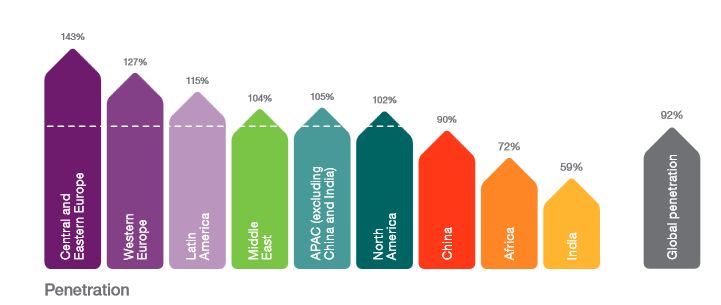

Ericsson Mobility Report February 2014 shows world mobile subscriptions grew to 6.7 Bn by December 2013 with the number of subscribers standing at 4.5 billion. World mobile penetration (subscriptions per head of population) grew to 92%.

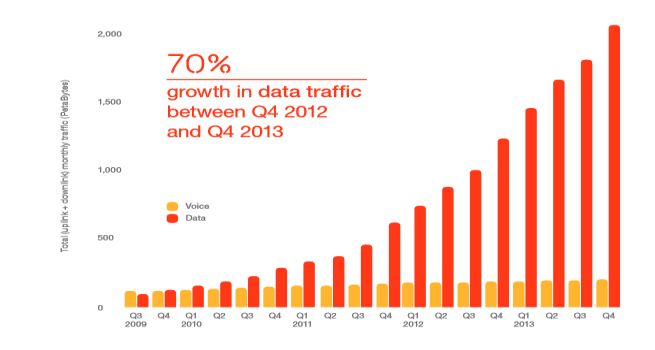

Ericsson reported that mobile broadband subscriptions grew by 40% in 2013 to 2.1 billion and that total data traffic on mobile networks grew by 70% over the same period.

In 2013 around 1 billion smartphones were sold accounting for 60% of phones sold. At the end of 2013 smartphones accounted for 30% of phones in use. As the number of smartphones continues to rise rapidly the volume of data traffic on mobile networks (2 PetaBytes per month in December 2013) will increase evenfaster than the current 70% p.a.

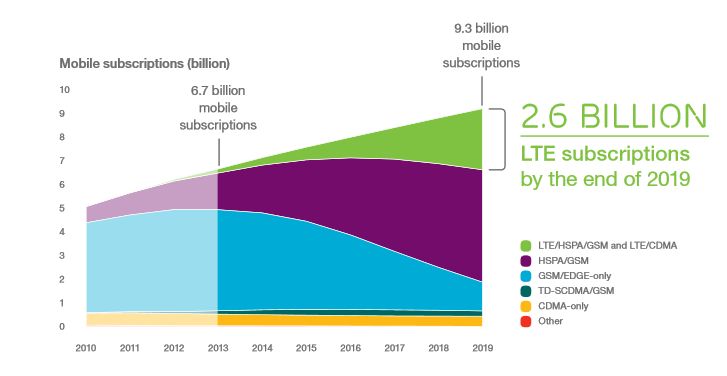

Ericsson points to the revolution in mobile networks underway in emerging economies which they say will see world subscriptions on 2G networks, dominantly used for voice and SMS, go from the current 73% to a point in 2019 when 80% of subscriptions will be on 3G and 4G mobile data capable networks. In these emerging economies mobile data will be far and away the dominant internet access mechanism.

Open Signal has a huge sample of mobile data speeds taken from networks around the world. The data is gathered from free Android and iPhone apps which test network speed and quality and then record and forward the information for compilation by Open Signal. The data are accessible on line and can be viewed here.

Open Signal has a huge sample of mobile data speeds taken from networks around the world. The data is gathered from free Android and iPhone apps which test network speed and quality and then record and forward the information for compilation by Open Signal. The data are accessible on line and can be viewed here.

Obviously the information is a moving feast and it represents the experience of just Android and iPhone users who have taken the trouble to download and run the app. None the less these should be pretty good selection of mobile users to choose to get an a good idea of the networks data speeds and quality.

Below is a table compiled from the Open Signal data for Australia for each operator and totally and for 3G and 4G separately and totally. Just for interest it shows the total results for a couple of other relatively 4G advanced countries USA Sweden and UK.

| 3G | 4G | All | |||||||

| Down Mbps | Up Mbps | Ping mS | Down Mbps | Up Mbps | Ping mS | Down Mbps | Up Mbps | Ping mS | |

| Optus | 2.4 | 0.9 | 311 | 18.4 | 5.9 | 103 | 3.0 | 1.1 | 305 |

| Telstra | 4.2 | 1.1 | 288 | 21.0 | 4.9 | 89 | 8.2 | 2.0 | 241 |

| Vodafone | 3.2 | 1.2 | 232 | 36.6 | 4.3 | 71 | 4.9 | 1.3 | 224 |

| All Aus | 3.2 | 1.0 | 286 | 22.0 | 5.0 | 89 | 5.5 | 1.5 | 263 |

| All UK | 4.1 | 1.5 | 300 | ||||||

| All USA | 3.9 | 3.0 | 231 | ||||||

| All Sweden | 8.7 | 2.3 | 248 | ||||||

The data shows that as expected Telstra has the fastest network overall. Telstra is 2.7 times faster than Optus and 67% faster than Vodafone. This results from Telstra’s earlier start with LTE (Sept 2011 Vrs Jul 20 12 for Optus and Jun 2013 for Vodafone). As a result Telstra has over 4 million LTE devices, probably double that of Optus, and four times the number reported by Vodafone. With 4G speeds recorded as just under 7 times that of 3G in the downlink and 5 times faster in the uplink the more of the faster services you have the better your overall speed.

It is interesting that the data supports the claims made by Vodafone that theirs is the fastest 4G network. Vodafone shows up as 75% faster than Telstra and twice as fast as Optus. You would expect this since Vodafone have only one quarter of the 4G services of Telstra and in the two large markets of Sydney and Melbourne they have more continuous 1800 MHz spectrum (2X20 MHz Vrs 2X15MHz for Telstra).

These numbers will move around. As Vodafone increases its 4G base you would expect to see its overall speed increase and its superiority of 4G speed diminish as the limited spectrum is shared by a larger base of devices. Optus and Telstra will benefit from deployment of their new 700MHz and 2600MHz spectrum from early 2015 and the ability of LTE Advanced to bond discontinuous spectrum. Optus has the additional potential to link its holdings of 2.3 and 3.4 GHz spectrum. For example Optus has reported a “Giga Site” trial employing 287 MHz of spectrum in the 700-MHz, 900-MHz, 1800-MHz, 2.1-GHz, 2.3-GHz, 2.6-GHz and 3.5-GHz bands to achieve a 2.3 Gbps mobile data channel – how it that for bragging rights. Just who will produce commercial devices for this and when we will have to wait and see.

According to analysts Canalys and ABI Research smartphone shipments reached just under one billion in 2013. This is double the number of shipments in 2011.

According to analysts Canalys and ABI Research smartphone shipments reached just under one billion in 2013. This is double the number of shipments in 2011.

Smart phones now account for 55% of total phones shipped.

Android increased its dominance of smartphone operating systems with 785 million ( just under 79%) of smartphones using the Google OS. 154 million iOS phones where shipped in 2013 taking Apple’s smartphone share down from 20% in 2012 to just over 15% in 2013. Windows phone shipments nearly doubled YoY in 2013 to 32 million (3%) driven by Nokia’s efforts. Blackberry 10 OS phone shipments dropped 42% to just under 20 million in 2013.

AT&T – number two mobile operator in USA – announced at CES in Las Vegas last week a sponsored data scheme.

AT&T – number two mobile operator in USA – announced at CES in Las Vegas last week a sponsored data scheme.

The AT&T scheme, which will operate on its HSPA+ and LTE networks, will allow private firms to cover the cost of transmission of content they provide to customers. The sponsor company will pay for the data transmission of consumers browsing or downloading their content. AT&T said that mobile shopping, mobile health care and companies with “Bring Your own Device” employee arrangements would be some of the sponsors it would target with the new arrangement.

This reverse charge data scheme may possibly be revolution in data charging or more likely an initiative, like charging for receiving mobile calls and texts, which finds application in the Americas only.

Rob Conway, chief executive of the GSMA for 12 years until September 2011 and a major force in the mobile industry, has died.

Rob Conway, chief executive of the GSMA for 12 years until September 2011 and a major force in the mobile industry, has died.

The GSMA annouced Rob’s passing and its commitment to honour his contribution to the mobile industry at the Mobile World Congress event in Barcelona 24th to 27th February. Rob presided over this major industry event during his lengthy tenure as CEO .

Apple have just announced here that iTunes sales of Apps rose to $10Bn in 2013. They also report over one million iPhone and half a million iPad apps available (many are the same app desined to work on both devices).

Apple says that it has paid out to date $15Bn to app developers. As Apple pay 70% of the sale price to the developer, this means it has collected $21Bn for the 50Bn app downloads to date. Apple customers paid $1Bn to download a record 3 billion apps in December 2013 alone. The majority of app downloads are free which contributes to the average revenue per download being around just 33c.

Asymco claims that Apple makes $2Bn p.a. from the iTunes store but that almost all of this revenue comes from sales of their own Apple software and that Apple’s margin on apps and music, which comprise the majority of iTunes sales, is very low.

Asymco claims that Apple makes $2Bn p.a. from the iTunes store but that almost all of this revenue comes from sales of their own Apple software and that Apple’s margin on apps and music, which comprise the majority of iTunes sales, is very low.

The Asymco estimate, reported here, is that the margin on iTunes music sales is just 1% and 2% on app sales.

Apple of course runs iTunes principally to assist it to sell more devices and computers. All up in FY 2013 (to 28 September 2013) Apple booked $37Bn in profit so the iTunes contribution to this if the Asymco analysis is on the money is just 5.5%

Facebook is about to become an Associate Member of the GSMA. Facebook will be joining the likes of Ericsson, Alcatel Lucent and other mobile suppliers as associates in the operators club that is the GSMA.

Facebook is about to become an Associate Member of the GSMA. Facebook will be joining the likes of Ericsson, Alcatel Lucent and other mobile suppliers as associates in the operators club that is the GSMA.

Over the Top OTT players are making increasing inroads into mobile carriers revenue on one hand while helping to drive demand for smartphones and data connectivity on the other. Facebook is not such an overt competitor to mobile carrier’s services as say Skype or WhatsApp and they add to mobile operator’s data traffic and provide a popular service for smartphone users. As such Facebook should be more comfortable inside the GSMA tent than many other OTT players and companies like Apple and Google all of who benefit massively, as well as contributing to the booming mobile industry.

It is interesting that in a Mobile Squared White Paper on OTT here it is claimed that the Microsoft owned Skype is costing the telcos $36Bn a year (and counting) in lost revenues mainly providing service for which its own annual revenue is $2Bn. It seems likely that Skype would be as welcome in the GSMA as wolf in the hen house. But you never know.

Research firm Ovum predicts that SMS numbers world wide will peak at 7.8 trillion in 2014 and then gradually decline as more people use newer OTT forms of text messaging. Ovum also estimates that social messaging will reduce mobile operators messaging revenue by $USD32.6 billion in 2013.

Ericsson Mobility Report November 2013 predicts that by 2019 5.6 Bn (60%) of the world’s 9.3 Bn mobiles will be smartphones up from 1.9 Bn (28%) in 2013. Ericsson also predict that connected PC’s and tablets plus mobile router subscriptions will rise from 300M in 2013 to 800M in 2019. The full report is here. Their predictions for router and tablet subscriptons they say is lower than previous reports due to the increase in the use of tethering mobile phones to these devices.

The growth in smartphones and mobile connected computers Ericsson predicts will increase mobile data traffic by a factor of 10 from 1.8 ExaBytes in 2013 to around 18 ExaBytes (18X1018 Bytes) by 2019. Already in 2013 mobile data traffic on networks is 10 times that of voice. So voice is well on the way to becoming irrelevent to network capacity while at the same time remaining a nice little earner for network operators unless or until the OTT players spoil the party.

The growth in smartphones and mobile connected computers Ericsson predicts will increase mobile data traffic by a factor of 10 from 1.8 ExaBytes in 2013 to around 18 ExaBytes (18X1018 Bytes) by 2019. Already in 2013 mobile data traffic on networks is 10 times that of voice. So voice is well on the way to becoming irrelevent to network capacity while at the same time remaining a nice little earner for network operators unless or until the OTT players spoil the party.

The Ericsson predictions show the rapid swing to 3G and 4G technologies with only around 20% of mobiles remaining on 2G by 2019.

Gosh 4G spectrum is cheap in New Zealand maybe we should buy some and import it!

Gosh 4G spectrum is cheap in New Zealand maybe we should buy some and import it!

With the conclusion of the 700 MHz 4G spectrum auction in NZ in October resulting in Telecom NZ and Vodafone each picking up 2X15MHz – the maximum allowed under the auction rules. They each paid $NZ66 ($A57.6). This was the reserve price. Third NZ operator 2 Degrees picked up 2X10MHz also at the reserve price $NZ44 million and 2X5Mhz remained unsold.

The band APT700 3GPP Band 28 is the same as will be used in Australia and elsewhere in Asia Pacific. The same 700 MHz spectrum was auctioned in Australia in May 2013 and also sold at the government set reserve price. The difference was that then Australian Labor Government needed the cash and set a reserve price of $A311 million per 2X5MHz lot compared to $NZ22 million ($A18.1) in New Zealand. Well OK there are only 4.4 million people in NZ compared to 22.7 million in Oz but that still makes the spectrum price in NZ 30% of the Australian price on a per head of population basis.

Android accounted for 81% of the world’s 251 million smart phone sales in Q3 2013 according to Strategy Analytics figures just released.

Android accounted for 81% of the world’s 251 million smart phone sales in Q3 2013 according to Strategy Analytics figures just released.

Overall mobile phone sales slipped slightly in Q3 2013 to 418 million. On the other hand smart phones, which now account for 60% of phones sales and around 90% of phone sale revenue, increased YoY by over 45%. Samsung is a major contributor to, and beneficiary of, the success of Android. It holds 35% of the smart phone market.

For what it is worth the form guide for this three horse race:

With the recent Google release of Android 4.4 KitKat which is aimed at running on lower specification smart phones which will drive growth in the less developed markets you can only see Android continuing its dominance. Microsoft, mainly though the efforts on Nokia, is gaining market share in particular through some very capable and well speced low priced phones. While Apple continues to operate at the top of the price list in the process retaining very healthy margins and profitability it is unlikely to make inroads into Android’s lead.

| Global Smartphone Operating System Shipments (Millions of Units) | |||

| Q3 ’12 | Q3 ’13 | ||

| Android | 129.6 | 204.4 | |

| Apple | 26.9 | 33.8 | |

| Microsoft | 3.7 | 10.2 | |

| BlackBerry | 7.4 | 2.5 | |

| Others | 5.2 | 0.5 | |

| Total | 172.8 | 251.4 | |

| Global Smartphone Operating System Market share % | |||

| Q3 ’12 | Q3 ’13 | ||

| Android | 75.0% | 81.3% | |

| Apple | 15.6% | 13.4% | |

| Microsoft | 2.1% | 4.1% | |

| BlackBerry | 4.3% | 1.0% | |

| Others | 3.0% | 0.2% | |

| Total | 100.0% | 100.0% | |

| Source: Strategy Analytics | |||

At Telstra’s Investor Briefing yesterday Warwick Bray ED Mobile and Wireline gave a picture of Telstra’s mobile network achievements and plans. This is summarised on the chart above. The full presentation pack from the briefing is here.

At Telstra’s Investor Briefing yesterday Warwick Bray ED Mobile and Wireline gave a picture of Telstra’s mobile network achievements and plans. This is summarised on the chart above. The full presentation pack from the briefing is here.

Bray pointed to mobile network capital expenditure of $1.2Bn in 2012/13 and a plan for the same in 2013/14. He repeated David Thodey’s AGM statement that Telstra would take LTE coverage from 66% in June 2013 to 85% by Christmas – always good to agree with the boss. Also mirroring Thodey’s AGM words Bray said Telstra was selectively deploying carrier agregation in LTE using its refarmed 1800MHz and more recently 900 MHz spectrum. Telstra is sourcing Category 4 (3GPP Release 8) devices for these deployments which could enable speeds up to 150Mbps by aggregating the two spectrum bands.

Bray’s slide points to Telstra’s trialling carrier aggregation with 700 and 1800 MHz spectrum and looking to source LTE Category 6 (3GPP Release 10) devices which can theoretically get to 300 Mbps down and 50Mbps uplink. Of course Telstra (and Optus) don’t get to use the 700 MHz spectrum, which they purchased in May this year until January 2015 so don’t hold your breath for these break neck speeds just yet. Telstra has a focus on pushing the adoption of this particular band of LTE 700MHz spectrum to be used in Australia termed APT700 (Asia Pacific Telecommunity 700MHz or sometimes APAC700) so that mass produced devices will support this band (3GPP band 28). For example the just released iPhone 5S supports the USA 700 MHz bands but not the APT700 Band 28. There is a very good White Paper by Ericsson explaining the adoption status and potential for APT700 on the GSA web site here.

One other interesting initiative on Warrick Bray’s slide is the trial with Ericsson of LTE-B. This is broadcast LTE which is based on 3GPP eMBMS (evolved Multimedia Broadcast Multicast Services). It allows the same content to be sent to multiple devices in the process relieving network capacity for symultaneous streaming of video for example. Telstra had originally announced this trial with Ericsson in February this year. Mike Wright from Telstra provides some more insight into this in an item reported in the Australian here.

Crown Castle has just announced its purchase and 10 year lease of respectively 600 and 9,100 mobile towers from AT&T in the USA in a deal woth $4.85Bn. AT&T will lease back capacity on the sites for $1,900 per site per month and Crown will look to getting additional tenants on the site to make the deal profitable for itself. Crown Castle owns or operates by lease arrangement some 30,000 mobile sites.

Crown Castle has just announced its purchase and 10 year lease of respectively 600 and 9,100 mobile towers from AT&T in the USA in a deal woth $4.85Bn. AT&T will lease back capacity on the sites for $1,900 per site per month and Crown will look to getting additional tenants on the site to make the deal profitable for itself. Crown Castle owns or operates by lease arrangement some 30,000 mobile sites.

Crown Castle owns around 1,600 towers in Australia. These have been acquired over the years since 2000 from Optus, Vodafone and Hutchison. The original mobile towers acquired by Crown were 700 from Optus in 2000 for $200M then 669 from Vodafone in 2001 for $130M. Another 140 were added from Vodafone in 2008 for around $40M.

The business model in Australia and the USA are similar. Crown buys the somewhat lazy tower assets and through deals it has with all mobile carriers and other radio operators leases space on the structures. The arrangement provides Crown a viable business while facilitating the sharing of towers and to an extent reduces the proliferation of cellular mobile structures.

There is a very interesting ARS Technica article on how Google is increasingly gaining control over the originally open source Android.

Ron Amandeo the author says that Google is intent on locking Android phone manufacturers into using the Google official version, rules and vision of Android rather than third party derivatives based on the open source code. Some like Amazon and many Chinese manufacturers are bucking the Google system but as the article describes Google is making it as hard for them as it can. Ron Amandeo’s article by is here.

At Telstra’s AGM CEO David Thodey pointed to substantial growth and investment in Telstra’s mobile business both in Australia and in Hong Kong.

At Telstra’s AGM CEO David Thodey pointed to substantial growth and investment in Telstra’s mobile business both in Australia and in Hong Kong.

David claimed that Telstra in Australia now had 15.1 million mobile serives an increase of 1.257 million in the past 12 months. Figures for Hong Kong where Telstra’s CSL has 1010, One2Free and New World mobile services increased by 425,000. CSL has 4.2 of Hong Kong’s 16.7 million mobiles.

Thodey said that Telstra had invested $1.2Bn in its mobile network last financial year and would invest the same amount in 2013/14 year. In addition Telstra had spent $0.8Bn to renew existing spectrum licenses (mainly for their 850 and 1800 MHz spectrum) and $1.3Bn for new 4G spectrum (700 and 2600MHz).

David Thodey said that Telstra now had 3.2 million 4G devices on its network and would extend the reach of 4G from the current 66% of the population to 85% by Christmas 2013 maintaining, he said, Telstra’s lead in mobile speed and coverage. On 4G speed Thodey referred to trials of LTE Advanced (3GPP Release 10) on the Sunshine Coast which by combining (Carrier Aggregation) 1800 and 900 MHz spectrum was able to achieve real world speeds of 90 to 180 Mbps.

Thodey said Telstra is now working to rollout 900MHz spectrum aggregated with their existing 1800MHz on the 4G LTE network. This 900MHz spectrum has been refarmed from the Telstra GSM network which today is only lightly loaded as customers have migrated to 4G.

Both Optus and Vodafone have also refarmed 900MHz spectrum but both have used this in their 3G networks. With spectrum efficiency nearly three times higher with LTE 4G compared to WCDMA/HSPA 3G Telstra is looking to get the maximum benefit from this valuable low banded 900MHz spectrum in advance of the availability of the 700MHz 4G spectrum which will be able to be used from January 2015.

You can see the webcast of the CEO’s presentation at the AGM at here.

Roy Morgan reports that only 27% of mobile users in Australia have a phone over two years old. With over 30 million services in operation in Australia this would imply more than 10 million devices falling out of use each year. Their report is here.

Roy Morgan reports that only 27% of mobile users in Australia have a phone over two years old. With over 30 million services in operation in Australia this would imply more than 10 million devices falling out of use each year. Their report is here.

With the Australian Cellular Industry’s Mobile Muster reporting that they are recycling circa 850,000 mobiles per year you wonder what is happening to the rest. Mobile Muster says that there are 23 million mobiles stored in homes unused. With around 10 million falling out of use per year adding to the 23 million existing top draw mobiles we are building up a big stockpile or, more likely, adding to the high tech content of our wheelie bins.

Roy Morgan reports not unexpectedly that Telstra customers have the higher percentage of greater than 2 y.o. handsets at 30% Optus has 25% and Vodafone 22%. Also not unexpected is that the brand of mobile over 2 y.o. is topped by Nokia 30% (reflective of past glory) with Samsung 21% and iPhone 18%.

The just released ITU ICT Facts and Figures Report shows that 2.7 billion people have access to the internet 38% of the world’s population.

The just released ITU ICT Facts and Figures Report shows that 2.7 billion people have access to the internet 38% of the world’s population.

750 million out of 1.8 billion households in the world (41%) have fixed internet connection. The speed of the service varies dramatically with South Korea Japan and Hong Kong having around 90% of fixed services at speeds 10 Mbps and above and all of Africa having virtually no services at this speed.

The ITU also reported that there were 2.1 billion mobile broadband services active in the world with a annual growth rate of 40%. This represents 30 services per 100 population in the world.

Developing countries have more than half (55%) of the mobile broadband services (nearly 1.2 billion) while they have almost half of the worlds fixed internet services.

The ITU estimate that the worlds mobile services at 6.8 billion in 2013 is fast approaching the 7.1 billion world population.