While Category 6 LTE devices are just coming onto the market the first being the Samsung Galaxy Note 4 Ericsson, Qualcomm and Telstra are now demonstrating category 9 speeds.

In the demonstration of LTE-A 20 MHz in each of three bands B28 (700MHz) B3 (1800MHz) and Band (2600MHz) were aggregated to achieve peak speeds of 450MHz. A Qualcomm equipped category 9 LTE-A modem was used and on the network side Ericsson’s suitably enhanced RBS6000 family base stations on Telstra’s 4GX network completed the connection.

In May 2014 Telstra as part of its Mobile Update gave its view of the speed steps with LTE advanced summarised as follows. Subsequently Telstra revised its date for introduction of category 9 in its network to April 2015 in capital city CBD’s.

| Standard | LTE | LTE-A | LTE-A 4GX | LTE-A 4GX | LTE-A 4GX |

| Timing | Now | Now | 2H 2014 | 2H 2014 | 1H 2015 |

| Device Category | 3 | 4 | 4 | 6 | 9 |

| Bandwidth | 15MHz | 20MHz | 40MHz | 40MHz | 60MHz |

| Bands | 1800MHz | 1800/900MHz | 1800/700MHz | 1800/700MHz | !800/700/2600MHz |

| Peak Speed Down | 100Mbps | 150Mbps | 150Mbps | 300Mbps | 450Mbps |

| Typical Speed Down | 2-50Mbps | 2-50Mbps | 2-75Mbps | 2-100Mbps | TBA |

The GSA has an updated report showing the adoption and peak speed of carrier aggregation capable networks world wide. They say that there are 49 operators in 24 countries with LTE CA. Their report is here.

Supporting these TLE Advanced speed steps on November 20 2014 Qualcomm announced their newest (5th) generation of Gobi modem chips the 9×45 family. This family of chips will be based on 20nm architecture and support LTE-A Category 10. They will support peak speeds of 450Mbps downlink and 100Mbps uplink on suitably upgraded LTE-A networks. These speeds are achieved by utilising 60MHz 3X carrier aggregation on the downlink and 40MHz 2X CA on the uplink. Category 10 devices have the same downlink as Category 9 but double the uplink speed.

Like previous families the 9×45 will be backward compatible with all older generations and Qualcomm say they will work on all major RF bands and combinations in both FDD and TDD LTE.

To make it truely future proof the device provides support for all four GPS constellations GPS (USA), Beidou (China), Glonass (Russia) and Galileo (EU) and for upcoming LTE Broadcast and Voice over LTE VoLTE. Qualcomm will include this modem family and hence capability into their latest system on a chip SoC Snapdragon 810.

The modem family has a companion RF360 Envelope Tracker. These devices are increasingly being used to vary voltage to power amplifiers in LTE devices to enable them to work at peak efficiency. The iPhone 6 and other newish devices employ envelope tracking.

The chips are sampling now and will be seen in commercial devices in 2015 according to Qualcomm. You can see the comparison of the Qualcom Snapdragon 800 series SoC’s here.

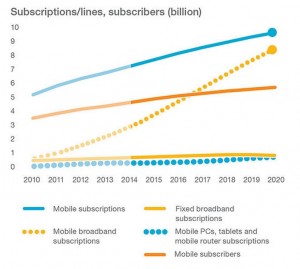

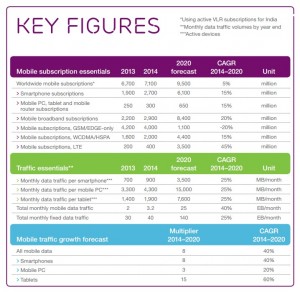

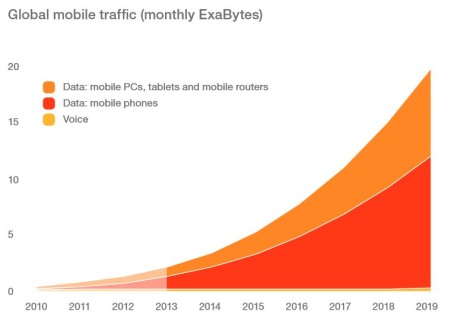

The latest Ericsson Mobility Report November 2014 predicts that by 2020 the world’s smartphones will grow to 6.1Bn of a total 9.5Bn mobiles.

Currently Ericsson say there are 2.7 Bn smartphones (38% of the 7.1Bn total). Mobile broadband subscriptions are projected to grow from 2.9Bn to 8.4Bn by 2020.

Ericsson predicts that smartphone data usage will increase from an average of 900 MB per month today to 3.5 GB per month by 2020. The combination of more devices and higher usage will see smartphone data increase by a factor of 8 between 2014 and 2020.

In Australia Telsyth reported that there were 16 million smartphones in use in Australia at June 2014 and predicted that this would increase to 17.5 million by the end of the year. This represents 74.5% of Australia’s 23.5 M population owning a smartphone.

As such there will be lower growth in smartphone subscriptions in Australia than Ericsson predicts worldwide and a little less pressure on mobile data network growth. Maybe these will only need to grow by a factor of 5 to 2020.

Telstra presentation at Comms Day Congress in October 2014 shows the huge change over the past 10 years in mobile network utilisation. 10 years ago the networks had 18 million subscriptions 98% of which were 2G CDMA and GSM/GPRS. 3G using WCDMA had been launched by 3 in April 2003 and was only available in capital cities. The Telstra network load in 2004 was 97% voice and 3% data.

Telstra presentation at Comms Day Congress in October 2014 shows the huge change over the past 10 years in mobile network utilisation. 10 years ago the networks had 18 million subscriptions 98% of which were 2G CDMA and GSM/GPRS. 3G using WCDMA had been launched by 3 in April 2003 and was only available in capital cities. The Telstra network load in 2004 was 97% voice and 3% data.

10 years on as data has grown 120% p.a. data carried has increased 3,000 times and now represents 96% of the network load. Where data speeds in 2004 peaked at 160Kbps for CDMA 1XRTT, 50 Kbps for GPRS and, 384 Kbps for WCDMA in 2014 LTE offers peak speeds of 150 Mbps with widely availble LTE category 4 devices and if you are in the right place with the category 6 Samsung Galaxy Note 4 which supports LTE Advanced Category 6 speeds up to 300 Mbps.

Of course if you want to go back another 10 years to 1994 then 93% of the mobiles were AMPS 1G voice and SMS only devices and there were just 1.7 million mobiles in use. So in the 10 years from 1994 to 2004 mobile services grew over ten fold.

Telstra went on to mention in their presentation 700/1800 MHz LTE Advanced (they term 4GX) deployment in Perth, Sydney, Adelaide and Darwin CBDs, and in some regional towns. They , like Optus plan for rapid switch on of 700MHz from 1st January when the spectrum license officially starts. Telstra says it will provide 700 MHz 4GX coverage to a three kilometre radius of all capital city CBDs and 50 regional locations at 1 January and to 90% of the Australian population by the end of January 2015. With the most popular mobiles like the Samsung Galaxy S5 and iPhone 6 supporting the APT 700MHz LTE band 28 Telstra expects to have over one million devices in its fleet ready to take advantage of the deeper and broader coverage and faster speeds offered by 4GX by the end of 2014.

The Telstra presentation is here.

Optus like Telstra is working hard to bring their 700MHz LTE Band 28 spectrum into use. They have the dual incentives to improve their depth of coverage in established 4G areas and to allow them to offer 4G service in regional areas where presently they don’t hold 1800MHz licenses. Optus also has launched LTE in 40 regional centres using 2600MHz spectrum 2X20MHz of which it acquired in the May 2013 4G spectrum auction. This 2600MHz spectrum became available in September 2014 and its use allows Optus to selectively introduce 4G ahead of availability of 700MHz in January 2015. Optus plans to have 4G in all capital cities and 100 regional towns in January 2015 and to provide 4G to 90% of the population by April 2015.

Vodafone is rolling out dual band LTE A using its existing 1800 MHz and re-farmed 850MHz spectrum with a focus on major metropolitan markets. It terms this network upgrade 4G+. Vodafone said in July 2014 that it planned to have 4G available to 95% of metropolitan population by the end of 2014. This would be circa 75% of total population coverage. Vodafone has the advantage by using 850 and 1800MHz LTE that the vast majority of its 2 million 4G customers have devices which will work today in these bands.

Vodafone is rolling out dual band LTE A using its existing 1800 MHz and re-farmed 850MHz spectrum with a focus on major metropolitan markets. It terms this network upgrade 4G+. Vodafone said in July 2014 that it planned to have 4G available to 95% of metropolitan population by the end of 2014. This would be circa 75% of total population coverage. Vodafone has the advantage by using 850 and 1800MHz LTE that the vast majority of its 2 million 4G customers have devices which will work today in these bands.

The availability of new 4G spectrum to Telstra and Optus combined with matching carrier aggregation capable chipsets and phones will add a lot of capacity and some spice to the bragging rights in the mobile speed contest.

The availability of new 4G spectrum to Telstra and Optus combined with matching carrier aggregation capable chipsets and phones will add a lot of capacity and some spice to the bragging rights in the mobile speed contest.

The new LTE 4G 2600MHz spectrum becomes available from October 2014. Of greater interest however is the Band 28 700 MHz spectrum which, following the completion of the UHF TV “restacking”, will be available for use from 1st January 2015.

Telstra has said that it will have 700 MHz LTE coverage within 3Km of the centre of all capitals and in 50 regional centres on January 1 2015. By this time Telstra says it will have 13 700 MHz capable device models representing one million of the 16 million devices on their network. Telstra says it has plans to spend $1.3Bn to bring 4G coverage to 90% of Australia’s population.

Both Optus and Telstra have gained early access to 700 MHz spectrum in selected areas. ACMA has listed Telstra trials in Griffith and Sydney (NSW), Brisbane (QLD) as well as Perth and Fremantle (WA) here. However other trial locations Esperance (SA), Mildura (NSW) and Mt Isa (Qld) have been mentioned. Telstra has said that 700MHz services will be turned on in Sydney, Adelaide, Darwin, Bundaberg, Yamba (NSW) and Sarina (Qld) in the week beginning 15 September 2014. They say they will expand these commercial trials to 20 additional metropolitan and regional areas by the end of 2014. Optus has trials in Darwin and Perth with permission also for Sydney.

Vodafone which did not participate in the 4G 2600/700 MHz spectrum auctions has been refarming some of its 2X10MHz of 850 MHz spectrum from 3G to 4G. This, albeit small block, of low band spectrum will improve the reach and depth of coverage of its 4G network. The 850 MHz spectrum has the advantage of being available straight away and being supported on the majority of modern smart phones already in service. Vodafone will rely for its 4G service on this 850 MHz spectrum combined with its more extensive holding of 1800MHz spectum.

The GSA has an updated report on the adoption of 700MHz band 28 by mobile operators. The report shows that as at Februay 2015 there were 42 countries either using, committed to, or advocating this band for LTE and 8 operators in 4 countries including Australia having launched LTE service in this band. The GSA report is here.

Using newly licensed and existing spectrum the highest 4G speeds will be achieved by the very latest devices which are LTE Advance LTE Category 6 capable. These devices can achieve peak download speeds of 300 Mbps by carrier aggregation of two 20 MHz carriers. Such devices as the just announced Samsung Galaxy Note 4 use the Qualcomm Snapdragon 805 system on a chip SoC in combination with the latest modem family Gobi 9×35. Otherwise customers with Category 4 phones which have LTE Band 28 700MHz capability such as Samsung Galaxy S5 and Desire 610, HTC One M8 and LG G3 (equipped with older Qualcomm Snapdragon 801 and Gobi 9×25 chips) will be able to achieve up to 150 Mbps using a 20 MHz carrier or by aggregating two 10MHz carriers. The newly announced iPhone 6 and 6 Plus are also only Category 4 (150Mbps) capable but they do cover all currently used and planned LTE bands including Optus’ 2300MHz TDD LTE in their 20 LTE band repertoire.

There are grand plans for ever increasing carrier aggregation capability built into, and being developed for, the LTE standard. The Qualcomm diagram below shows the possibilities of combining spectrum from different LTE bands, both FDD and TDD, and both licensed and unlicensed spectrum as well as “Multiflow” combining data streams from multiple base stations to achieve faster speeds and greater capacity.

In December 2013 Optus upped the ante in the aggregation speed stakes demonstrating 520Mbps using 4X20MHz of its 2.3GHz TDD LTE spectrum at St Marys Sydney. Optus was using Huawei network kit. In May 2014 Telstra demonstrated 450Mbps using three LTE channels however in June 2014 Nokia and SKT trumped everyone and announced trials in which they achieved 3.8Gbps by aggregating 10X20MHz channels combining TDD and FDD LTE. This is twice the number of carriers (5X20MHz) which 3GPP foresees being used. No doubt this will change with the relentless desire for increased speed and capacity.

The speed race can only get more interesting (and complex) from here.

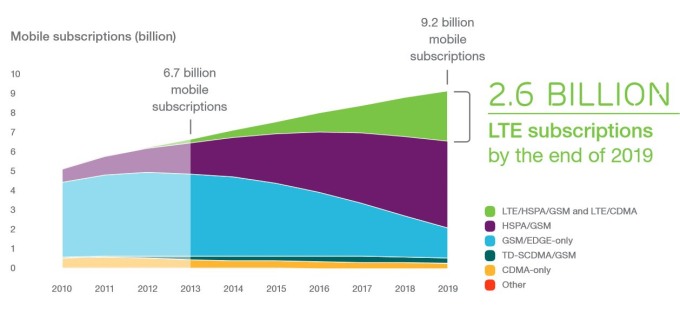

Ericsson Mobility Report August 2014 reports that world mobile subscriptions have grown to 6.8 billion by June 2014 and that mobile broadband subscriptions included in this number reached 2.4 billion.

Ericsson say that there are 4.6 billion unique mobile subscribers so clearly dual SIM and multi device customers are common.

Driven by increased smartphone penetration and mobile broadband devices Ericsson say data traffic increased by 60% from June 2013 to June 2014.

Growing at around 6% annually world subscriptions Ericsson predict will grow to 9.2 billion by 2019. By then 28% of subscriptions will be 4G LTE.

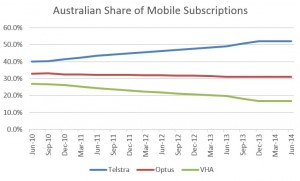

In Australia service numbers have been flat for the last year to June 2014 at 30.6 million and declined by 200,000 over the two years to June 2014.

In Australia service numbers have been flat for the last year to June 2014 at 30.6 million and declined by 200,000 over the two years to June 2014.

Over the four years to June 2014 Telstra has gained 12% of market share to 52.2%, Optus has lost 2% and VHA has lost 10% to 16.8%.

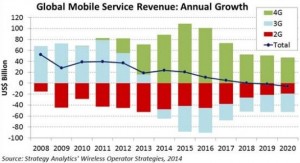

Strategy Analytics have predicted that world mobile service revenue will grow to just over one trillion $US by 2015.

Following that growing 4G revenues will only just offset falling 2G and 3G revenues and that by 2019 growth will have stalled for the first time in mobile history.

All this at a time when it is widely predicted that mobile data traffic is going to explode.

All this at a time when it is widely predicted that mobile data traffic is going to explode.

This will set challenges for MNO’s who will need to fund the network capacity and in many places, including Australia, subsidise the cost of the ever more capable devices demanded by their customers.

VHA has announced that it will refarm its valuable low band 850 MHz spectrum from its HSPA+ 3G to its LTE 4G network. It says that by the time the initial refarming is completed at the end of 2014 it will provide LTE coverage to 95% of the Australian metropolitan population. Their press release is here.

VHA has announced that it will refarm its valuable low band 850 MHz spectrum from its HSPA+ 3G to its LTE 4G network. It says that by the time the initial refarming is completed at the end of 2014 it will provide LTE coverage to 95% of the Australian metropolitan population. Their press release is here.

VHA through its merger with Hutchison has 2X10 MHz of 850 MHz spectrum in metropolitan areas and 1X5Mhz in regional areas. This spectrum has already been refarmed twice. Originally it was spectrum licensed to Telstra and used until 2000 for 1G AMPS. It was purchased at auction in 1998 and used for Hutchison’s Orange brand CDMA network in Sydney and Melbourne from 2000 until August 2006. Following the merger of Vodafone and Hutchison announced in February 2009 the now spare spectrum was added into the 2100 MHz VHA 3G network from late 2010. It has served since then to improve the depth and breadth of coverage of the VHA 3G network.

Now VHA plans to lift their 4G coverage by moving the 850MHz spectrum across to their 1800MHz LTE network. This it can do in the metropolitan areas by initially moving 2X5MHz, half the holding, to LTE leaving the other half to continue along with the high band 2100 MHz to serve their HSPA+ 3G network. Since they only have 2X5MHz in the regional areas they can’t painlessly refarm the 850 spectrum in these areas. According to their recent press release only 1.5 million of their circa 5 million customers on 4G LTE so there is still a lot of load on the 3G network including, until VoLTE is introduced, all the voice calls. This is why their press release focus is on metropolitan coverage.

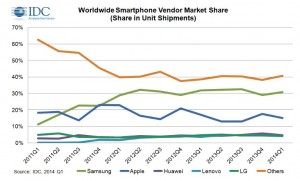

IDC’s Worldwide Quarterly Mobile Phone Tracker reports 288 million smartphone shipped in Q1 2014. This is 63% of all phones shipped. IDC predicts that over one billion smartphones will ship in calendar 2014. Samsung leads the brands with 31% share and Apple has 15%. The share and movement since 2011 are shown on the IDC graph right.

Market share is expected to move towards the lower priced yet highly spec’ed units mainly from Chinese makers. Chinese makers Huawei and Lenovo already figure in the league but some of the brands like Xiaomi, Oppo, ZTE and OnePlus are likely to move from the “Others” to rank with them in market share.

Data storage like processing power of PC and mobiles has progressed rapidly while cost per unit of capacity and power have increased massively. The photo shows the change for portable storage – if you count putting a massive core memory bank into a plane portable.

All this however pails into insignificance compared to the human brain. The brain is said to have the equivalent of 256 billion GB so you would need 4 billion of the 64 GB SanDisk micro SDXC cards to equal the brain’s capacity.

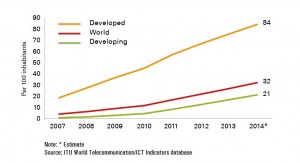

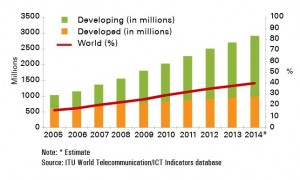

The ITU in their 2014 ICT Facts and Figures Report says that there will be almost 7 billion mobile subscriptions in the world at the end of 2014 with a global penetration rate then of 96%. The annual growth rate ITU says is the lowest it has ever been at 2.6% indicating saturation in particular in the developed world markets.

There are 2.3 Bn Mobile Broadband Services in the world according to ITU with an average of 32 services per head of population (84 in the developed world and 21 per 100 population in the developing world). MBB sevices continue to grow strongly especially in the developing word where 2013/14 YoY growth rate is 26% compared to 11.5% YoY growth in the developed world.

The corresponding figure for fixed internet is around 700M services or 10 services per 100 population (27 per 100 in the developed world and 6 per 100 in the developing world)

The ITU says that by the end of 2014 the number of people who have access to the internet will reach almost 3 Bn approaching 40% of the world population.

According to its new CEO Rajeev Suri Nokia, having shed its loss making mobile phone business, is going to payback $2Bn in debt and resume paying dividends.

The sale on 25th April 2014 of the loss making Nokia Devices and Services business to Microsoft for €5.6Bn has left Nokia with three profitable units the Networks business, an R&D and Intellectual Property unit called Technologies and a location services business called Here. Between them they booked a $216M operating profit in 1Q 2014.

Nokia’s market value is now about 20 billion euros, down from 300 billion euros it was in 2000, when Nokia was the dominant global mobile phone supplier. Nokia started out in the 1860′s making rubber products including gumboots and is nothing if it is not a surviver.

The Nokia phone business lost €326 million in the last quarter it was in Nokia’s hands (1Q 2014) and it is not clear what Microsoft plans to do to turn this around. Former Nokia President and CEO Stephen Elop, is now Executive Vice President of the Microsoft Devices Group reporting to Microsoft CEO Satya Nadella. Elop is now looking after Lumia smartphones and tablets, Nokia mobile phones, Xbox hardware, Surface, Perceptive Pixel (PPI) products, and accessories.

Elop said they are working on branding but that they won’t be using Nokia or Windows Phone. Microsoft’s communication on the arrangement is here.

Watch this space.

According to Strategy Analytics first quarter 2014 mobile shipments were up 9% YoY to 408 million. Samsung holds a commanding lead in market share with 28% more than the next three Nokia, Apple and Huawei combined. There is a very long tail in the market share distribution with 42% of the share shared amoung the around 112 “other” phone makers. 70% of the 408 million mobiles shipped were smartphones a percentage which is ever rising as the cost of low end smartphones continues to fall.

SA say that that 57.6 million tablets were shipped in 1Q 2014 with Android dominating the share with 66%. The rounded numbers are:

| Units Shipped 1Q 2014 | ||

| Mobiles | Share | Units Shipped (Millions) |

| Samsung | 28% | 113 |

| Nokia | 12% | 47 |

| Apple | 11% | 45 |

| Huawei | 4% | 14 |

| LG | 3% | 12 |

| Others | 42% | 177 |

| Total | 100% | 408 |

| Tablets | ||

| Android | 66% | 38 |

| Apple | 28% | 16 |

| Windows | 6% | 4 |

| Total | 100% | 58 |

Apple may be losing share of units shipped but its position at the top of the price tier and a gross margin to die for of 39% saw it increase its profit for the quarter by 7% to just over $10 billion on revenue of $45.6 billion.

The shift from dedicated expensive boxes of network kit to flexible cheap servers running NFV (Network Functions Virtualization) is speeding up. Mobile Network Operators will benefit from this evolution through lower equipment costs and greater flexibility of network design and configuration.

The shift from dedicated expensive boxes of network kit to flexible cheap servers running NFV (Network Functions Virtualization) is speeding up. Mobile Network Operators will benefit from this evolution through lower equipment costs and greater flexibility of network design and configuration.

However MNO’s are appropriately conservative people mostly very appreciative of the value of reliability and the nasty consequences of system failures. Thus it is likely that only as the big network equipment suppliers begin to adopt SDN (Software Defined Networks) and NFV that major deployments will accelerate. It is not that the current big suppliers of mobile network kit (Ericsson, Huawei, NSN, Alcatel Siemens, ZTE) will be the only participants in this market it is just that until these big players can make it reliable and practical to implement in the tough real network world it will not get momentum in the market.

A good indication of the direction and priority of SDN and NFV can be seen from market leader Ericsson which has 35% of the world market for this kit and a market share which their CEO Hans Vestberg says is more than number two and three suppliers to the market combined. Ericsson is undergoing a restructure which will see its Networks Division split into two parts Radio and Cloud and IP. Radio will manage the traditional radio networks kit while Cloud and IP will develop and market NFV, SDN and cloud based platforms.

Recently Vestberg said that only one third of Ericsson’s 2013 revenue (227Bn SEK or $37Bn AUD) came from harware with 23% from software and 43% from services. Back in 1999 73% of their revenue was from hardware sales. The movement of focus from hardware to services which include network design, build, operations and support has been underway in Ericsson for a long time. The next wave will clearly reduce dependence on hardware sales further as NFV and SDN as supported by the open sourced OpenDaylight become widely adopted.

The MNO’s will benefit from these changes through reduced network equipment costs but will need to carefully manage the transition and reliability issues associated with the move.

Reuters reports that the European Parliament has voted in Brussels overwhelmingly in favour of a law removing mobile roaming charges in 26 counties of the EU from December 2015.

Reuters reports that the European Parliament has voted in Brussels overwhelmingly in favour of a law removing mobile roaming charges in 26 counties of the EU from December 2015.

Neelie Kroes, the European commissioner for digital affairs a champion for this change is reported as saying “This is what the EU is all about – getting rid of barriers to make life easier and less expensive.”

It is reported that the changes will take 5% off the European mobile telco’s revenue but that most of this will be picked up by increased usage of mobile roaming and by reducing the cost to operators caused by mobile users bypassing the high roaming charges by buying prepaid service for small durations.

In this regard it is a pity there is not a world body which could enact a global version of the new EU law.

In Austrlaia Comms Minister Turnbull earlier this year released a draft of a law “The Telecommunications Legislation Amendment (International Mobile Roaming) Bill 2014″ which would give the ACCC powers to control wholesale prices for roaming between Australia and New Zealand – One small step for man!

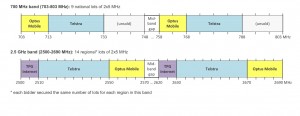

We are moving towards the availability of the digital dividend 700MHz spectrum with the restacking of the UHF TV channels on Band IV channels on or below TV Channel 51. Telstra and Optus are now rolling out APT700 Band 28 capable infrastructure on their base stations.

The APT700 Band 28 spectrum was auctioned in May 2013 and can be used from January 2015 by Telstra who licensed 2X20MHz for $1.24Bn and Optus who acquired 2X10MHz for $622M.

At present there are only a few devices which operate on the APT700 LTE band however this is expected to change as more countries adopt, license and deploy equipment in the band. At present according to Ericsson’s APT700 Market Update 27 countries with combined population of 2.2 billion have adopted APT700. Along with Australia and New Zealand these include the large markets in India, Pakistan, Brazil, Mexico, Indonesia and Japan. Both the new Samsung Galaxy S5 and HTC One M8 sold in Australia do support Band 28. We will have to wait until August/September to see if the new iPhone 6 will follow with APT700 support.

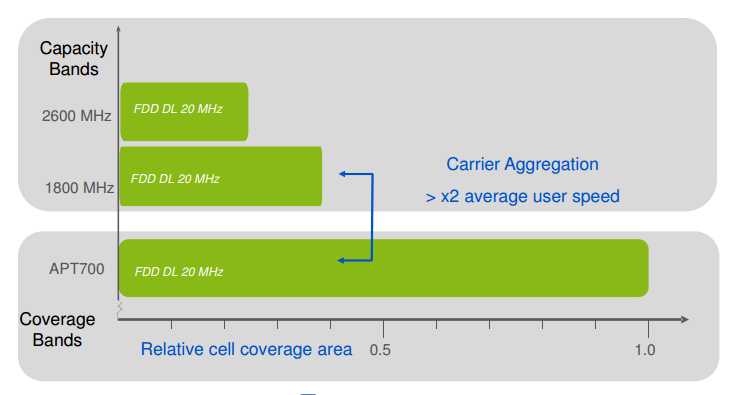

The Ericsson chart below shows the way in which the APT700 can be deployed along with the current 1800MHz and the other Optus and Telstra licensed 2600MHz spectrum to provide LTE with wider and deeper coverage. The adoption of LTE Advanced 3GPP Release 10 channel aggregation will provide far greater capacity than exists today on either 4G LTE or 3G HSPA networks.

Telstra is in the box seat with this LTE Advanced deployment having 2X20 at 700MHz, 2X15MZ (2X20MHz outside Sydney and Melbourne) at 1800MHz along with 2X40MHz of 2600MHz. Optus is well placed with 2X10MHz of APT700, 2X20MHz of 1800MHz in capital cities except Canberra and 2X20 MHz of 2600MHz. Optus has other attractive capacity and speed options with LTE TDMA. Vodafone, which did not participate in the May 2013 4G spectrum auction, has good holdings of 2X25 MHz of 1800MHz spectrum in the capitals but will lack depth and range of 4G which Telstra and Optus can offer using the “waterfront” APT700 spectrum.

There is an excellent Wiki on the APT700 band here.

Interesting to see the outcome of the unsold – some say overpriced at $933M – 2X15MHz of APT700 spectrum. Emergency services are making a strong push to be given this spectrum which would be a tragic outcome.