (uplink 1725 to 1785MHz and downlink 1820 to 1880MHz) is now widely used world wide as Band 3 LTE.

The reserve price has been set at $0.08 per MHz per head of population. This is markedly cheaper than the reserve set for the auction of the 700MHz, Stephen Conroy termed “Waterfront Spectrum”, which was priced at $1.36 per MHz/pop.The purchasers will be limited to a maximum of 2X25MHz each.

This spectrum will be useful to expand the capacity of 4G LTE networks and will be of particular benefit to Vodafone which is rich with 1800MHz spectrum in the capital cities but has virtually none elsewhere. As Vodafone did not compete in the 700/2600MHz 4G auction they have been spectrum limited with their 4G roll-out in country areas to date. Optus also holds no 1800MHz spectrum outside the capital cities but has been able to roll out 4G LTE agressively using its new holding of 700 and 2600MHz spectrum and its 98 MHz of TDD LTE 2300MHz. Telstra mostly has 2X15MHz of 1800MHz spectrum nationally see more detail here and has widely deployed LTE using this spectrum. All are expected to compete in the auction. Others with an interest in the 1800MHz band are big miners, air and rail operators and defence.

Applications to participate in the auction close on 1st October 2015 and the auction will commence on 30th November.

Information about the consultation and auction process is on the ACMA web site here.