Well done Telstra with the extra capacity for the City to Surf on Sunday. With 70,000 participating plus support teams and volunteers the normal mobile capacity at the finish at Bondi is really tested.

Well done Telstra with the extra capacity for the City to Surf on Sunday. With 70,000 participating plus support teams and volunteers the normal mobile capacity at the finish at Bondi is really tested.

Telstra took the trouble to roll out a Cell on Wheels right on the beach promenade. This made it possible for its customers to get in contact after the race and even to email photos like the one to the left of the CoW. I observed first hand the frustration of some folks (not on the Telstra network) trying to link up with their family at the conclusion of the race. They gave up after multiple call attempts.

The Global Mobile Suppliers Association GSA reports that there are now 200 LTE networks launched in 76 countries . This is an increase of 112% in the past year.

Of the 200 networks 182 are LTE FDD including Tesltra and Vodafone 9 are TDD only and 9 have a mix of FDD and TDD which now includes Optus. GSA says that 443 operators are investing in LTE in 130 countries.

1800 MHz (Band 3) is the most popular band largely because, like Australia, many operators already licensed this band for GSM and used it alongside 900MHz to provide capacity in high density areas. As GSM traffic has reduced due to customers moving to 3G the capacity of the 1800MHz GSM overlay is not needed allow for the refarming of the spectrum. The next most popular band is 2600MHz (Band 7) which was very early on designated for 4G LTE and has been newly licensed. This Band 7 will be used by Telstra and Vodafone in Australia from 2014.

Telstra’s announcement yesterday of its growth of 1.3 million mobile services gives it 15.1 million mobile subscriptions and 49% market share. This is Telstra’s highest market share this century. Telstra has gained share largely at the expense of Vodafone and its fall from favour due to its much publicised network and service issues.

Telstra’s announcement yesterday of its growth of 1.3 million mobile services gives it 15.1 million mobile subscriptions and 49% market share. This is Telstra’s highest market share this century. Telstra has gained share largely at the expense of Vodafone and its fall from favour due to its much publicised network and service issues.

It will be interesting to see the effect on performance of the extensive network upgrade which Vodafone is undertaking. Their noses must be well and truly to the grindstone in Vodafone network land with actions like:

- Change-out of its radio access equipment with Huawei Single RAN kit

- Introduction of an 850 MHz low band HSPA channel on its 3G network to improve capacity and coverage

- The roll-out of 4G LTE 1800MHz to boost network peak speeds

- Addition of lots of new base stations helped by the May 2012 Optus base station sharing deal

- Inclusion of base stations in their network resulting from the closure of the 3GIS Hutchison/Telstra shared network

- Implementation of roaming onto Optus’ network to boost coverage in remote areas

Vodafone announced this month the turning on of 1,200 new base stations in regional areas across Australia indicating their $1Bn program is getting traction.

Telstra will need to keep its pedal to the metal to keep its network growing to match the growth in the whole mobile data market as well as the growth in its share. Telstra’s CEO recently mentioned ongoing 40% YoY growth in mobile data volumes. This level of growth has been experienced for some years.

Just released IDC data on market share of smartphone and tablets by operating system shows that Android continues to stretch its lead over iOS. Windows Phone is gaining but from a low position. Blackberry is losing phone share rapidly and as Symbian is basically phased out it looks ever more like a three horse race in the rapidly growing (51% YoY) smartphone market.

According to IDC information smartphones comprised 54.6% of the 432 million phones shipped in 2Q. Interesting that Telstra’s CEO David Thodey said at Mobile Asia Expo in July 2013 that 72% of phones in use in Australia were smartphones which must be high by world standards.

| Smartphone | Tablet | |||||||

| Operating System | 2Q13 Unit Shipment M | 2Q13 Market Share | 2Q12 Unit Shipment M | 2Q12 Market Share | 2Q13 Unit Shipment M | 2Q13 Market Share | 2Q12 Unit Shipment M | 2Q12 Market Share |

| Android | 187.4 | 79.3% | 108 | 69.1% | 28.2 | 62.6% | 10.7 | 38.0% |

| iOS | 31.2 | 13.2% | 26 | 16.6% | 14.6 | 32.5% | 17 | 60.3% |

| Windows | 8.7 | 3.7% | 4.9 | 3.1% | 2 | 4.5% | 0.3 | ,01 |

| BlackBerry OS | 6.8 | 2.9% | 7.7 | 4.9% | 0.1 | 0.3% | 0.2 | 0.7% |

| Linux | 1.8 | 0.8% | 2.8 | 1.8% | ||||

| Symbian | 0.5 | 0.2% | 6.5 | 4.2% | ||||

| Others | N/A | 0.0% | 0.3 | 0.2% | 0.1 | 0.2% | N/A | N/A |

| Total | 236.4 | 100.0% | 156.2 | 100.0% | 45.1 | 100.0% | 28.3 | 100.0% |

Samsung remains the largest smartphone vendor in 2Q 2013 at 30% however both it and Apple’s share has fallen YoY as lower priced units begin to take share. Nokia and Blackberry are in the Others category.

| Smartphone | Tablet | ||||||||

| Vendor | 2Q13 Unit Shipments M | 2Q13 Market Share | 2Q12 Unit Shipments M | 2Q12 Market Share | Vendor | 2Q13 Unit Shipments M | 2Q13 Market Share | 2Q12 Unit Shipments M | 2Q12 Market Share |

| Samsung | 72.4 | 30.4% | 50.3 | 32.2% | Apple | 14.6 | 32.4% | 17 | 60.3% |

| Apple | 31.2 | 13.1% | 26 | 16.6% | Samsung | 8.1 | 18.0% | 2.1 | 7.6% |

| LG | 12.1 | 5.1% | 5.8 | 3.7% | ASUS | 2 | 4.5% | 0.9 | 3.3% |

| Levono | 11.3 | 4.7% | 4.9 | 3.1% | Levono | 1.5 | 3.3% | 0.4 | 1.3% |

| ZTE | 10.1 | 4.2% | 6.4 | 4.1% | Acer | 1.4 | 3.1% | 0.4 | 1.4% |

| Others | 100.8 | 42.4% | 62.8 | 40.2% | Others | 17.5 | 38.8% | 7.4 | 26.2% |

| Total | 237.9 | 100.0% | 156.2 | 100.0% | Total | 45.1 | 100.0% | 28.3 | 100.0% |

The Gartner data graph right shows the huge turn around in mobile O/S share since 2018.

Nokia, which dominated the market until iOS and Android came along, had a market capitalisation the same as Apple in 2007 (circa $110Bn). Now Nokia has been sold to Microsoft for $7.2Bn and Apple’s market cap at $413 is the largest in the world (just ahead of Exxon) having peaked at $650Bn in August 2012.

It sure shows how the time distance between rooster and feather duster is getting very short.

“The reports of my death have been greatly exaggerated.” Samuel Langhorne Clemens: Mark Twain

The wisdom is that SMS is dead or dying due to Over the Top messaging players like WhatsApp, Viber, BlackBerry Messenger, Apple iMessage and Facebook Messenger. Well SMS might be a simple service massively overpriced considering its cost of production but dead or dying it is not. Industry source Portio’s founder and MD Karl Whitfield claims that world SMS revenues are going up and will top $133 billion in 2013. He says:

Since the early days of SMS in the 1990s to today, in mid-2013, SMS revenue worldwide has gone UP every single year. So far, the operator community has not “lost” anything. From 2013 to 2017 inclusive, SMS revenue worldwide will remain above 2010 levels, hardly an industry ravaged by new threats and killer competition. SMS will continue to generate over USD 100 billion per annum for at least the next five years.

In Australia ACMA reports that 36 billion SMS’s were sent in the year to June 2011 up 23% form the previous year while Telstra says SMS’s on its network have gone from 1 billion to 12 billion between 2002 and 2012.

An SMS comprises a maximum of 1,120 bits so if data were charged at the current SMS rate of 25 cents then 1GB of data which is typically provided on smartphone plans today for around $10 would cost $1.8M. It makes international roaming data charges of typically 1.5c per KB or $15,000 per GB look like a bargain.

Moto X is the latest attempt by Motorola under Google’s ownership to resurect its former position of greatness in mobile phone products.

Those of us who are long of tooth still have memories of the mighty Motorola as the innovator and maker of the first practical mobiles the DynaTAC’s. They shifted the goal posts later on with MicroTAC AMPS and early GSM phones which showed the world how good a compact flip phone could be.

Apart from a few flashes of brilliance like the original RAZR phones in the mid 2000′s Motorola seem to have lost their way. With their purchase by Google for $12.5Bn in mid 2011 Motorola has been set on a course of reform aimed at restoring its past glory while contributing more than just circa $6Bn worth of Intellectual Property Rights to Google.

The Moto X needless to say is a pure Android phone. It has some quite innovative product and sales features and low and behold is being made in Texas USA.There is a full run down on the Moto X and some of the backgroud leading to its creation on Wired web site here. The full specs of the new phone are on GSM Arena here.

You could wish Motorola good luck with their venture but as others like Research in Motion/Blackberry and Nokia are finding it is a hard road back to fame in the mobile phone business.

The 2012 ACMA Communications Report shows that at June 2012 3.129 million people over 18 years of age (18%) don’t use a fixed line. This number has doubled in the last three years. The USA Wireless Association CTIA in the USA reports that at December 2011 34% of American households were mobile only.

The 2012 ACMA Communications Report shows that at June 2012 3.129 million people over 18 years of age (18%) don’t use a fixed line. This number has doubled in the last three years. The USA Wireless Association CTIA in the USA reports that at December 2011 34% of American households were mobile only.

So while this trend continues it will reach a limit imposed by the need for fixed access to carry the ever increasing volumes of internet data. Mobile networks could carry all of the voice calls, SMS and MMS. With the current technology, number of base stations and mobile spectrum the volume of data carried on the fixed network could not be carried on mobile networks. In Australia according to the ACMA report there were 421 PB (One Peta Byte is 1015 Bytes) downloaded in the three months to June 2012 – who says the Government isn’t watching what you are doing! Of this only 32PB (7.6%) was downloaded to mobile phones and devices. There were 6 million fixed internet access services and 22 million mobiles and dongles used to access the internet. Thus the 21% of internet connections which are fixed carried over 92% of data. Mobile networks would need to have their capacity increased by a factor of 13 and then be able to continue to grow capacity to match the annual over 50% yearly increase in internet data.

Of course it is technically possible for a mobile network to be designed to carry all the internet data as NBN is proving. It would be technically possible to scale this sort of network up to serve everyone and not just the 4% NBN is targeting. It would require a base station for approximately every 250 premises (tripling the number of base stations to circa 60,000), perhaps a doubling of the mobile spectrum, and some serious fibre for backhaul (like that needed for fibre to the node FTN). Food for thought!

The latest system on a chip offering from Qualcomm in the Snapdragon series is a cracker. The Snapdragon 800 is Qualcomms first to support LTE Advanced which allows aggregation of LTE channels to improve speed and efficiency.

The latest system on a chip offering from Qualcomm in the Snapdragon series is a cracker. The Snapdragon 800 is Qualcomms first to support LTE Advanced which allows aggregation of LTE channels to improve speed and efficiency.

LTE-A ultimately will allow the aggregation of up to five 20MHz channels from different LTE bands which will deliver up to 1 Gbps down to the mobile and 500 Mbps up. There is an excellent white paper on 3GPP Release 9 and beyond including LTE-A on the 3G Americas web site here.

The Snapdragon 800 chip has the more modest support for two channel aggregation which yeilds LTE Category 4 downlink speeds of up to 150Mbps. The Snapdragon 800 is manufactured for Qulacomm by Taiwan’s TSMC using its new 28nm High Performance Mobile process. As well as running LTE-A the Snapdragon 800 chip also supports LTE FDD, LTE TDD, WCDMA, CDMA1x, EV-DO, TD-SCDMA and GSM it has quad core processor which can run up to 2.3 GHz per core. It supports USB3, Bluetooth (4.0), WiFI (802.11ac), GPS, up to 55 M pixel camera and 1080p and extenal 4K (3840X2160) video. It is amazing how much can done on a single low power chip. There is more information here .

The Snapdragon is currently used in LTE-A versions of some phones icluding the Samsung Galaxy S4 for use by SK Telecom in Korea on its LTE-A equipped network. It is understood that SK are in negotiations for inclusion of LTE-A in the upcoming iPhone 5S. As both Samsung and Apple have used earlier Qualcomm Snapdragon chips there is a good chance the 800 will appear in upcoming products.

Nokia Siemens Networks NSN will be renamed Nokia Solutions and Networks NSN following a $A2.7Bn Nokia acquisition of the half of NSN it does not own from Siemens.

Nokia Siemens Networks NSN will be renamed Nokia Solutions and Networks NSN following a $A2.7Bn Nokia acquisition of the half of NSN it does not own from Siemens.

NSN has ticked up $8Bn in losses over its first five years. Siemens, which had to tip in 1 billion Euro into NSN in 2011 as a result of the ongoing losses, has been looking to exit the business.

With over $19BN in annual revenue this year NSN has turned in a small profit on the back of big orders for 4G network kit and drastic restructuring involving 20% (56,000) staff cuts. Nokia obviously sees potential whereas Siemens has lots of other, more profitable, irons in the fire in its divese engineering empire.

Why such a low price Ray Le Maistre’s blog has some suggestions here.

Anyone concerned at the scale and takeup of TDD LTE can stop worrying.

According to the China Daily the world’s largest mobile company by subscriptions China Mobile which has over 700 million mobile customers is letting a contract for 207,000 TDD LTE base stations. They are currently down the track with a 13 city trial rollout with kit from ZTE and Alcatel Lucent. CM is expected to concentrate on the 2.6GHz (2.57 – 2.62 GHz) TDD LTE band 38.

CM’s 2013 capital spend has increased to $30Bn USD more than half of which will go on the new TDD LTE network. Telecom Asia reports that CM plans to cover 100 cities and 500 million population with the 200K base station deployment. The Telecom Asia article points to the large quantity of under utilised TDD spectrum around the world.

The potential booming LTE TDD network equipment and device market may see these underutilised assets pressed into service to feed the growing appetite for mobile and wireless data services especially in high population developing markets.

Optus’ rather more modest investment in TDD LTE following its $252M purchase of Vivid from Channel 7 in February 2012 has seen it deploy 2.3 GHz TDD LTE at 13 sites in Canberra (launched in June 2013) and taking this to 50 sites this year.

Optus has 98 MHz of 2.3 GHz and 65 MHz of 3.4 GHz TDD spectrum as part of the Vivid purchase. This is mainly in capital cities. The other 2.3 and 3.4 GHz spectrum assets were previously owned by Austar are now being used by NBN Co for the wireless part of the NBN rollout.

These previously underutilised spectrum assets, licenses for which run out in 2015, are now seeing increased use.

NBN Co has started to sell the higher speed 25/5 Mbps wireless broadband. The faster speed service is wholesaled at $27 per month just $3 more than the original 12/1 Mbps service.

NBN Co has started to sell the higher speed 25/5 Mbps wireless broadband. The faster speed service is wholesaled at $27 per month just $3 more than the original 12/1 Mbps service.

The fixed wireless part of the NBN which is expected to service some 4% of NBN connections (around 500,000 premises) when it is completed in 2015. It will use around 2,300 base stations each costing between $300,000 and $400,000. The base stations will be equipped with TDD LTE technology using the 2.3 and 3.4 GHz spectrum which NBN acquired from Austar for $M120 in February 2011. This spectrum 98 MHz in 2.3GHz band and 65 MHz in 3.4 GHz band came to Austar as part of a swap with Unwired (then Vivid Wireless now owned by Optus). Basically Unwired had the spectrum in metro areas and Austar had the non metro.

The fixed wireless equipment used by NBN for this service is to be provided, built, operated and maintained by Ericsson. The up to $1.1Bn contract for this work was let in June 2011 and includes options covering 10 years. The contract also covers business support systems including service activation, management and assurance as well as network performance and capacity management. The agreement requires Ericsson to design, build, operate and maintain NBN Co’s network end-to-end, including business support systems.

By March 2013 17,000 fixed wireless customers were connected and there are now around 80 base stations completed. NBN had targeted 70,000 fixed wireless connections by the end of June in its August 2012 Corporate Plan. This seems unlikely to be achieved. It appears that the NBN is not immune from the problems of site access and approval for base station sites which beset all mobile operators. As well CEO Mike Quigley has pointed to some radio path issues which may require changed designs further slowing progress.

By March 2013 17,000 fixed wireless customers were connected and there are now around 80 base stations completed. NBN had targeted 70,000 fixed wireless connections by the end of June in its August 2012 Corporate Plan. This seems unlikely to be achieved. It appears that the NBN is not immune from the problems of site access and approval for base station sites which beset all mobile operators. As well CEO Mike Quigley has pointed to some radio path issues which may require changed designs further slowing progress.

The NBN approach should offer good speed stability – obviously not as fast or consistent as fibre (either FTTP or FTTN) but superior to true mobile wireless broadband. NBN can engineer the TDD LTE base station capacity to the known demand of the customers served by the site. The radio path can also be more controlled as the customer antenna is externally mounted and can give predictable signal strength and signal to noise performance. NBN has a lot of spectrum to work with. It is higher frequency than common mobile broadband networks leading to higher radio path losses. The greater path loss however can be compensated for by the higher gain of the customer antenna and the predictable path due to the fixed external to the building mounting. NBN has another strength in that it has access to fibre links and so it can engineer the base station backhaul capacity (the capacity of the transmission link from the base station to one of the 252 points of interconnection) to match customer demand on the base station.

The NBN Fixed Wireless Factsheet is here.

The 3% of the NBN’s customers using satellite will also get 25/5 Mbps service once the two new dedicated NBN Ka-band (26-40 GHz) satellites are launched by Ariane Space from Guiana Space Centre in French Guiana in 2015. These satellites NBN Co 1A and NBN Co 1B will be launched using Ariane 5 770 tonne heavy-lift rockets under the $300M launch contract.The satellites each costing $1Bn and with 80 Gbps capacity will be built by Californian company Space Systems Loral. At present around 25,000 connections have been made by NBN using their interim satellite service at speeds of 6 Mbps. This interim service was lauched on 1st July 2011 using satellite capacity rented from Optus ($200M) and IPStar ($100M). These interim service connections and the balance of NBN satellite customers will be converted to the 25/5 service following the commissioning of the new NBN satellites in 2015.

After the telegram perhaps the next to go will be the good old public or pay phone.

After the telegram perhaps the next to go will be the good old public or pay phone.

With the number of mobiles in the world fast approaching the world population and passing it at around 7.2 billion in the middle of 2014 it is not unexpected that the need for public phones is declining rapidly.

There is an interesting report in a recent Economist quoting UK statistics with British Telecom’s public phones reducing from 92,000 to 60,000 in 10 years to 2012. Of the remaining 60,000 12,000 get less than one call a month – no need to queue or to empty the coin tin to often.

In Australia the rate of decline is even higher with ACMA reporting in its Communication Report 2011/12 that payphones in Oz went from 45,000 in 2008 to 31,000 in 2012.

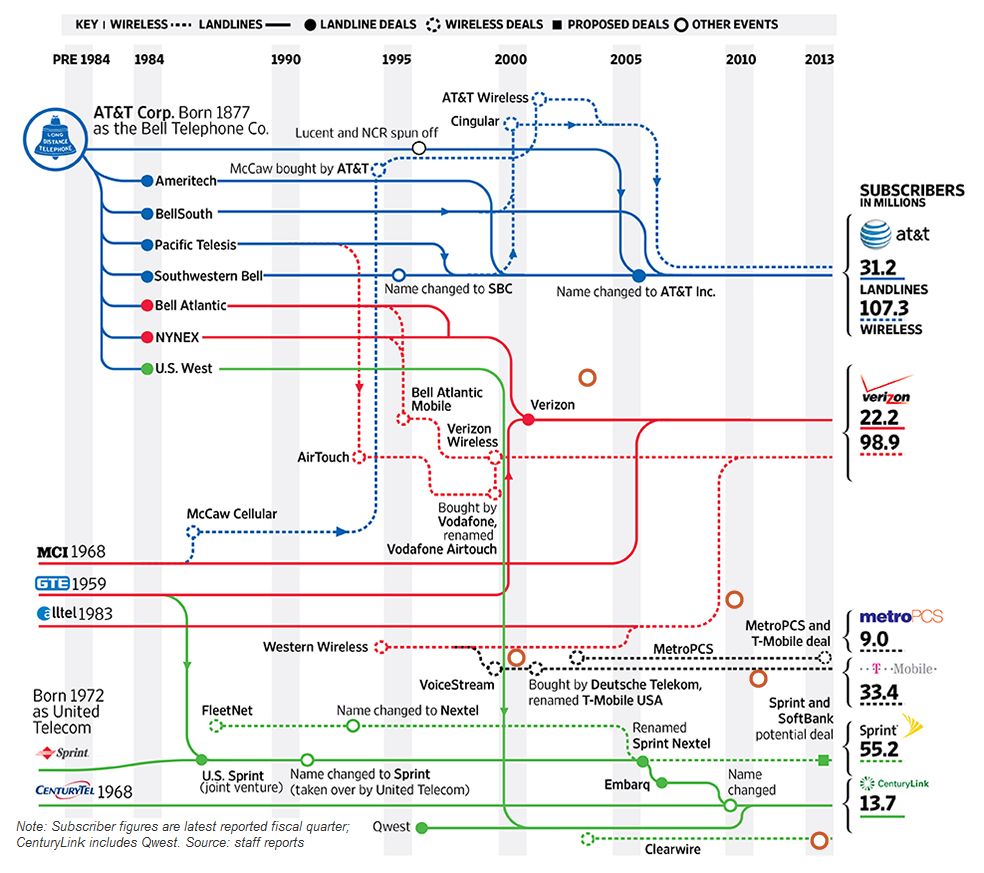

Did you ever wonder what happened to fixed telephones and subsequently mobiles through the years following the break up of the AT&T owned Bell System in January 1982. The Wiki has a pretty comprehensive coverage here however this week the Wall Street Journal had a great chart showing how the old monopoly which was split into seven Baby Bells plus some new entrants have morphed into into some mighty corporations.

From a mobile perspective the split of the wireline operators and licensing of competitive operators (originally one per area under the old AMPS system) has made it much harder for even these massive corporations to provide a national service except by complex roaming arrangements. Contrast this with most of the rest of the world which, with some notable exceptions, have operators with national licenses and nationally consistent service, pricing and roaming.

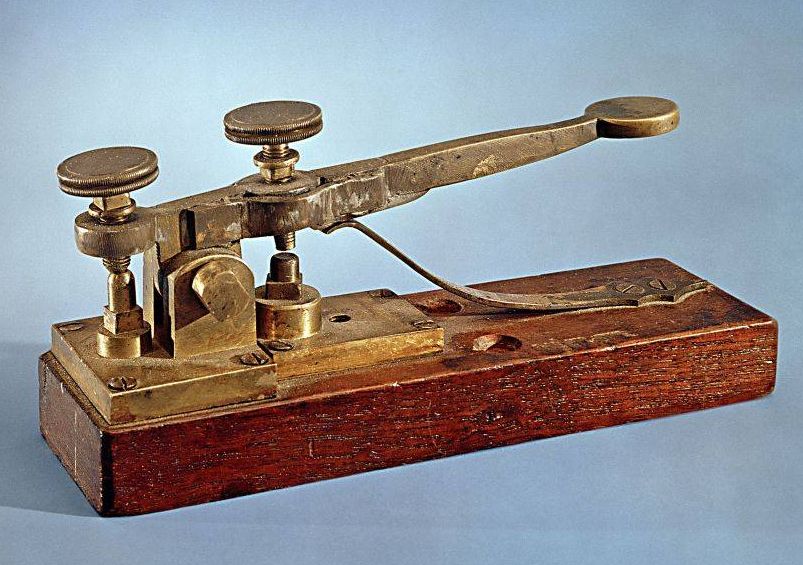

The Huffington Post reports that Indian Government telco BSNL is about to turn off its telegram service according to Huffington Post the last in the world.

The Huffington Post reports that Indian Government telco BSNL is about to turn off its telegram service according to Huffington Post the last in the world.

The service, HP reports, is loosing BSNL $23M per year which with just 5,000 telegrams per day sent represents over $12 per telegram. This is a far cry from the cost of mobile calls in India among the lowest in the world and which can be as low as 1 cent per minute.

The story reminded me of a piece from the Melbourne Argus in 1853 which someone sent me which read;

“To us old colonists who have left Britain long ago, there is something very delightful in the actual contemplation of this, the most perfect of modern inventions.

We call the electric telegraph the most perfect invention of modern times….

As anything more perfect than this is scarcely conceivable, and we really begin to wonder what will be left for the next generation upon which to expend the restless enterprise of the human mind…..

Let us set about the electric telegraph at once.”

The background was that in early 1853, Samuel McGowan, a young Irish-Canadian, arrived in Melbourne bringing with him several Morse telegraphy sets from the United States. He intended to form a private telegraph company to construct and operate telegraph lines between Melbourne and the Victorian gold diggings.

So all technologies have their day. As we marvel day by day the latest internet service or smart phone you can wonder what will the generation in another 160 years be expending that restless enterprise of the human mind on.

Bucking the long term trend where networks are upgraded and then customers and operators wait impatiently for devices to use the new capability Samsung have announced a Galaxy S4 which will work on LTE Advanced networks. The device is projected for launch later this year.

Bucking the long term trend where networks are upgraded and then customers and operators wait impatiently for devices to use the new capability Samsung have announced a Galaxy S4 which will work on LTE Advanced networks. The device is projected for launch later this year.

LTE Advanced utilising LTE Release 10 is on very few of the circa 170 LTE networks in the world today (145 networks January 2012 and estimated by GSA 234 by December 2013). SK Telecom in Korea has launched LTE-A with the Samsung phone and 13 operators, Telstra among them, have either announced or plan to implement LTE-A in 2013.

LTE Advanced improves on standard LTE (3GPP Release 8 and Release 9) by allowing channel aggregation up to 100 MHz – should an operator be fortunate enough to own that much spectrum. Otherwise it increases MIMO layers up to 8 and provides support for HetNets which will provide exciting capacity and performance improvements to networks in the future using integrated Picocells. There is a good summary presentation on LTE by Qualcomm, the maker of the chip at the heart of the newly announced turbo Galaxy S4, here.

Most LTE devices today are Category 3 100/50 Mbps in 20 MHz spectrum. Telstra in February said that they are aiming to launch a Category 4 phone and a dongle later this year. Category 4 is 150/50 Mbps while the LTE Advanced Category 6 is 300/50 Mbps. Samsung say it will be twice the speed of the fastest existing LTE devices in real world speed.

| 3GPP Release | User Equipment Category | Maximum L1 Downlink Data Rate | Maximum number of DL MiMo Layers | Maximum L1 Uplink Data Rate |

|---|---|---|---|---|

| Release 8 | Category 1 | 10.3 Mbit/s | 1 | 5.2 Mbit/s |

| Release 8 | Category 2 | 51.0 Mbit/s | 2 | 25.5 Mbit/s |

| Release 8 | Category 3 | 102.0 Mbit/s | 2 | 51.0 Mbit/s |

| Release 8 | Category 4 | 150.8 Mbit/s | 2 | 51.0 Mbit/s |

| Release 8 | Category 5 | 299.6 Mbit/s | 4 | 75.4 Mbit/s |

| Release 10 | Category 6 | 301.5 Mbit/s | 2 or 4 | 51.0 Mbit/s |

| Release 10 | Category 7 | 301.5 Mbit/s | 2 or 4 | 102.0 Mbit/s |

| Release 10 | Category 8 | 2998.6 Mbit/s | 8 | 1497.8 Mbit/s |

Ever wonder What causes mobile device market success to turn so quickly? Why have Nokia and RIM Blackberry gone from hero to zero in just a couple of years? How did Samsung rise so rapidly in a crowded and capable field to be the largest producer of mobiles by volume? Can someone do to Samsung what Samsung did to Nokia? An interesting Mobile Future Forward Research Paper by Chetan Sharma here has a good analysis of the factors which drive the market.

Ever wonder What causes mobile device market success to turn so quickly? Why have Nokia and RIM Blackberry gone from hero to zero in just a couple of years? How did Samsung rise so rapidly in a crowded and capable field to be the largest producer of mobiles by volume? Can someone do to Samsung what Samsung did to Nokia? An interesting Mobile Future Forward Research Paper by Chetan Sharma here has a good analysis of the factors which drive the market.