The Global Mobile Suppliers Association (GSA) has forecast that with the current annual growth rate of 140% the number of LTE subscriptions world wide will top one billion by the end of 2015.

The Global Mobile Suppliers Association (GSA) has forecast that with the current annual growth rate of 140% the number of LTE subscriptions world wide will top one billion by the end of 2015.

The rapid growth in 4G LTE is in part due to the fact that it is the first generation and standard which has worldwide acceptance. For 1G there were a dozen different standards with USA, UK, Italy, Japan, the Nordic Countries, Germany, France etc all having their own standards and spectrum bands. 2G saw just four widely used standards GSM, D-AMPS, CDMA and PDC uniquely in Japan. 3G narrowed to three widely used standards WCDMA, CDMA/EV-DO and TD-SCDMA uniquely in China and finally with 4G LTE, with the standard widened to accommodate FDMA and TDMA variants and 44 (at last count) frequency bands, the single standard. 5G from 2020 should follow this lead.

The GSA reports that 30% of global operators have launched LTE (422 operators in 143 countries) with 2/3rds of these in 45 countries having commercial LTE-A mostly supporting carrier aggregation CA with category 6 devices giving up to 300 Mbps in the downlink (50 Mbps up) using 2X20MHz CA. There are, the GSA says, 3,253 (and counting) different LTE capable mobile devices from 305 suppliers in the world market.

Globile mobile subscriptions had increased to 7.2Bn by 30th June 2015 according to the Ericsson Mobility Report for August.

Growth in subscriptions is currently running at 5% per annum whereas world population (currrently 7.36Bn) grows by around 1%. So soon there will be more mobile subscriptions than people.

Ericsson goes on to point out that the number of mobile subscribers is around 4.9Bn as many subscribers have multiple subscriptions.

Ericsson says that included in the 7.2BN at June 2015 there were:

- 3.1Bn mobile broadband subscriptions

- 740M 4G LTE subscriptions

- 45% of subscribers use a smart phone

- More than 75% of phone sales (Q2 2105) were smart phones

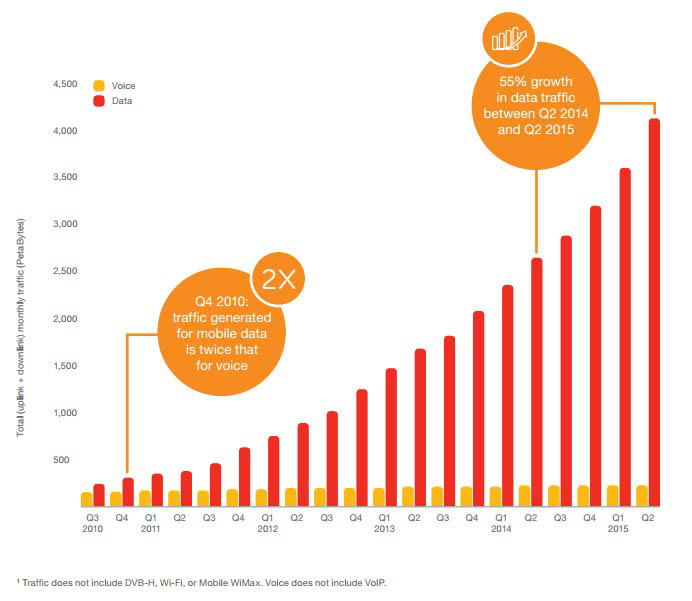

The report says that mobile data is increasing 55% YoY and is now more than 90% of network traffic – up from 50% in 2010.

Gartner has reported here the 2Q 2015 mobile phone sales.

They say 446 million phones were sold in Q2 with 74% (330 million) being smart phones.

Android continues to lead the smart phone OS share with 82.2% (down from 83.8% from in 2Q 2014). iOS rose to 14.6% and Windows 2.5%.

Samsung remains the largest supplier of mobiles with 19.9% (down from 21.9% a year ago) followed by Apple with 10.8% (up from 8% in 2014).

In Australia Statistica has the OS share in 2014 as Android 58%, iOS 34%, Windows 6.5%, Other 1.5%.

The just released ACMA report Australians’ Digital Lives which is here shows the increasing use of the internet in the lives of Australians.

It points to 92% of Australians going on line in the 6 months to May 2014 and 100% of those aged 18 to 44 doing so. On the other hand 6% (1.1M adult Australians) said that they had never used the internet.

94% of Australian have a mobile phone and 74% of these were smartphones. 70% of Australians used a mobile to access the internet

The above ACMA grapic shows that data downloaded in the June quarter 2014 was just over one Exabyte(one billion GB) and that downloads via mobiles were 4% of this. The mobile phone data downloads however were doubling each year. In the June quarter 2014 ABS reported that a fixed broadband user on average downloaded 52GB per month while a mobile subsciber downloaded 80 times less at 630MB per month on average.

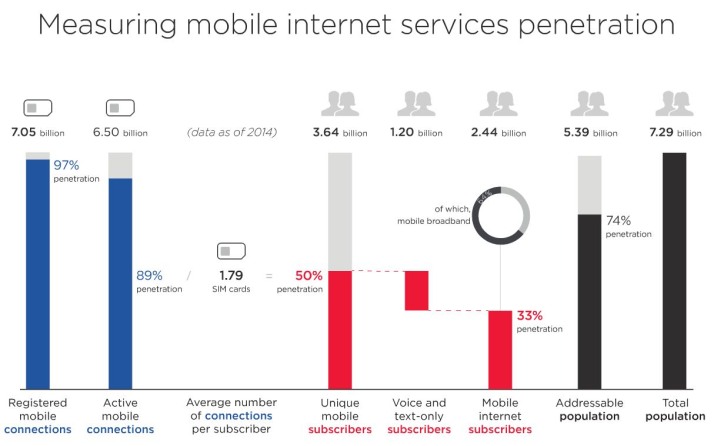

An interesting info-graphic published by GSMA Intelligence at Mobile World Congress 2015 above shows the world mobile service penetration.

While registered mobile connections (7.05Bn SIM cards) to world population (7.29BN people) is 97% because on average each mobile subscriber has 1.79 SIM’s the total unique mobile subscribers according to GSMA is 3.64Bn. Of these 3.64Bn mobile users 64% already use their phones to access the internet and 36% just use voice calls and text messages.

GSMA say the addressable population for mobile ownership (those over 14 y.o.) is 5.39Bn so the number of unique subscribers to addressable population is 68%. As such there is still room for growth of users as well as for data usage as more people subscribe and more convert to data capable smart phones.

Obviously the customer growth potential is dominantly in the less developed world with near saturation in numbers of unique subscribers in the developed markets.

In Australia ACMA’s 2013-14 Communications Report stated that 94% of Australia’s 23.8M population over 14 (19.3 M people) used a mobile. Thus with 31 million SIM subscriptions in Australia there are 1.7 SIM cards on average for each unique mobile subscriber.

With 94% device penetration most of the mobile growth in Australia (and in the developed world generally) will be generated by further migration to smart phones and more data use particularly by consumption of video content on these devices. As well multiple SIMs per person are likely to increase as people adopt tablet and PC’s with wireless connection and the “things” part of the Internet of Things greatly increase in number.

In a report Mobile Economy 2015 launched by GSMA’s Director General Anne Bouverot at Mobile World Congress GSMA says that the world’s 3.6 billion unique subscribers (50% of the world’s population) have 7.3 billion subscriptions (SIM connections) and will grow by one billion to 4.6Bn subscribers (59% of the world’s population) with 10Bn SIM subscriptions by 2020.

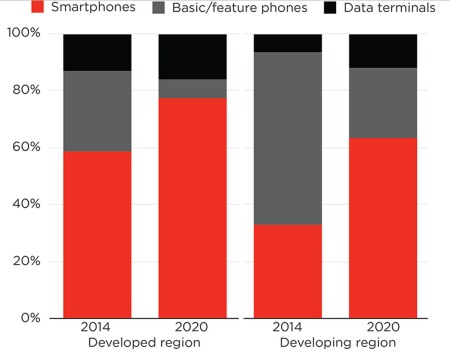

The GSMA report further says that smartphones in use will go from 2.6Bn in 2014 to 5.9Bn by 2020 during which time the precentage of connections on 3G and 4G networks will rise from 39% to 69%. The data carried on cellular networks is projected to grow by a factor of 10 from 2014 to 2019.

Other big picture statistics from the report include that the mobile industry worldwide contributes US$3.0Tn to GDP and supports 13 million direct plus 11.8 million indirect jobs. World mobile operator revenue in 2014 was reported

to be US$1.15Tn and mobile operators collectively were projected to spend US$1.5Tn in CAPEX between 2015 and 2020.

The GSMA Mobile Economy 2015 report is here and the summary infographic to the report is here.

“A decade ago, just one in five of the global population was a mobile subscriber – we have now surpassed the 50 per cent milestone and can look forward to connecting a billion new subscribers over the next five years,” commented Anne Bouverot, Director General of the GSMA. “Mobile sits at the heart of a new ecosystem that is uniting the digital and physical worlds, and powering economic growth. At the same time, mobile operators continue to deploy networks to all corners of the globe, connecting unconnected citizens and addressing socio-economic challenges in areas such as digital and financial inclusion, healthcare and education.”

The GSMA has established a group to draw up industry agreed specifications for an embedded SIM card.

The industry and the GSMA recognise that with the prospect of over 10 billion Mobile to Mobile (M2M) subscriptions likely by 2020 as part of the Internet of Things (IoT) the issue and control of mobile subscriptions using traditional SIM cards will be impractical. The new standard which is being developed by a number of operators, network and device and SIM card suppliers.

The first technical definition was release in February to GSMA and SIM Alliance members.

There is more information on the GSMA web site here.

Not to be left behind in network speed bragging rights Optus yesterday announced it has achieved 480Mbps over its lab network at Macquarie Park in Sydney and at its “Gigasite” at Lambton in Newcastle. The 480 Gbps was achieved by LTE Carrier Aggregation (LTE-CA) using four 20MHz channels. Tay Soo Singtel’s CTO said that they used three TDD channels and one FDD in the trial along with a prototype Category 8 device.

Using 4X4 MIMO and only 2X20MHz of 2.3 GHz TDD spectrum Tay said that Optus was able to achieve 418Mbps in Macquarie Park indoors and 350Mbps outdoors in Newcastle.

Evolved Universal Terrestrial Radio Access e-UTRA is the air interface standard of 3GPP’s Long Term Evolution (LTE). The standard provides for peak download rates of 299.6 Mbit/s for 4×4 antennas, and 150.8 Mbit/s for 2×2 antennas with 20 MHz of spectrum. LTE Advanced supports up to 8×8 MIMO antenna configurations with peak download rates of 2,998.6 Mbit/s in an aggregated 100 MHz channel. As such there is still room to up the bragging rights in the future. It will be a question of how much spectrum the operator has and how many MIMO layers are practical.

Just prior to World Mobile Congress in Barcelona Telstra made a number of announcements on the evolution of their LTE 4GX network and along with Ericsson Australia NZ’s CEO Håkan Eriksson outlined arrangements which will see Telstra collaborating with Ericsson’s 5G initiatives to “drive the standards, test new concepts and research the new architectures.”

Just prior to World Mobile Congress in Barcelona Telstra made a number of announcements on the evolution of their LTE 4GX network and along with Ericsson Australia NZ’s CEO Håkan Eriksson outlined arrangements which will see Telstra collaborating with Ericsson’s 5G initiatives to “drive the standards, test new concepts and research the new architectures.”

Mike Wright Group Managing Director Networks announced that Telstra would;

- Deploy Category 9 capability on its LTE-Advanced 4GX network in selected capital cities by April 2015. This would allow compatible devices to aggregate up to three 20MHz LTE carriers to achieve peak download speeds up to 450Mbps (with uplink at 50Mbps). The Category 9 devices such as those built around Qualcomm’s Snapdragon 810 System on Chip will be available later in 2015.

- Following closed trials including at 2014 Melbourne Cup Telstra will integrate LTE Broadcast LTE-B into its network by May 2015. From then they will progressively enable permanent LTE-B channels at key venues and events leading to customer access to LTE-B later in 2015.

- Enable Voice over LTE (VoLTE) across its network by April 2015 leading to customers with compatible phones of which there are many (see here) being able to benefit from some of the VoLTE improvements and capabilities later in the year. Following the network changes Telstra would also trial Video over LTE (ViLTE) for video calling and voice over WiFI.

- Collaborate with Ericsson on development of 5G standards, participate with Ericsson on its 5G radio test bed in Stockholm in 2015 and later run a 5G field trial locally. They would also work with Ericsson on capabilities of their core network products many announced just prior to WMC here to lead to 5G ready evolved core.

- Telstra and Ericsson will also run a Machine Type Communications (MTC) (3GPP Release 13 planned March 2016) proof of concept with Telstra and selected industry partners. MTC is an enabler of the IoT (Internet of Things) see here for more information.

Full details of the Ericsson/Telstra collaboration are in the press release here .

David Thodey will retire as CEO of Telstra on 1st May and will be replaced by current CFO Andy Penn.

David Thodey who is 60 was born in Perth and educated in New Zealand. He was recruited from IBM to Telstra in April 2001 as Group Managing Director of Mobiles. He went on to head up Telstra Enterprise and Government from December 2002 and was appointed as CEO in May 2009 following the turbulent reign of Sol Trujillo.

David Thodey normalised the government relationship and more than doubled the value of the company in his years at the helm through some astute deals most notably the $11Bn NBN and NBN2 arrangements.

In the mobile space David Thodey built on the excellent network quality NextG legacy left by Trujillo continuing to spend to improve speed, coverage and capacity with 4G LTE and more recently 700MHz Carrier Aggregation 4GX. With this strategy Telstra has been able to increase its mobile market share (from 41.4% in 2009 to 52.2% today) while pricing at a premium over Optus and Vodafone.

Vodafone has just announced that it has completed trials of voice over LTE (VoLTE) services on its network and expects to launch the service this year. CTO Benoit Hanssen said “Vodafone will be one of the first to launch VoLTE in Australia”.

Vodafone has just announced that it has completed trials of voice over LTE (VoLTE) services on its network and expects to launch the service this year. CTO Benoit Hanssen said “Vodafone will be one of the first to launch VoLTE in Australia”.

Telstra and Optus are known to have trialled the technology and Telstra demonstrated VoLTE calling on its live 4GX network in November 2014. .

According to Global Suppliers Association GSA VoLTE has been launched on 14 networks with 80 operators (including Vodafone, Telstra and Optus) in 42 countries investing in the technology.

VoLTE will provide not just voice but a suite of Rich Communication Services RCS based on IP Multimedia System IMS standards once implemented. IMS supports SMS, high definition voice, video telephony, multimedia sharing during voice calls and more. VoLTE roughly halves the call setup time and removes the necessity for a 4G phone to move to 3G for a voice call as is the case today.

As well as an LTE network operators need an evolved packet core network which is VoLTE capable and to install a IMS core to support the services. The LTE phones also need to support IMS. At present VoLTE compatible smartphones include the iPhone 6 and 6 Plus, the Samsung Galaxy S5 and Galaxy Note 4 and Huawei Ascend Y550. New release high end phones which inlcude the Qualcomm SoC like Snapdragon 800 series or VoLTE modem chips will support VoLTE.

Unlike the many other over the top OTT messaging, voice and video services like Skype, iOS Facetime, Viber, WhatsApp Nimbuzz, Tango, LINE etc. VoLTE is 3GG standards based (3GPP IR.92). The capability is thus integrated in the device and in the network and optimised for performance, capacity, power drain etc.

Operators are generally not rushing to bring VoLTE to market as it does require robust LTE network coverage, a population of VoLTE capable phones as well as investment in IMS capable core network. As in Australia where operators, by and large, have good coverage 3G networks to carry voice then the incentive to spend capital to move this voice to LTE has not been strong. Now as more devices are available and 4G network coverage is improving with the inclusion of 700 MHz (850MHz for Vodafone) on LTE the time is starting to be right for the move.

It will be interesting to see the marketing and customer take up of VoLTE/IMS features beyond HD voice. Standards based video telephony has been a feature of WCDMA and was initially much hyped in 2003 but you never hear about it today. IMS likewise has been around for a long time with not much traction. Time will tell.

Global mobile data is growing strongly. Cisco here predicted in February 2014 a 10X increase in mobile data from 2.5 Exabytes (1000GB)per month to 24EB/m by 2019. This is similar to the Ericsson projections referred to in the post below.

Global mobile data is growing strongly. Cisco here predicted in February 2014 a 10X increase in mobile data from 2.5 Exabytes (1000GB)per month to 24EB/m by 2019. This is similar to the Ericsson projections referred to in the post below.

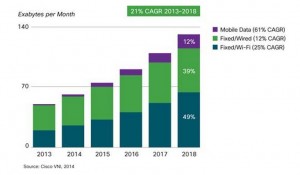

Total IP data is also experiencing strong growth. In June 2014 Cisco here had total world IP data in 2014 at 62EB per month growing to 132EB/m by 2018 (2.2X in four years).

From data in these Cisco reports mobile represented 4% of world data in 2014 but by 2018 this will climb to 12%.

So while they are fast growing, mobile networks are, and will remain a minority generator of world IP traffic.

The Cisco graph right also shows the growing part that WiFi has in the carriage of data. This WiFi increase will be driven by ever faster WiFi networks like those on 802.11ac providing replacement in speed and performance of wired connections for video consumption. This combined with video consumption on tablets and from dongles like Chromecast and ever increasing use of WiFi hotspots.

GSMA Intelligence reports the percentage of mobile subscriptions which use smart phones Vrs feature and basic phones and data terminals (USB and WiFi dongles) in the graph right..

In the Ericsson Mobility Report November 2014 the company reported that 38% (2.7 Bn out of the total world’s 7.1Bn sunscriptions) where on smart phones. Ericsson projected this to grow to 64% (6.1Bn out of a total of 9.5Bn total phones) by 2020 and for smartphone data to go from an average of 900MB to 2.9GB per month in the same period. This increase in smartphones combined with the increase in average data usage Ericsson say will increase world mobile data use by 8X from 2014 to 2020.

Telstra’s CFO Andy Penn stated on 13th February following Telstra’s half year results announcement that 80% of mobiles in Australia were smart phones. This places Australia a little ahead of the smart phone takeup reported by GSMA Intelligence for the developed world.

The latest USA spectrum auctions just concluded yielded $44.9Bn mostly for 2X25MHz of AWS spectrum. The most sought paired bands 1755 to 1780MHz and 2155 to 2180MHz are adjacent to the standard AWS Band 4 see all bands list here

The latest USA spectrum auctions just concluded yielded $44.9Bn mostly for 2X25MHz of AWS spectrum. The most sought paired bands 1755 to 1780MHz and 2155 to 2180MHz are adjacent to the standard AWS Band 4 see all bands list here

The price per MHz per head of population (MHz/Pop) covered for the paired spectrum was $USD2.65. This compares with around $USD0.46 for the original 2X45MHz of AWS spectrum when it was auctioned in 2006 and 2008.

The last Australian auctions for 700 and 2600MHz 4G spectrum which concluded in May 2013 yeilded $AUD1.965Bn. There was much debate at the time that the government set reserve for the prime “water front” 700MHz spectrum at $311M per 2X5Mhz lot was to high and subsequently 2X15MHz was passed in at auction. The portions of 700MHz which were sold went for the reserve price which amounts to $AUD1.35 /MHz/Pop. The AWS3 USA spectrum license is for 12 years and the Australian ones including the 700MHz are for 15 years.

Considering that by any measure the Band 28 APT 700MHz spectrum is far more desirable compared to USA AWS 2100/1700 MHz the price set now looks more like a bargain by comparison. Of course the real bargain in Australia was the 2600MHz 2X70MHz of which was sold for $98M which is just 3 cents /MHz/Pop.

The message is that wherever you look cellular spectrum is more in demand and (especially for low band lots) significantly more valuable. Like water fronts they don’t make any more.

Following the expiry of the “quiet time” after the AWS3 auction AT&T has joined the chorus of critics of the auction rules and outcome, warning that frequencies should go to companies that are willing to deploy networks – “not speculators or stockpilers”.

AT&T were pointing at Dish Networks primarily a satellite Pay TV company which won $13 billion worth of licences with a $3 billion ’small business’ discount,” Dish with around $14Bn p.a. in earnings would hardly qualify as a small business in most places.

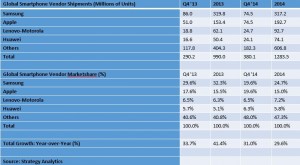

Gartner reports that in calendar 2014 1.95 Bn mobile phones were shipped compared to 265M tablets and 300M PC and laptops.

Elsewhere Strategy Analytics reports that 1.283Bn smart phones were shipped in 2014 with the distribution as shown on the chart below.

Interesting to note that Samsung’s market lead has reduced with Apple matching Samsung’s 74.5M smartphones shipped in Q4.

Lenovo has moved up the market share rank with stong sales aided by their 2014 acquistion of Motorola mobiles from Google for $2.9Bn.

Apple’s improvement was driven by the launch of the greatly hyped iPhone 6 and 6Plus. These have proved very popular particularly in China USA and Europe (not to mention Australia). This also lead to Apple reporting $18Bn profit in Q4 2014 the highest of quarterly profit of any company ever reported. They also announced the production of their one billionth iOS device fittingly an iPhone 6 which they have kept at Cupertino HQ. Apple’s cash pile resulting from all this accumulated profit (all $178Bn of it) however is not kept at Cupertino or in the USA at all. It is kept safely away from the USA tax man and other tax administrations as far as possible.

Telecoms.com has the 2014 quarter by quarter shipments here.

Telecoms.com has the 2014 quarter by quarter shipments here.

Reporting on operating system share IDC claimed 1,300 million smartphones were shipped in 2014 with Android dominating with 1,059 million or over 81%.

Nokia, Ooredoo Qatar and China Mobile have just announced at ITU Telecom World 2014 in Doha that they claim the world speed record for carrier aggregation on LTE achieving 4.1 Gbps.

They achieved this by combining 10X20 MHz carriers, a mix of TDD and FDD, twice the largest number of carriers currently specified by 3GPP.

Don’t expect to see these peak speeds on any commercial network any time soon but it does show what is possible if – and it is a big if – you have enough spectrum.